Having bad credit is a little like going through life with an anchor tied around your waist. Bad credit is a dead weight that consistently drags you down and holds you back. Credit can go from good to bad incredibly quickly and with just a few of the wrong decisions. Once that happens, life gets a lot harder for as long as the credit scoreremains low.

Overcoming Bad Credit Now

People don’t think of their credit score as part of their identity. Yet it affects every aspect of their lives over and over on a daily basis. If you have bad or even just less-than perfect credit, you have probably dealt with these issues a lot. We have outlined some below, along with ways to work around them even if you have bad credit.

- Finding a Place to Live – Renters with bad credit tend to look untrustworthy to landlords, even if it’s not true. These renters either get turned down or have to agree to higher rents with more restrictive terms. Convincing a landlord to take a risk is easier with recommendations, pay stubs, or a co-signer. When this doesn’t work, seek out a sublet or a rental agreement that does not include a credit check.

- Purchasing a New or Use Vehicle – Getting the money to purchase a vehicle is hard if the buyer is seen as a credit risk. Unfortunately, going with a vehicle is not an option for a lot of people. People who are turned down for conventional auto loans may be approved for poor credit auto loans through RoadLoans. These kinds of companies offer a lifeline to people who need to purchase a vehicle and also want to restore their credit.

- Getting Approved for a Loan – Lenders accept a lot of risk, which is why they are hesitant to loan to anyone with poor credit. Not having access to financing is a huge hurdle, locking people with bad credit out of the opportunities that others enjoy. A variety of sub-prime loans are available to helps these borrowers purchase houses, start businesses, and stay afloat.

Recovering from Bad Credit in the Future

Bad credit is hard to overcome, not impossible. With time, commitment, and the right approach, anyone can restore their credit and reap the benefits that come with it. Start with these steps:

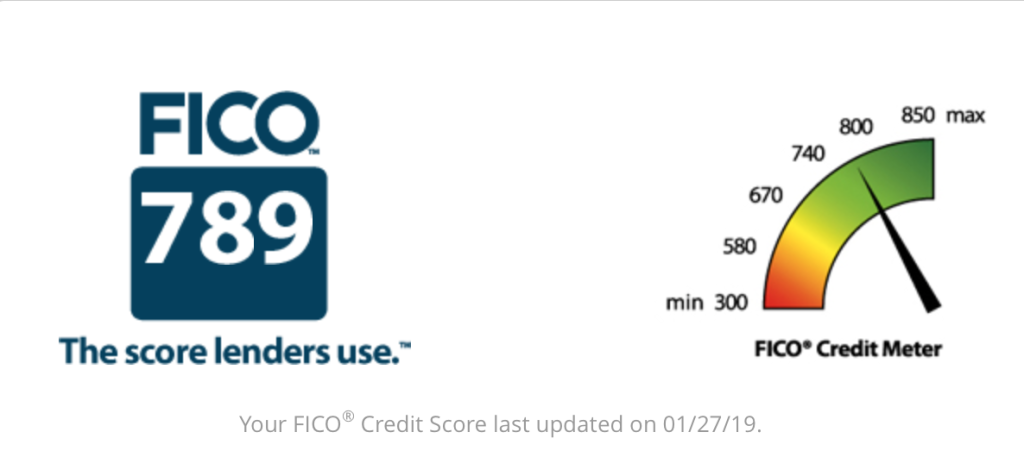

- Review Your Credit Report – Request a copy so you know exactly how bad your credit really is. Definitions of “bad credit” vary, but any score under 700 can (and should) be improved.

- Dispute Any Errors – Errors on your credit report can drag down your score significantly. If you find any of these errors, make the credit reporting agency aware. Be sure to have documentation proving that the information is inaccurate.

- Reverse the Slide – Stabilize your credit score by paying all your bills on time and paying down your debts. That probably means living on a budget, which is never easy, but in this case it’s absolutely necessary.

- Use Credit Responsibly – The only way to shake a reputation as a risky borrower is to prove the opposite. Take out a secured credit card, make small purchases on a regular basis, then pay the bill on time without fail. Slowly but surely your credit score will start to improve.

Repairing your credit takes time, effort, and sacrifice. Honestly, it isn’t easy or a lot of fun, but it is worth the effort. Be patient about seeing results and be systematic about how you manage your credit. You won’t regret it once your name is attached to a strong credit score.