My Savings and Investing Priorities Pyramid | brokeGIRLrich

With a variable income like mine, trying to figure out how to get ahead and where the money should go at any given time is pretty challenging.

On the one hand, I’d argue that almost anything you manage to save and invest is a solid start – so if you’re just getting started, do whatever you can to start taking steps forward.

There came a time though when I realized I had several goals that I wanted to meet and enough money to contribute to more than just the bare minimum savings.

A common way to achieve a bunch of financial goals is to take the amount you need or want, divide it by 12 and automate those suckers right into the accounts you want them to go to.

As a freelancer with a largely variable salary over the last 10 years – I laughed at that as much as you might.

I don’t automate anything other than 401k contributions when I’m working for a company that has a 401k. And honestly, if I’m working for a 401k company, I’m probably at a salaried job and could automate more – my freelance roots always shiver at the thought of automation.

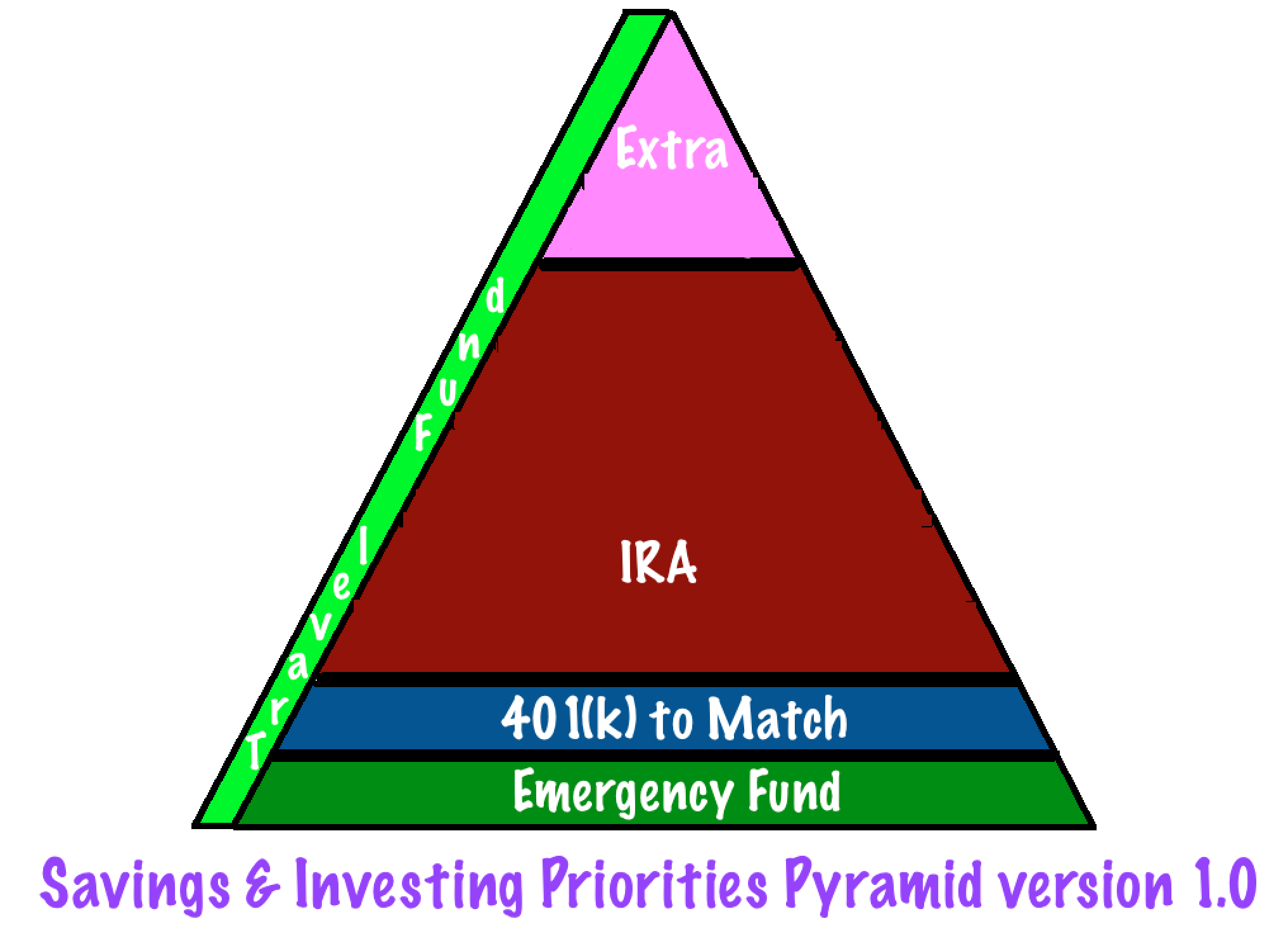

Instead, I have a priorities pyramid:

At the beginning of each year, I sit down and make a bunch of goals that seem likely attainable.

Emergency Savings

Some goals also have set amounts and they’re done. My Emergency Savings was sitting happily at $10,000 for a long time before I decided to use a windfall to push it up to $15,000.

I also have large cash reserves right now to buy a car and put a down payment on a house, so my Emergency Savings are fine right where they are for the foreseeable future.

When building my Emergency Savings, I start with the goal of adding $1,000 a year as the base of the pyramid until I reach my target number.

My Emergency Savings:

- Keeps me out of debt.

- Let’s me take advantage of great work opportunities that might come with a cost like moving.

- Can be used to deal with a car issue, if necessary.

- Can pay for some or all of the car insurance payment, if I fall behind in my savings.

Emergency savings can also be used for those expenses that you never saw coming. It could be that you need to retain a personal injury lawyer due to an accident, or something in your home has broken and needs fixing. You never know what’s coming, and this fund makes it possible to help yourself without going into debt.

Your pyramid might be more realistic with a smaller goal of $100 or it might be more realistic to forego the other layers of the pyramid this year and just focus on the layer that gets you up to (or closer to) $1,000 in your emergency fund.

401(k) Match

The next layer is contributing up to the match on a 401(k). If your company offers you free money, take it. If they match the first 3% of your contributions, you make sure $570 goes into that account this year.

Health Savings Account

The next layer is maxing out an HSA (Health Savings Account), if one is available to you. This does not apply to an FSA (Flexible Savings Account) – those are way less useful.

The best thing about this account if that if you don’t need the money, it can be an investment account.

If you are absolutely strapped for money, save your medical receipts and you can withdraw the amount you’ve spent on those expenses. You also get a break on your taxes by contributing to an HSA.

Individual Retirement Account

The next layer is to max out an IRA. I have a Roth IRA because my taxes now are probably lower than they’ll be in the future. Whether you go Roth or Traditional, the reason I like to tackle my IRA next is that for a long time, this was the last step on my pyramid and $6,000 is a lot of money, but it really does add up.

Also, as a freelancer, putting away $500 a month was unlikely, but dumping in $1,000 here and there after getting my myriad of stipend paychecks generally worked out. Usually sometime in October I would find I was still like $1,000 away from maxing out the account and I would feel super motivated to hit my goal number and start sacking away $10 here and $50 there and whatever I could find or hustle.

I feel a strange sense of accomplishment every year when I see the little bar fully green and Fidelity tells me I’ve contributed the maximum allowed for the year.

Car Savings

It is a phenomenal car that has lasted 12 years and, knock on wood, doesn’t appear to have any real issues yet.

That being said, I do know that someday I will need another car. So I use this time when I’m not making car payments to essentially “make car payments” to myself – so when the time comes, I can go buy another car.

I’d like to buy another car in the same price range and style as my Matrix, so I just save up what I can, when I can. This is often a goal that doesn’t get met on lower cash flow years. On average, I set it as a reach goal at $2,000 a year these days. When I first started saving a few years ago, I had it at $500 a year. I almost never hit it when I was younger… I almost always hit it now.

It also doubles as a secondary emergency fund. Although I’m saving up to be able to buy a new car, if terrible things happen between now and then and I deplete my emergency savings, I could use the car savings too and just buy used. And if the terrible things happen and the car goes at the same time, I will buy as used as I have to in order to not go into debt over the car.

Fingers crossed life stays… rosy-enough. At least financially.

House Down Payment

In a similar vein, I realize that I may want a house sometime soon. As this is a vaguer goal to me, though with a higher expense, I save for it after my car goal is met each year.

If the house goal moves up, I could pilfer from the car savings account.

Recently, I set the goal at $5,000 a year for the house down payment. It also started out as a $500 a year goal. Some years I hit it, some years I don’t, but I’m closer than if I were starting at zero and almost at 20% of a down payment for houses in the range I generally look at.

401(k) Remaining Balance

If all these goals are met, I go back to my 401(k) and tackle the remaining balance. Honestly, there have been 3 jobs where I had access to a 401(k). The first one I only managed to contribute up to the match.

The second one I was able to set at $100 a month, and that was stretching it for me back then.

The last one I was able to set it to max out. I had gotten a nearly $20,000 raise going into that position, so I was in the super lucky position to just pretend like I hadn’t gotten any raise and automate the whole thing to come out of my paychecks directly.

I’m in the process of setting up a Solo 401(k), and in that case, I’ll be back to using my pyramid system and it will be a later in the year goal to max out.

Everything you contribute to a traditional 401(k) helps lower your tax bill.

Brokerage Account

We’re nearly at the top of the account and here is where my brokerage account sits. I try to buy $2,000 in stock every year. At least $1,000 is in index funds. Sometimes I will buy a well-researched individual stock with the other $1,000.

The reason it’s so far down on the list is that it doesn’t have any tax advantages.

Bonus Savings & Investments

The capstone of the pyramid is for the odd year when I still have extra money. When I was saving up the Emergency Fund, any extra money went into there to help get closer to my big target goal.

After the big target goal was met, that freed up even more money over the year to reach the other goals and I started to find that in November and December, I might have more money in my checking account than expected.

When that was the case, it usually meant I didn’t have to worry about Christmas (budgeting win!) and also, I could roll over extra cash into a first of the year HSA or IRA deposit and start strong!

After a few years, I was rolling a big chunk into those first of the year deposits, which put me further ahead and then I was able to top off extra savings in the car and down payment accounts.

Or add some extra to my favorite savings account that runs up the side of the pyramid.

Travel Fund

Traveling is pretty much my favorite thing. I’ve been really lucky to have some friends and family who love it as much as I do and so I’ve never been short on travel buddies.

Each year, while I’m hitting those other goals, some money gets diverted to my travel fund.

Some years, that fund is pretty low and I manage a long weekend in Niagara Falls or Nashville.

Some years, eff it, the car savings aren’t happening and we’re going to Hawaii or Peru.

Life is short, sometimes way shorter than any of us planned. And there has to be a balance to things.

Maybe travel isn’t your main priority, but whatever it is that makes you happy, make sure you have a plan and you’re saving for it and doing it sometimes. All the retirement savings in the world aren’t going to help you out if you don’t make it to retirement.

Maybe my pyramid doesn’t quite work for you but you can definitely make your own, with numbers that work for you. Your pyramid also doesn’t have to have all these things on it.

My first pyramid was pretty simple. As the extra space got bigger, I would add another savings or investing layer to the pyramid.

…and sometimes I’d go on a really awesome vacation.