Update: 4/18/17: In light of digit’s move to start charging $2.99/month for their services, you may want to check out my post What Are Some Other Ways to Save besides digit?

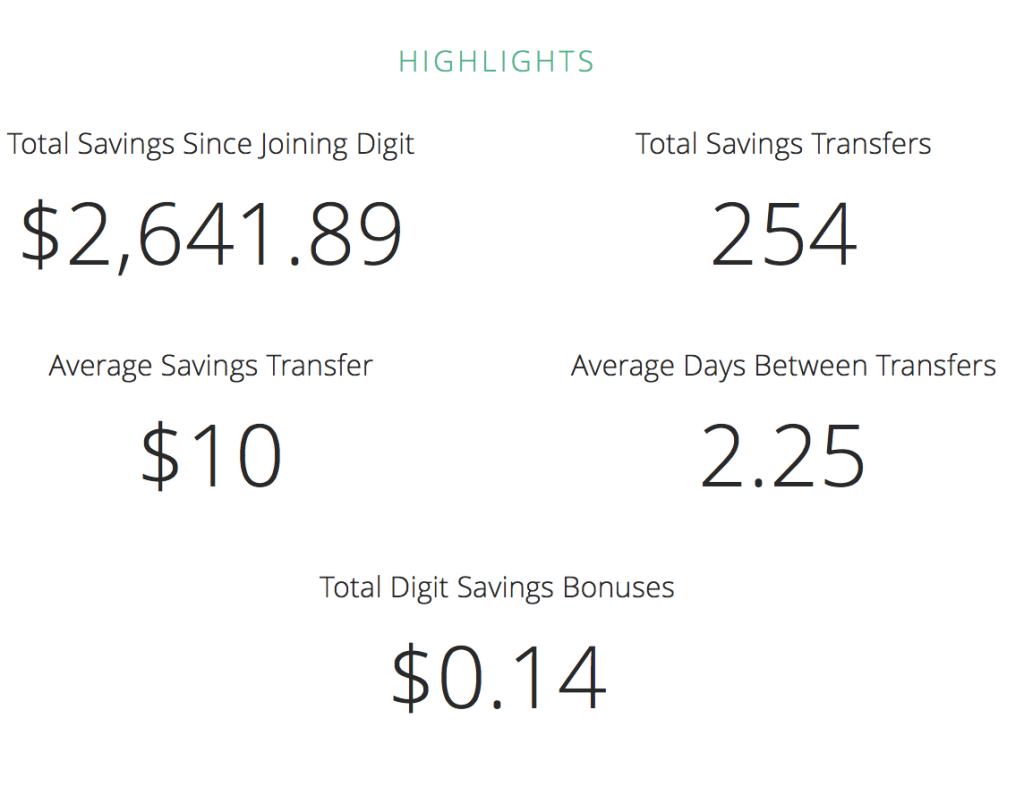

A year ago, I wrote an update on how useful I found digit after one year of using it. I’ve also compared it to Acorns and found I like it way better.

Sometimes things change over time. Mint used to be the best of the best at tracking your net worth and now several other programs are just as good, if not better. Ally was one of the first online banks with customer service that blew the others right out of the water. Now there are quite a few.

All that being said, I haven’t found anything I’d even consider replacing digit with, especially as someone with variable income. Digit promises to never overdraft your bank account and there have been a few periods of under and unemployment the last two years where digit corrected itself to my lack of income stream and yet still continued to sock away a little here and there that I never even noticed.

When money is really rolling in, it also adjusts and takes bigger deposits out, but I still don’t notice those either. I usually keep half an eye on the balance and when it hits $100, I’ll withdraw it and (almost always) as it to one of my savings goals for the year. After I hit my savings goals earlier in the year, digit kind of slipped my mind and I just let it ride. I was pleasantly surprised to see over $600 in there for my last withdraw!

The things about it is it’s just so mindless. I still have plenty of savings and investing goals that I actively work towards and budget for, I just get a little pushed along each time that digit balance hits $100 and over the course of the year, those little pushes add up. I tend to pleasantly find myself a little ahead of schedule with my goals by midyear.

I’ve also used the pause feature for the first time here this month and I loved that I could set it for a specific time period. I had a large influx of money coming from a few of my savings accounts into my checking account to pay a big bill, carefully calculated to be just enough, and I wanted to make sure digit didn’t cipher any off before all the deposits were made to my checking account. I just paused my digit savings until after the due date of the bill and then it picked right back up.

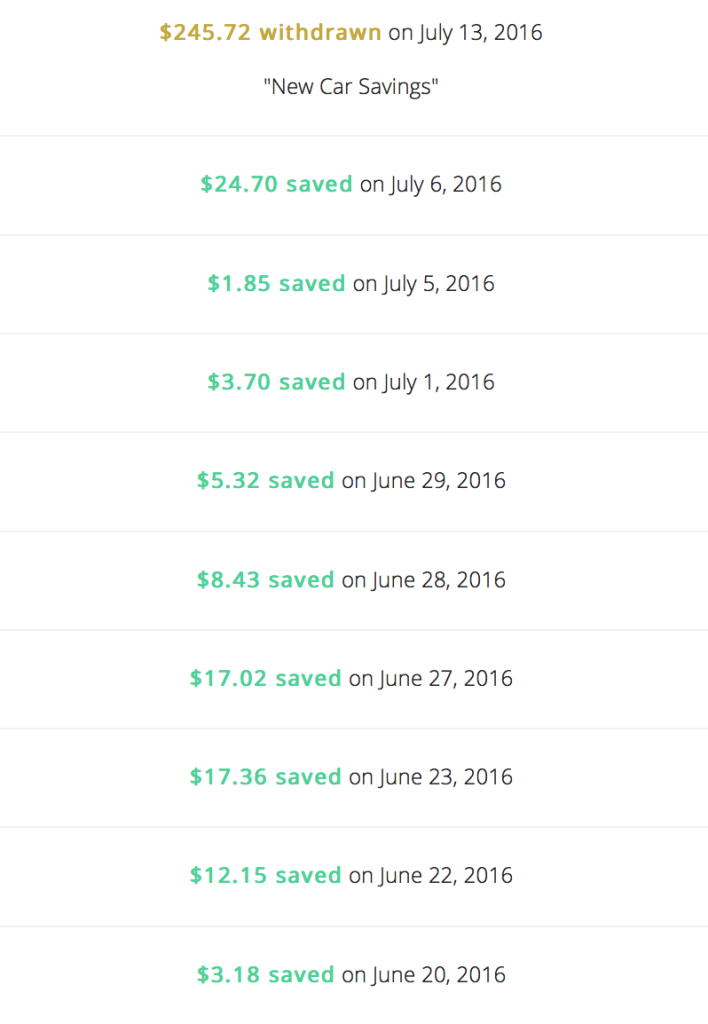

The journal feature also keeps me accountable. There’s an option to enter what you’re transferring the money for each time you make a withdraw and it helps remind me that this is supposed to be savings not Starbucks, nail polish and ModCloth money. The only feature I’m not a huge fan of is how you navigate the journal, because it’s just a long list of each amount saved with the withdrawals interspersed, so it’s not easy to just pull up where all your withdrawals went for the year.

Full disclosure, I love digit so much, I got my actual, real life, best friend excited to use it too and she hated it. She didn’t like the money disappearing from her bank account, when she set it to take lower amounts, she didn’t think it really responded to that well enough and she paused it and it ignored her command. So it’s possible that digit isn’t for everyone, but as for me, digit is one of my favorite money management tools and I’m looking forward to another year of magic extra money.

Have you tried digit yet? Add it to your money management arsenal for 2017 to help reach your savings goals a little quicker and a little more painlessly.

I actually love digit as well though the tone thing I’ve found since I don’t use one of the big commercial banks it loses connection often so a week or 2 will go by before it gets connected again and I have lost that time for it to pull any savings. I know it’s something they are working on though. Short of that, I love it.

I had no idea it had some issues with banks. I have mine synced with Ally, so I haven’t had any issues there.

I haven’t used Digit, but I can see how it could be very helpful in upping your savings rate. Personally I like to track my money to the penny, so for me I believe it would mean extra time tracking all those little transfers. Does the savings go to your own savings account at the bank (with interest) or does Digit store it for you?

Digit stores it for you. I personally transfer it out into savings accounts each time it reaches $100. So I lose about 3 to 4 weeks of interest. On the flip side, I wouldn’t withdraw those little amounts otherwise and would assume I just have more spending money, so losing the little bit of interest (that I probably wouldn’t have gained anyway), is ok with me.

Glad you found something that works for you. It would drive me nuts.

RAnn recently posted…Stock of the Month: Hanesbrands, Inc.