I really like some aspects of psychology, especially why we do the things we do. I’ve been fascinated with personality typing and stuff like Briggs-Meyers tests since I first learned what they were (yeah, I even do those silly Facebook tests – I am a Snape). While each of these “types” are broad generalizations, the fact is that most people do fall within one of these categories pretty well, if with a few exceptions.

A few years ago, a financial planner named Ray Linder noticed that people also seemed to fall into groups regarding how they dealt with their money. Linder was also interested in Jungian psychology (the basis of Briggs and Meyers test) and found that within the groups that Briggs and Meyers suggested, a few could be chunked together and, overall, there are four types of ways people approach money – Protectors, Planers, Pleasers and Players.

If you don’t have debt and have very strict structures placed around your savings goals for the future, you’re a Protector and you’re likely an ESTJ, ESFJ, ISTJ, or ISFJ. Debt has probably never been a big thing for you, or if it was a necessity for a little while, you probably paid it off like a madman.

If you’re a little looser with your investing strategies and have an easier time seeing a better route to your big goal, you’ll go with it, then you might be a Planner and you’re likely an ENTJ, ENTP, INTJ, and INTP. Planners have no trouble spending if it helps reach the big goal.

If you love spending your money on others and making people happy is a big deal ro you, you are probably a Pleaser and you may be an ENFJ, ENFP, INFJ or INFP. If you feel like people take advantage of your generosity regularly, this is probably you, and you are more likely to be carrying some debt.

If you feel money is made to be spent and YOLO and all that, you are probably a Player and are likely an ESTP, ESFP, ISTP, or ISFP. You probably have a large amount of debt and trouble getting out of it because there’s always something amazing that has to be done or bought right now. It’s not entirely you’re fault, apparently you are a little hard wired that way.

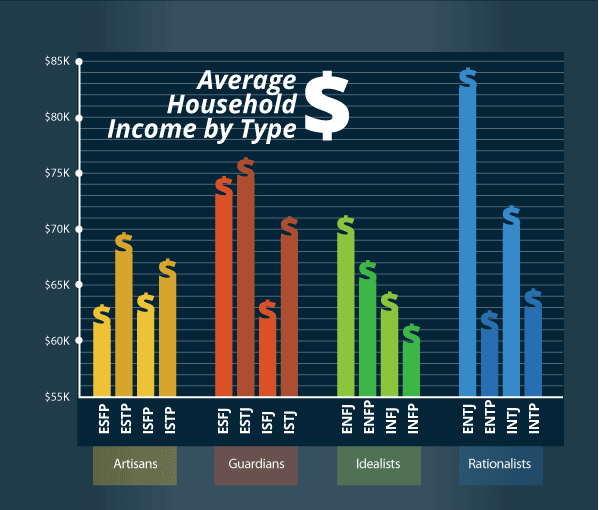

An interesting infographic about how personality type effects salary, but I have to say, based on the education section, I’m a little leery about it’s accuracy. Nonetheless, something to think about.

Looking for more ways to step up that debt repayment plan? Enter to win a copy of Suze Orman’s The Money Book for the Young, Fabulous & Broke. Contest ends December 31st.

a Rafflecopter giveaway

So brokeGIRLrich readers, which personality type are you?

Sources

Keirsey, David. Please Understand Me II. Del Mar, CA: Prometheus Nemesis Book Company, 1998. Print.

“What Your Personality Type Means for Your Money.” LearnVest. 14 Jan 2013. Web. 10 December 2013.

For years I was a player, now I’m a protector.

Brian@ Debt Discipline recently posted…Week End Round Up #10

Way to make a change for the better! As much as I think we have a lot of innate tendencies, I still think we can choose to overcome the negative ones.

Great post! I am not sure that I fall into one of the four, there is a bit of an overlap. I am definitely no longer in the player stage and moving toward the protector. Stopping by from SITS Sharefest!

Tiffany recently posted…The Best Me Campaign Day 13 – 3 Reasons Why Loving What You Do Is Important

Oh, I can definitely see how different personality types use money differently! This makes a lot of sense!

Rachel G recently posted…How I Deal with Fear

I think I’m somewhere between a protector and a planner. I used to be crazy about my budget, but I’ve definitely loosened up recently while continuing to keep my eye on the prize.

Stefanie @ The Broke and Beautiful Life recently posted…Budget Travel: 3 Days in San Diego

It seems like being a planner is the way to go. I try to be that person, but I’ve definitely got a strong YOLO urge that needs to be beaten down on a regular basis.

Definitely interesting seeing that I’d be considered a ‘Protector’ since I’m an ISTJ personality type. I have debt, mainly in the form of student loans though, and i dislike having them wholeheartedly. I definitely try my best to pay it off but I get easily overwhelmed by financial dilemmas. Thankfully my significant other is great at calming me down and helping me realize that with a little planning and budgeting (which I am actually very good at doing) – things are manageable. Bits and pieces people! I love psychology btw, a student and human observer I love all things social sciences! Have a great one Melissa! -Iva

AwesomelyOZ recently posted…A Childlike State

Hey, great post! Thanks for raising awareness. Can debts be written off due to a mental illness?

Thank you so much for this enlightening post, I have significantly got some thing right here and I will bookmark this page for your next upcoming post.

Pingback: The Benefits Of Having Great Friendships - brokeGIRLrich

Pingback: The Benefits Of Having Great Friendships - DM News

Pingback: The Benefits Of Having Great Friendships | Indianapolis Local News