Let’s face it; the stock market can be pretty intimidating. It’s like a foreign country – they use their own lingo, money suddenly seems to work differently and it’s (seemingly) in a constant state of unrest.

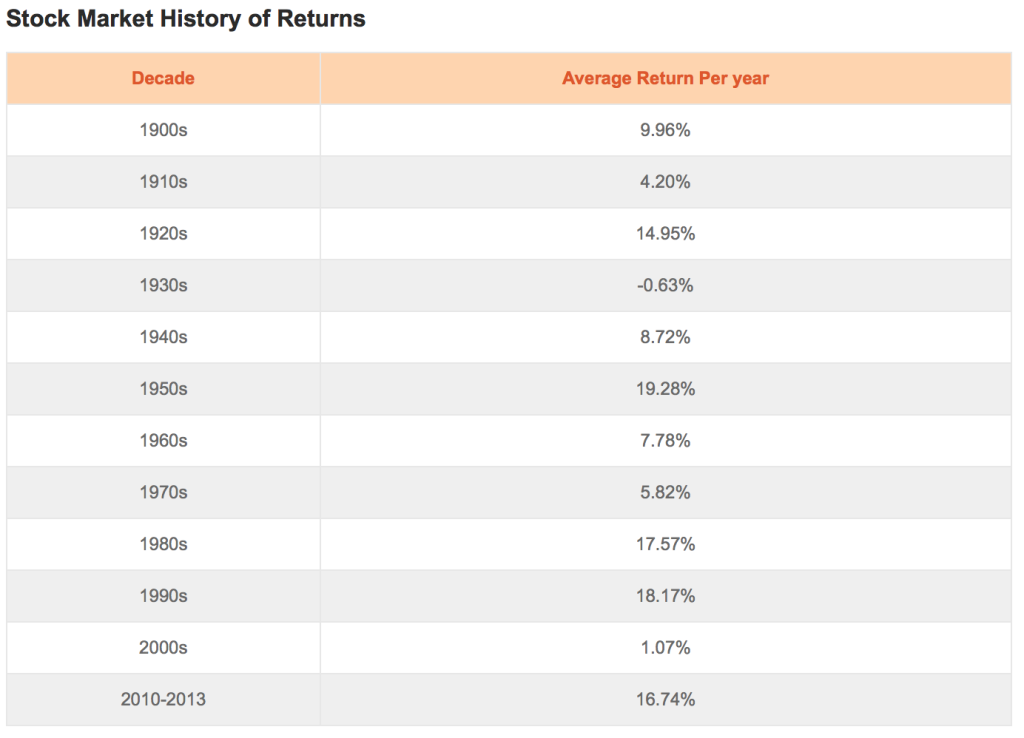

It’s so easy to get swept up in the panic that the media can create about stocks crashing. They frighten everyone into thinking that the stock market is the same thing as gambling, but really it’s not. Since the 1900s, the only decade where the average return wasn’t a positive number was the 1930s – even with how rough the first decade of the millennia was, the average return was still 1.07%. That’s nothing to write home about, but if you rode it out through the entire decade, you still most likely came out at least 1.07% ahead of what you initially invested.

More importantly, the average annual return is 7%. Inflation usually holds pretty steady at 4% per year. An excellent savings account might net you 1% interest. The best CD rates are around 2% and they lock up your money for 5 years.

The stock market is your best bet for a financially secure future if you just learn a few things first.

To begin with, the stock market as a whole is made up of a multitude of different companies. Trying to narrow it down to one company to invest in can be a very intimidating process. It’s also much riskier to invest in an individual company. To minimize some of that risk, the safest place to start looking into stock is index funds.

Index funds are a collection of companies all held in one fund. If something happens to one company, the price of the fund might drop a little, but your money is still secure because it’s likely that the rest of the companies are doing fine.

Some popular index funds are the Russell 2000 (a collection of small companies), the DJ Wilshire 5000 (a total stock market index fund) and the MCSI EAFE (a collection of foreign stocks). However, many index funds that are very comprehensive, like the ones listed in the previous sentence, can be pretty pricey.

For less expensive index funds, you can check out index funds put together by larger investment companies. The Vanguard 500 Index Fund (VOO) is a collection of companies from the S&P 500 and you can currently buy it for under $200 a share.

The S&P 500 (or Standard & Poor’s 500 Index) is a collection of 500 stocks selected by very informed analysts and economists. The companies are always large and American. It’s generally considered the best overall representation of the American stock market.

Similarly, Vanguard Total International Stock ETF (VXUS) does the same thing with long standing, established foreign stocks including companies like Honda and Unilever.

When you look into index funds, you want to establish how much it costs to buy and what the expenses will be. Index funds cost money to run, so you cover those costs with your expense ratio. The lower the better because over time the difference can really add up. If you invest $10,000 in an index fund with a .5% expense ratio versus an 2.5% expense ratio over 20 years that can add up to a $20,000 difference.

You can also purchase index funds in certain sectors, which gets a little riskier, but still stretches your investment out across several companies to lessen some of the risk. For instance, you can buy an index fund like Technology Select Sector SPDR ETF, which is made up of tech companies like Apple, Facebook and Verizon. Or you could invest in an index fund like iShares US Pharmaceuticals which covers companies like Bristol Myers Squibb, Johnson & Johnson and Merck.

Stocks on an individual level can certainly seem overwhelming and if you’re not careful, they can definitely get you into financial trouble. However, a little background research and some safe choices can keep your finances growing at a pace that outstrips any other kind of savings vehicle and makes sure you’re ready for retirement when the time comes.

Index funds are a really simple, low-fee way to get your toes wet in the stock market. Great explanation.

ZJ Thorne recently posted…Net Worth Week 19 – Heatwave Edition

Melissa,

I like your article. Good overview of the past results of the stock market, and great intro to indexes. I love to warn people whenever I can that looking at past history of what stocks did is not necessarily predictive of the future. While most blindly accept that stocks on average will continue to grow at about 7% in the future as they have in the past, there is no guarantee of this. Past performance is not always predictive of future performance. While this is especially true of individual stocks and mutual funds, you can apply this to past performance of anything in the market.

I like to carefully invest in index funds, coupled with smart investing in real estate rentals (without taking on debt). This is what I blog about it. Good luck on your journey!

Great overview and hopefully gets folks to consider investing a bit more to increase their wealth if they’re overweight cash equivalents like checking and savings accounts.

I think ETFs and index funds are a great way to get started, especially broad market ones. They help reduce risk and volatility while still earning healthy, consistent returns. Individual stocks are certainly more advanced.

Chris@TTL recently posted…ETF vs Stock: Invest to Be Bill Gates (or Just Be in the Bar)?