Guys, it has been almost six years since I spent a month writing out my Budget 101 series. SIX YEARS.

I think that’s pretty exciting but it also made me think it’s time to revisit the idea. I was recently at a symposium of stage managers, talking about personal finance, and a few of them questioned my budgeting sheet a little bit.

As I reviewed the old one, which was great, because it helped me out when I needed it to, I realized that maybe times had changed a little and it was time for an updated budget sheet.

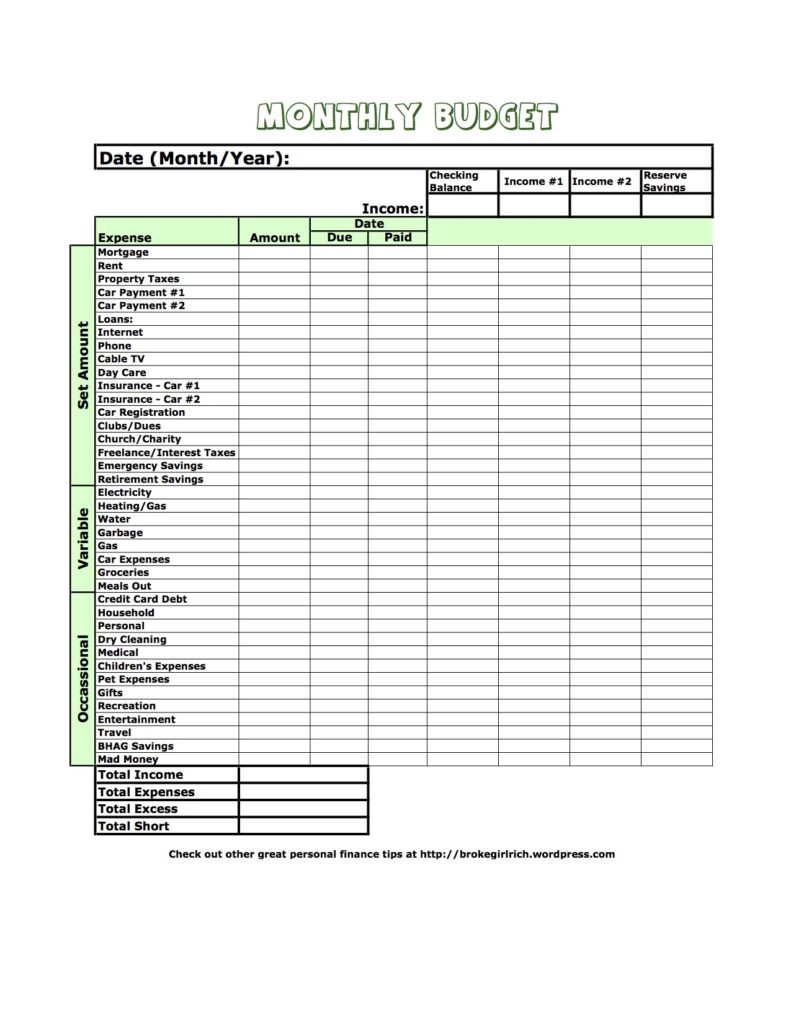

Here’s the old budget sheet:

And, if you want to check out the old Budget 101 series, you can find some of the highlights here:

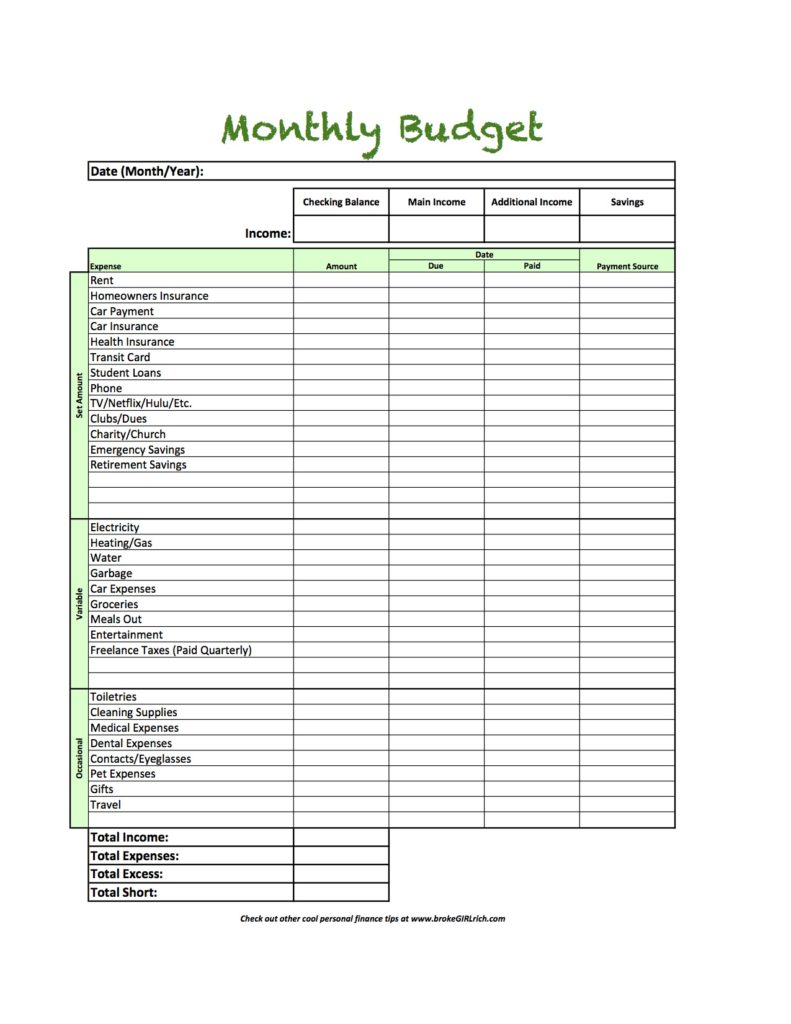

Here’s the new budget sheet:

And here are a few things I’ve learned over the last few years that I used to update the layout.

When filling out the new budget sheet, I think you should put your top of month checking and savings amounts in those boxes and then your set salaried/contract amount under Main Income and a reasonable projected amount from any side hustles into Additional Income (always low ball this number, if you’re not sure).

After you fill in your expense, note where you’ll pull the payments from: Checking Balance, Main Income, Additional Income, Savings.

Sometimes even just allocating where you’ll get the money provides you with more control. Maybe you’re shorts on some categories with your Main Income, but if you bounce Entertainment and Meals Out or some combination of variable categories to Additional Income, if you come up short, you come up short. You don’t actually have to do the things in those categories.

Here’s another big thing I learned, notice there are empty boxes in the new budget.

I totally realize now that not everything fits in a perfect little box and personal finance is personal – so you likely have some bill or something you want to save up for that is not on the old budget sheet.

I also realized that my first budget sheet was geared toward 100% suburban married life. And while I definitely live in the suburbs at times, married life is not my thang.

The updated budget sheet is also more geared toward city life and expenses you’d likely rack up there.

So you might be wondering, why do so many personal finance bloggers blab on and on and on about budgeting?

The best first step you can take with your money is to confront where it’s going.

Forget about even fixing the problems for a sec, because the reality is you may not even know what all the problems are.

Although, the reality also might be that things aren’t even as bad as you think they are.

Uhhhh… but they might be too.

However, pretty much anything is fixable, but you need to know what’s up to get your plan of attack in order, and budgeting is the easiest way to get that snapshot.

It lets you play around with different lines too to see if there’s any way of getting into the black.

If you’re not a fan of the printable sheets – you can try automating your budgeting system with great electronic tools like Mint and Personal Capital.

What do you hate the most about budgeting?

Having a budget is so important to getting free financially. Thanks for sharing these budget sheets.

I like where you stated:

“I totally realize now that not everything fits in a perfect little box and personal finance is personal…”

Yes, budgets are fluid and there are times when things pop up that we were not expecting so having those extra spaces is important.

Budgeting has really made a difference in our lives. It gave me a sense of control. The only thing I do not like about budgeting is that it is never fixed. Every month single month is different, at least in my family’s situation. It’s a never ending adjustment. However, it is all worth it. Thanks for sharing these worksheets.

I agree, there is always some variable that throws things a little bit. I read a great post on another blog (I feel bad I can’t remember which one) about having a sinking fund line – where you save some extra money to cover those random little things that seem to pop up every month. I know for a long time I would forget to account for my contacts, which is actually a pretty big spend (like $700) once a year.