How Credit Card Hacking My Tuition Has Been Going | brokeGIRLrich

I thought today I’d share a brief update on credit card hacking some of my tuition has been going.

So to clue you all in about how I pay my tuition, I’m a self-funded PhD student, which is a joy, and if I knew in 2021 what I know now about higher education, I would’ve approached this a bit differently because I didn’t even understand the terminology to look for funded PhDs in the UK when I was applying to schools.

But. Here we are.

My tuition is £15,100 a year, so somewhere between $18,000-20,000 depending on the exchange rate.

My dad helps me out with $5,000 towards that each yet.

The first year was prorated since I started in February.

I paid the full second year fee in September 2022.

I just paid the full third year fee this week.

I should have a smaller prorated fee to go in September 2024 and then a £500 writing up year fee for year 4 that I’ll probably have to pay in February 2025.

The payments for these fees come from working during my PhD and savings. And I have managed one super small £500 scholarship so far.

To pay my initial fees, I opened a:

- CapitalOne Venture

- US Bank Connect

CapitalOne Venture was also $0 for the first year and $95 for future years, though I cancelled before the end of the first year.

I had to spend $4,000 within three months and I got 75,000 miles (approximately $750 credit). It also had a $100 statement credit for AirBnB.

U.S. Bank Altitude Connect Visa Signature Card was $0 for the first year and $95 for future years, though I cancelled before the end of the first year.

I had to spend $2,000 in 120 days to get a $500 statement that I could use as cash back or for travel.

I wound up using these credits to pay for most of my AirBnB in London for my first two months of living here while I looked for an apartment.

To pay my second year fees, I opened a:

- Chase Sapphire Preferred

- American Express Hilton Rewards

Chase Sapphire Preferred was $0 for the first year and then $95 a year afterwards. I cancelled it before the end of the first year.

I had to spend $4,000 in the first 3 months to get 60,000 bonus points (approx.. $600 in travel or statement credit). It also had a $50 statement credit for hotel stays that I used during the year.

American Express Hilton Rewards has no annual fee.

I had to spend $1,000 in 3 months to earn 100,000 Hilton Honors bonus points, which I figured would be enough to pay for a hotel for a weekend getaway.

And this was my first misstep. My school doesn’t accept AmEx as a way to pay. However, $1,000 in 3 months if pretty doable, so I managed to hit the minimum spend there.

I also tried to open the United Mileage Explorer at this time and got denied because I had opened too many credit cards within the last two years.

I felt this was also a pretty big misstep because London and Newark are both United hubs. It is the main line I fly to get home. I went to the U.S. 4 times in 2022-2023. A checked bag costs about $100 each way.

And while I am very cheap sometimes, I am also kind of homesick all the time and every time I go home, I drag a bunch of New Jersey back to London with me in the form of my stuff to decorate my home or food. So – I pay that every time.

That’s $800 in just checked bag fees.

If I’d have been on top of this situation, I would’ve opened the Explorer first and also just kept it the entire I live here since the $95 annual fee clearly pays for itself with a single trip home.

To pay this year’s fees, I opened:

- United Explorer Mileage Plus

The United Explorer MileagePlus is $0 for the first year and $95 a year after that.

I had to spend $3,000 in 3 months to get 60,000 bonus miles (approx. $600 travel credit). It also comes with a free checked bag on every flight. 2 United Club passes. And several other little travel perks.

I spent a while contemplating going for the United Quest card. It has a $250 fee but I was completely sold it was my best choice. I think I’ll wait until after I graduate to consider that upgrade. Clearly I’d still save from my prior spending on checked bags, but I achieve the same outcome with the Explorer card for a fraction of the price. It also comes with $125 credit on flights, which I very likely would have used and 500 PQP but, let’s be real, I’m never getting any kind of upgradable status on United with my super basic economy flight choices.

Unless some of you travel hacking warriors know otherwise and would like to school me. I’m all ears.

For my final year, I am considering:

- British Airways Visa (though this is also a Chase card and I may be at the limit of cards I can open still) – which would be 75,000 and at least $100 statement credit on up to three flights after spending $5,000 in 3 months

- CapitalOne Savor – $200 cash bonus after spending $500 in 3 months and no annual fee

- World of Hyatt Credit Card – 2 free nights per $5,000 spent

And we have been talking about going on a cruise, so maybe if we plan the cruise for that summer, a rewards card related to that cruise line.

—

A key thing I had to keep in mind was to watch for no foreign transaction fees. That is absolutely crucial to this making any sense. I have an old Barclaycard that is my emergency backup card out here and I have had to use it once or twice and the transaction fees are crazy. So Barclaycards are out for now.

It also have to be Visa or MasterCard. Those are the only two types of credit card I can pay my tuition with.

Again, like with any other rewards card churning, it’s imperative to pay off the balance immediately. I put the tuition on my credit card and then move over the money from my savings account earmarked for tuition to pay it right off.

But since I can do that, I’ve managed to make a tiny dent in this essentially astronomic fee I pay each year and use it for some travel as well. In some cases, the rewards wound up being an extra $100 or so because of the total amount put on the card to pay the tuition.

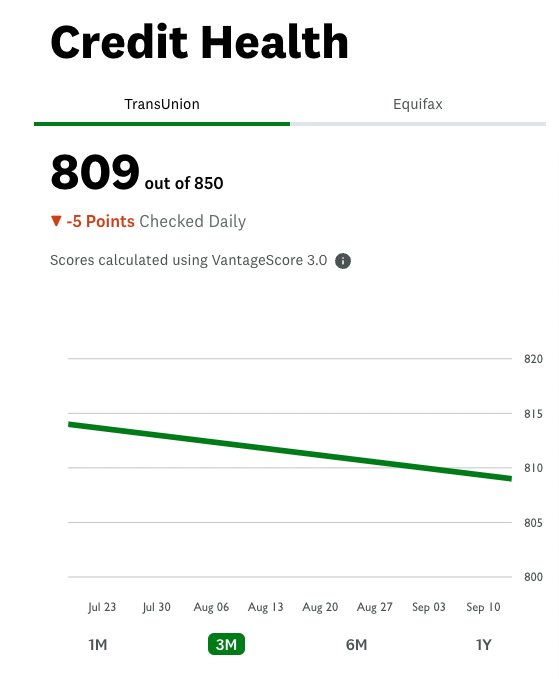

And for those concerned about what this kind of thing does to your credit score, the churning did drop my credit score by 5 points.

To 809. So I think I’m still good.