I totally forgot that April is Financial Literacy Month! Probably because every month is Financial Literacy Month here at brokeGIRLrich.

Turns out that today is specifically Financial Fitness Day, a phrase sent over to me in an email from CO-OP Financial Services. I usually ignore these types of emails, but they were smart about it and sent over a fun little quiz I can share with you guys!

Sorry – I love a good quiz. It takes me back to my sprawled-on-my-bed-with-Seventeen-magazine-finding-out-which-Backstreet-Boy-I’ll-marry days. Also, there’s a possibility you could be MC Hammer, which I can’t stop laughing at.

We get it: finances can be a scary thing, especially if you are looking at your own bottom-line. If you are one of these people, we are making it easy to get your feet wet and better understand your current financial habits and overall financial health.

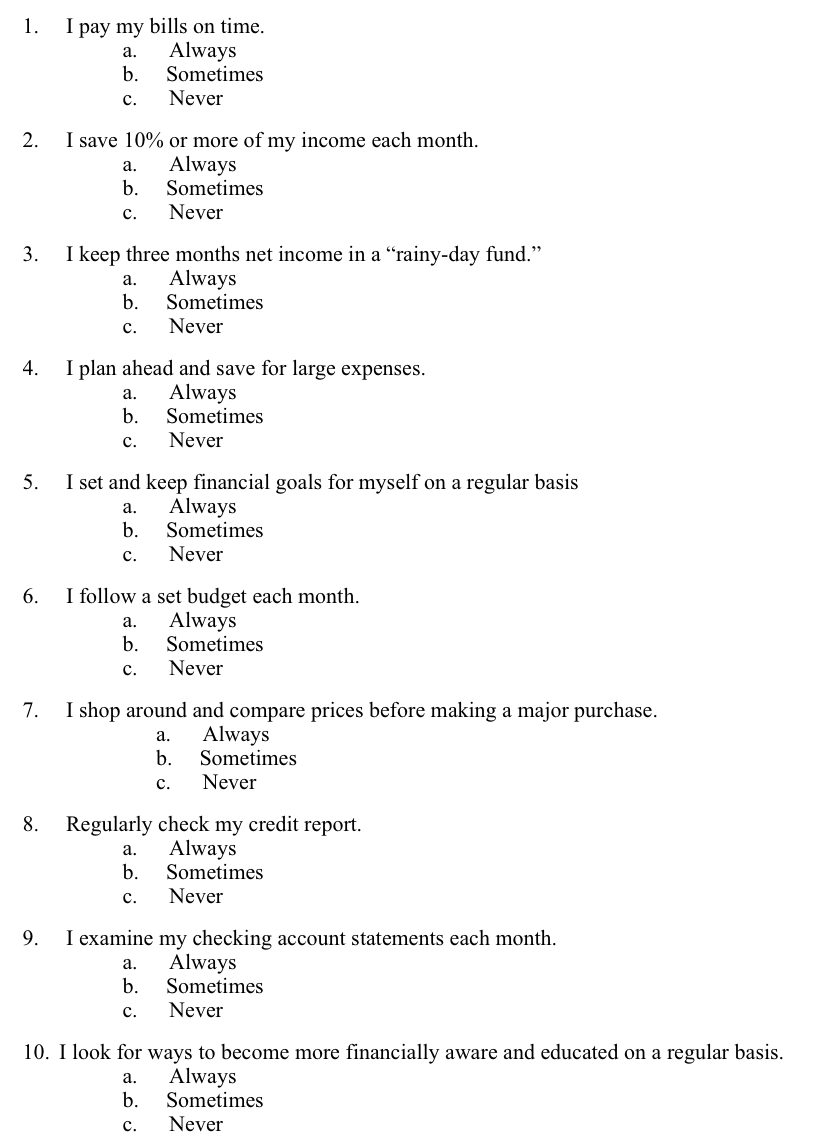

Answer the questions below and get a baseline financial assessment

Now that you’ve taken the test, let’s add things up.

Each answer is worth the following:

- A – 2

- B – 1

- C – 0

Add it up and let’s see if you who you are “channeling.”

15-20

Are You Warren Buffet!?

Even if you re by some chance you are indeed Warren Buffet, it doesn’t hurt to occasionally assess your financial habits and make sure your monetary ducks are in a row. Keep up the good work!

10-14

Are you MC Hammer?

You might be on the rise again and getting back to Hammer Time. Let’s make sure you stay on track and avoid potential stumbles and setbacks.

0-9

Are you Macaulay Culkin?

You have no idea what has happened since the 1990’s, which might be the last time you checked your credit score. Moving on is definitely frightening, but in an age of technology, there are some great resources that can help your financial enlightenment.

Where are these resources? They can help you if you are a Warren Buffet, MC Hammer and Macauley Culkin. Visit CO-OP Credit Unions here.

Personally, I was pretty excited to come in as a Warren Buffet – but I’m also not the best at shopping around before making a purchase or always following a budget. Both are skills I could certainly improve!

~*~*~

Another reason Financial Fitness Day caught my eye is because one of my all time favorite posts by another blogger is Are You Financially Sexy? by Shannon over at Financially Blonde. She’s an excellent personal finance advisor and has her own company where she’ll get you in shape at The Financial Gym.

In this great post, she posits that rather than 36-24-36, as the Commodores suggest, sexiness really stems from 750-35-15-35. That covers your credit score-savings-credit card utilization-debt to income ratio.

The first step to getting to your optimum financial sexiness is to learn your credit score and then get to work on improving it. It’s easier than you probably think.

Next you want to make sure you’re saving a decent chunk of your income for the future (at least 15%). This also helps to make sure you never utilize more than 35% of your credit.

So if you find out on this financial fitness day that you’re far from a financial brick house and more of a Macauley Culkin, don’t panic.

Once you face the facts, you can start to improve and if it turns out you’re a Warren Buffet, you can still always do even better!