I had an alarming conversation with my little brother recently. He’s a pretty smart dude, just turned 21, and recently got his first credit card. I was talking with him about how I was starting to get into credit card churning and he was interested in hearing about all the rewards card perks.

Then he wanted to know what the catch was.

As far as I’m concerned, there is no catch. For me. But I told him you really can’t carry a balance on those cards since the interest rate is so high.

Then my clever, educated brother told me always carries a balance each month since it’s good for his credit score.

Wrong.

Wrong. Wrong! WRONG!

Good gracious, who started this lie? I feel like it was the credit card companies themselves.

Or some malicious little gremlin that also tells you things like eating brownies after midnight means they don’t have calories and surely if you turn on red when it says no turn on red here, this won’t be a stoplight with a camera in it.

Wrong. Wrong! WRONG!

It always has the camera.

But I get it, why trust me? My brother sure doesn’t. He did not leave that conversation ready to trade in his reward-less card with low interest for carry his pointless little balance for the joys of free travel and cash back and no balances each month.

…of course, I did once shut all the lights off on him and lock him in the basement in the dark for ten minutes when he was three. He hasn’t trusted me so much since then.

However, you might consider trusting Experian. And TransUnion. And EquiFax.

They would never lock you in a basement.

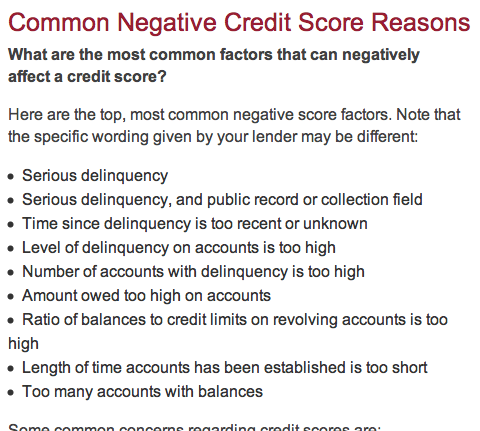

From EquiFax’s Website – “amount owed too high on accounts,” “too many accounts with balances” and “ratio of balances to credit limits on revolving accounts is too high.”

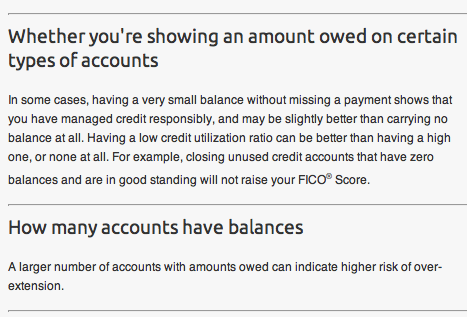

FICO might lock you in a basement. I’d like to know in what cases this is true, FICO? How about in most cases? Why didn’t you cover that?

From FICO’s website – really, FICO? WTF? You are a liar. Way to commit to it too with word choices like “may be” and “in some cases.”

After finding these snippets on their websites, I can see how some might be confused. Especially with that FICO one, which literally looks to me as though it’s trying to keep you in debt.

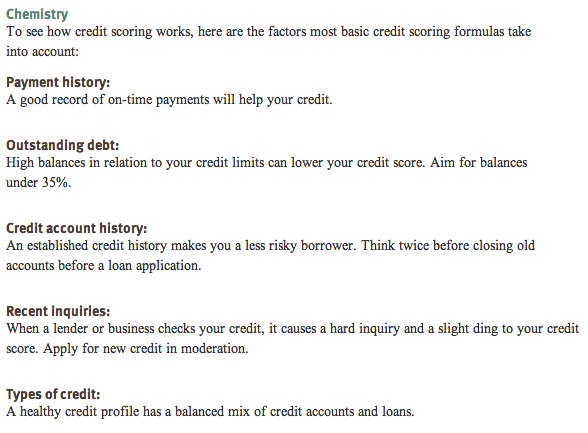

Like most things in America, these seem to be written for the lowest common denominator. They’re telling you what to do to have adequate credit.

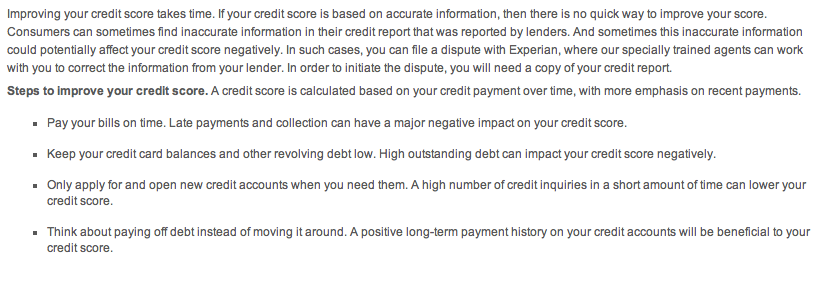

The personal finance community (and my brother) are not a collection of the lowest common denominator. So, take it to the next step to have excellent credit and pay those balances off. And keep your utilization rate well below 35%. Good golly, 35%? That could be a ton of debt if you have high credit limits.

The balance on each statement is what goes into your credit score updates. So if you receive a bill one month for $456.26 and promptly pay it all off, it’s likely to look like your card has a balance on it of $456.26 till the next statement comes and it switches to that number.

As long as you’re occasionally putting money on the card, your credit report realizes it’s happening.

So really, carrying a balance does nothing for you except make the credit card company a little richer.

Honestly, the lower your credit utilization ratio (the amount of money you’ve spent of your cards vs your total credit limit), the higher your score. Logically, constantly paying off the balance of your credit looks excellent.

Finally, let’s close out with some advice from my favorite credit monitoring website, Credit Karma, where you can check on your score as often as you please for free and they recently added access to your credit report as well.

Credit Karma – because personally, I trust people who aren’t trying to make any money off of me more.

Not good enough for you? Well I’m all for putting my money where my mouth is. I pay off my balance every single month and have for the vast majority of the last twelve years (the length of my credit history). I honestly think there was a 2 month period when I was 23 that I carried a balance and about a 6 month period when I was 26.

My credit score is 787 – even with 2 recent hard inquiries from new credit cards and the fact that that balance column says zero 95% of the time. And even when there is a number there, it’s from the fully paid off amount on the statement the previous month.

Do you know your credit score?

Check out Credit Karma to find out for free. Then start tracking it every 6-12 months. And once you’re rocking the no balance life, check out this excellent collection of Credit Card Churning 101 articles by the Queen of Credit Card Churning over at Club Thrifty.

I have watched my credit score go up in the last year as I have paid off the balance every month. I never heard that carrying a balance could be beneficial, thank goodness!

Lauren recently posted…What Would You Do for $50,000?

I really can’t believe how common of a misconception it is!

Wait, brownies after midnight DO have calories?! You’ve ruined my entire worldview :)!

Totally agree on paying cards off–we’ve always paid ours off in full every month and my husband and I both have great credit scores. Interestingly, our credit scores jumped even higher once we got our first mortgage since they do like to see that you can manage your debt well.

Mrs. Frugalwoods recently posted…Frugal Hound Sniffs: The Barefoot Budgeter

It’s true. Mine got a nice boost thanks to Sallie Mae… so at least that wench had that going for her.

So crazy….I just talked to someone who, after I told them about only really using rewards cards, told me one of the perks of his card was that if you paid off the entire balance before the due date, there was no interest charged. *crickets*

It was hard to tell him that’s how EVERY single card works. And see the look of disappointment.

femmefrugality recently posted…Combating the Disproportionate Rise of Textbook Prices

…wow.

Such a big misunderstanding by so many people. Way to break it down Mel!

Brian @ Debt Discipline recently posted…Net Worth Update: July

AMEN! I can’t believe FICO would write it that way though. Feels quite deceptive. Hope your brother heed’s your words and pays off his cards in full instead of throwing away money in interest.

Broke Millennial recently posted…How To Reduce or Avoid Student Loan Debt: A Guide To Being A Debt-Free College Student

Me too! And I’m definitely dismayed with FICO as well.

My mother has always told myself and my sister to carry a balance on our credit cards. And that is where the damage started. Becaues once you carried a balance and didn’t pay it off in full, it was much easier to keep adding to the debt and never actually completely paying it off. Hence-where we are now.

I can imagine. I’ve always been nearly neurotic about wanting to see that number hit $0 every month.

Right now, I don’t have any credit card but I’m planning to sign up my very first one. But if ever, I have my own credit card, I would definitely keep a good credit score.

Kate @ Money Propeller recently posted…Avoid These 4 Most Common Financial Mistakes at the Beach

Excellent advice! I’ve heard the “better to carry a balance” lie a few times. I can’t figure out where it comes from. My only theory is that people mix it up with “You’ll get offered more credit cards if you have recently carried a balance” [because the credit card companies are looking for people who will make profits for them]; that does seem to be true, but in my experience you can get the best credit cards simply by asking for them, and then you don’t get all that junk mail! (Credit card offers in your mailbox or recycling bin are actually dangerous, because someone can take them and sign up for cards in your name.)

You might be interested in how credit cards work for me. It sounds like your approach is similar to mine. I get discounts at Costco and Target that have saved me thousands of dollars over the years.

Becca @ The Earthlings Handbook recently posted…9 Things I Forgot to Bring After Maternity Leave

It doesn’t seem to take much at all to start getting tons of credit card offer junk mail!

Oh.my.dog did you just want to throttle your brother when he said that? Memories of 3 years of age….hee hee.

It’s really sad that there is so much misinformation out there and believed to be true by seemingly intelligent people.

Now that’s one thing I can say I did learn from my parents, to pay off credit cards every month. But then again my mother also believed she had to marry a man who wore glasses because that’s what her Granny told her. Good looking men were trouble. So Mum married a handsome guy who wore glasses, plus he was frugal. Mum was pretty smart.

debt debs recently posted…Sticky Business: A busy bee ‘s work is never done

Guys who wear glasses can be pretty darn smexy. That’s for sure.