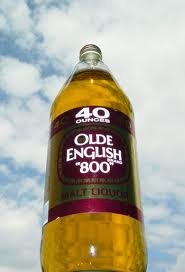

When you’re the same age as the common name for this kind of alcohol you should have the sort of finances that allow you to never, ever drink it again. Unless you want to play Edward 40-Hands… cause you’re never too old for Edward 40-Hands.

1.) Assess your financial state for retirement.

Everything I keep reading says 40 is when you hit mid-life (which sounds swell, because mid-life doesn’t sound Over the Hill to me at all). So if you’re rounding the corner on another phase of life, it’s probably a real good time to evaluate your financial achievements. You should have 3-3.5X your annual salary saved up for retirement. Check out a great, free online tool to calculate what you need for retirement again and make sure you’re on track. If you’re not, most of these tools will tell you what you need to do to get on track. If that number seems staggeringly, hopelessly high, just do the best you can. If possible, you should be contributing the max to any 401(k) or IRA you have at this point.

2.) Save for Your Kids College Expenses

If you’re going to help put Junior through college, you need to start saving early. Never, ever touch your retirement accounts to help your kid through college. Honestly, they’d probably rather have the burden of student loans in their 20s, than trying to take you in, pay a mortgage, and raise their own kids in their 40s or 50s when you have inadequate retirement funds. 529 Plans have great tax advantages to save for your kids college years. You can also take out loans in your own name or co-sign with your child to help fund their education.

3.) Get your Estate in Order

During your 40s, you need to make a will, create an advance medical directive and assign a durable power of attorney. Do this now while you’re still young and healthy.

4.) Eliminate your Debts

You should keep plugging along with your same financial plans of your 20s and 30s to keep paying down your debts – pay off the highest interest ones first and then just keep going until you are debt free. Unless you haven’t been doing that. If that’s the case, now is the time to start.

5.) Start reconsidering the size of your house.

If you’re nearing the point of becoming an empty nester (or your nest was never populated with kids in the first place), consider if this is where you’ll want to live out your retirement years. It could be a major financial benefit to consider downsizing your home as the number of bedrooms you need reduces.

6.) Look into long term care insurance policies.

So, not a happy thought, but your twilight years could require some time in a nursing home. Strokes and Alzheimer’s happen. And the time when you’ll get the best rates locked down will be in your happy, health prime – your 40s.

7.) Let a divorce destroy your financial future.

Marriages fail at all ages, but if this event has hit you, you’re probably going to reel at the financial shock of it all for a while. It’s important to completely reassess your financial situation after the dust settles. Your lifestyle used to be funded by two paychecks and now it’s not. You may need to downsize your house and other spending habits for a while to get back on track.

8.) Check in on your kid’s financial education.

Making sure your kids get a sound education in finance is just as useful as all those years they spend in school (I mean, seriously, I’ve never used chemistry or physics. I would have benefited 1000% more from a class in personal finance and investing). And you will have to bail them out of less financial messes over time. Score.

9.) Save for your kid’s weddings.

So perhaps you have no intention of helping your child pay for their wedding, but lots of parents do (especially if you have a baby girl). The average wedding costs $28,000. Which is ridiculous. I could almost buy two of my car for that much. Nonetheless, if helping Suzy into wedded bliss is on your two do list, start earmarking a chunk of change for that now. Even if she is only in high school and you are desperately hoping that loser she’s dating now doesn’t make it past sophomore year.

Also, check out my rafflecopter giveaway – a copy of Dave Chilton’s The Wealthy Barber. The best introductory book to personal finance out there.