Dobot: The Best Tool to Boost Savings | brokeGIRLrich

About six years ago, I was a super advocate for digit and Dobot. Both of these are apps that connect to your checking account and siphon out small amounts using an algorithm (or you can schedule a set amount) into a saving account.

They were incredible and free, but then both services started charging.

If you’re bad at saving cause you’re lazy or forgetful, spending a few dollars a month for the app can be worth it.

It didn’t feel worth it to me though.

Circling back to this year and I’ve started doing assorted financial literacy webinars and so I looked into what the current going rate for these apps are.

Digit now charges $5/month to use it.

You can read my previous reviews of digit here (year one) and here (year two).

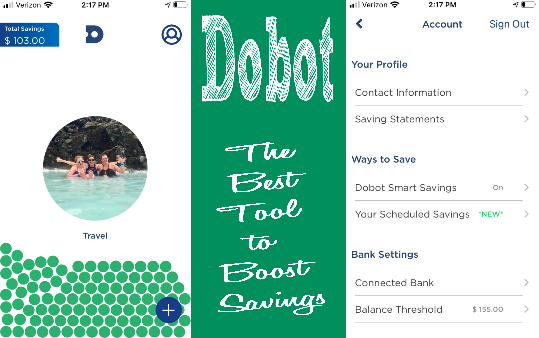

To my surprise, a bank bought Dobot and it is once again free! I was able to shout it from the Zoom rooftops about what a great and useful app it is especially for folks with variable income.

I also learned from some participants in these webinars that your bank might have a similar tool for free.

Back in the day, digit and Dobot really helped me grow my emergency savings.

Currently I’m using Dobot to save for my vacation goals when the world reopens. Again, I have very variable income – it can be anywhere from $0 to $2000 a week and there is no rhyme or reason to my current schedule at work.

Currently I’m using Dobot to save for my vacation goals when the world reopens. Again, I have very variable income – it can be anywhere from $0 to $2000 a week and there is no rhyme or reason to my current schedule at work.

I’ve also been keeping a lower balance than I usually do in my checking account and the algorithm has not over drafted me.

You’re also able to set a balance threshold. If my checking account goes below $155.00, Dobot will pause until the balance is higher than that.

After redownloading it about a month ago, it’s siphoned out $103.00 painlessly towards my travel goals. It let me add a silly picture of my BFFs and I on a previous vacation that we have spoken longingly of for the last year+.

So hopefully it will continue to be a painless way to save for our next great adventure.

Pingback: Tools To Get To The Basics Of Financial Responsibility - brokeGIRLrich

Dobot sounds like the budgeting BFF I never knew I needed! If only it could also stop me from impulse-buying fancy coffee and unnecessary home decor. 😂 Love the idea of a savings robot—because let’s be honest, my willpower alone is about as strong as a wet paper towel. 🤖💰