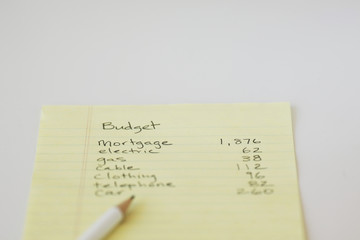

One of the most useful things I did when I was trying to pay off my student loans and figure out how to get by with what was left was to start budgeting.

But I’ll admit, budgeting wasn’t super exciting.

I still don’t think it is – but I also don’t do it very often anymore.

I’m lucky that I’m in a position now where I have a good grasp on what’s in my bank account and how much I’m spending each month – but it wasn’t always like that.

Before I really knew how to handle my money, making a budget was probably the best tool I had. It’s like having a language dictionary when you’re trying to learn a new language. You can refer to it a ton and it’s very useful. As you become fluent, you don’t need the dictionary very often.

I still have most of my money tracking itself through Mint, so if I start wondering about something, it’s really easy for me to go look through my purchases and check out where the missing money went.

If I didn’t have any budgeting system, it would often seem like money was just disappearing.

Once I knew where the money was going, it was easier to take control of it. It’s a little easier to cut back on takeout when faced with the harsh reality of how much I’m spending each month. I may have never known candles need their own budget line in my life if I wasn’t conscious about how I was spending my money.

Now that I know, I can wing it a lot more – so the work earlier in life has totally paid off.

I have a good handle on my money, but I still budget. I like to keep a close eye on where my money’s going to go. But then again, I like budgeting, so it’s not a big deal to me.

Gary @ Super Saving Tips recently posted…How to Save $25,000/Year Just By Retiring!

I’ve tried it a couple of times, but as you said, I have a pretty good grasp of where my money is going, I have enough money to support my lifestyle and to save an appropriate amount so tracking every penny I spend, at this point, is more trouble than it is worth. I know the difference between needs and wants and when the bank balance gets too low, we cut back on wants.

RAnn recently posted…Review of Finances: 3rd Quarter 2018

I don’t budget because I don’t know where my money is going, or because I don’t have enough money. I budget because I like to assign a task to each dollar. I find that unassigned dollars have a tendency to get lost on the way to the savings account! They like to wander into coffee shops or book stores just a little too much.

I do budget… every month. I know what is going on but I like to keep track, notice trends, and progress!