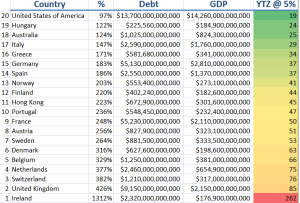

Everywhere you look in America, there are endless headlines about debt – every generation and every type of debt. We seem to be very thorough about getting into debt here. Plenty of other nations moan about their debt levels, but America isn’t really doing that awesome (although also not as bad as some seem to think).

And there’s something about all these numbers that are fascinating to me. I mean, how does this even happen? Once we started going a little into the red, why didn’t the government start to think “this is bad” and take steps to rectify it then, instead of letting our national debt get so out of hand. And why don’t we?

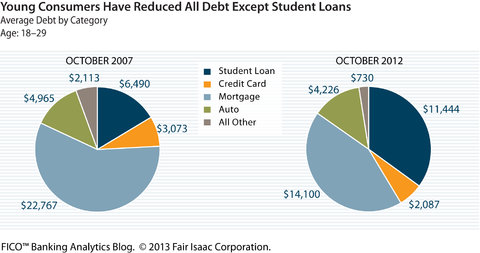

As a millennial myself, I sympathize with the fact that we are a little screwed. We’re the first full generation (although Generation X didn’t escape unscathed either) where college has become a necessity despite the huge tuition hikes that make it nearly unaffordable. This isn’t to say it’s impossible to get through college without taking on debt, because it can totally be done and there are plenty of websites and blogs that’ll tell you how they did it, but for most people in their late teens and early twenties it means they are probably going to take on some debt. So instead of just starting out with a clean slate, they now have to figure out how to pay back (on average) $26,600 – you know, about the same amount our parents had to save up for down payments on their homes. And let’s not get started on the abysmal employment rates for this generation either. Nonetheless, a lot of us seem to be noticing this debt trend and doing something about it. I think it’s lucky people still call us Millennials and not Generation Debt – oh wait, some do.

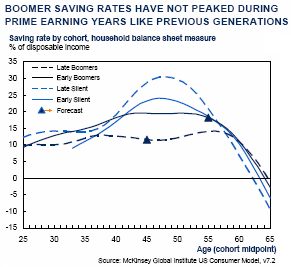

One reason (most) don’t call us Generation Debt is because we totally don’t have the corner on it. After all, we learned our money skills from somewhere, didn’t we? Most of us are kids of Baby Boomers, who, bless their hearts, really did want us to know we could have it all (unless your family were immigrants, in which case you may have been super awkward growing up and your home packed lunches may have made you smell like cabbage, but you’ve probably got your sh*t together now – fortunately the bazillion participation trophies my mom argued for were balanced out in my house by my very Russian dad who taught me that you have to earn things and not everybody is good enough. “Someone has to flip the fries at McDonalds” got me through a lot of my more difficult classes in college a lot better than “you can be anything you want to be, sweetie”). And I really don’t want this to read as an attack on Baby Boomers, because, you know what? They really did believe they could have it all and they were pretty much the first generation to do so. And there really is something behind that mentality. But I think somewhere in the having at all mindset, Boomers lost track of exactly how to get it all, and the advance planning needed to make that happen. Or they always thought they had more time. Or… I don’t know. I’m not a Baby Boomer.

I guess the reason all these charts and numbers interest me so much is because I just want to do a little better. And to do that, you need to know what you’re up against. I keep reading about how Baby Boomers will probably have to delay their retirements. It makes me wonder why? And how do I make sure that doesn’t happen to me? I read about all the foreclosures on the houses bought by Generation X and I want to make sure that when I buy a house someday, I can keep it. And I want to see what’s happening in my own generation to make sure I’m not falling into the same traps. I do agree that some debts can be “good” like student loans and mortgages, but none of them feel good to me and more I can avoid them, the better.

For more thoughts on how to survive debt free, enter to win this month’s giveaway – a copy of Suze Orman’s The Money Book for the Young Fabulous & Broke. Contest ends December 31st.

a Rafflecopter giveaway

brokeGIRLrich readers, what financial lessons have you learned from other generations?

This post is linked up as *Part of Financially Savvy Saturdays on Femme Frugality and My Pennies My Thoughts*

Site looks fantastic, congrats!

Stefanie @ The Broke and Beautiful Life recently posted…Managing Big City Wedding Costs

Thanks!

I’ve learned a lot of the same lessons as you did from your parents. My parents were hard workers and even though they weren’t immigrants always stressed that it was possible to fail. But I was still special and unique and could do anything I wanted to (mostly my mom, too, haha.) But from that entire generation, not necessarily specific to my parents, I’ve learned that savings is important, and, really, you can’t have it all. You can finance it all and end up in debt, but a much more viable solution to living a happy life is identifying what is important to you and allocating your resources (time, money, whatever) there. Some people will succeed. Some people will fail. Prepare for the worst. Hope for the best. And don’t count on real estate to always accrue more value. :p

femmefrugality recently posted…Financially Savvy Saturdays Fifteenth Edition

P.S. Thanks so much for the link!

femmefrugality recently posted…Financially Savvy Saturdays Fifteenth Edition

Of course, there’s another one coming up on Monday coincidentally too. It just wound up tying in nicely.

Yes, I used to all the time and now, I try my hardest not too. I’m trying to build up my EF so I won’t have to in the future. Visiting from Financially Savvy Saturdays.

The Frugal Exerciser recently posted…Christmas Fitness Gifts