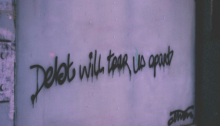

Beware the Dangers of Debt & Desperation

Most people don’t want to think about their debt. But simply ignoring your credit obligations won’t make them go away. Letting debt get out of control often leads to dire situations. People in this predicament tend to make decisions out of desperation, which can hurt them down the line. Be aware of this phenomenon if…