Budgets = Freedom: A Quick Look at Budgeting | brokeGIRLrich

When I started my blog (cough, cough, seven years ago), I used to come up with themes for the month, so I’d know what to research and concentrate on. If you’re just getting started with budgeting and want to dive deeper, there’s a budget 101 series you can put in the site search bar and a lot of posts will come up.

But today we’re just going to revisit the topic in its most basic form a little. I read somewhere once that you have to hear something seven times for it to really stick. I have no idea if that’s true, but a little repetition never hurts, right?

Let’s start with my budget mentality. Budgets = Freedom

Say what? You might not agree. You might feel like a budget is trying to limit you. I feel like a budget gives me control.

When I use my budget like the bada$$ tool it is, it lets me know where my money is going and control it.

A budget breaks down into two parts – money coming in, money going out.

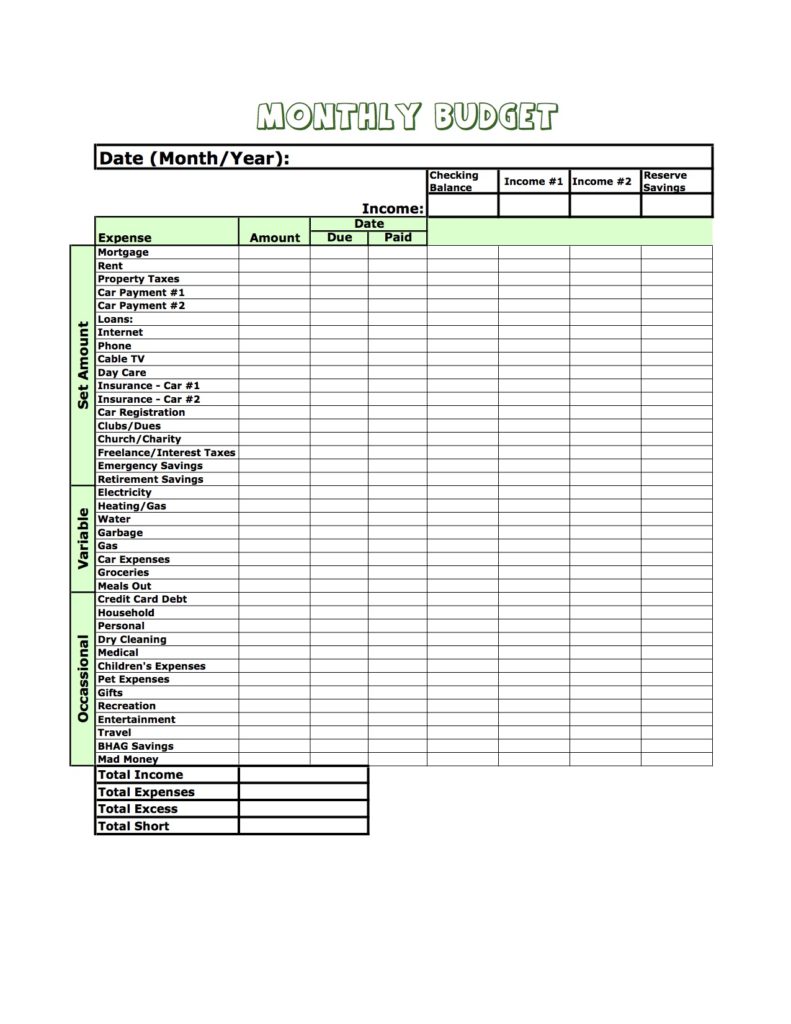

There are plenty of fancy budget systems and excel sheets out there, and I’ve got a picture of mine right here that you are welcome to steal, but you can make a budget with a simple pen and paper or your own empty Excel sheet.

Monthly Budget Sheet

It doesn’t have to be fancy. It does have to be functional.

Start with the easy expenses, the ones you know you’ll have to pay every month:

- Rent

- Car Payment/Public Transport Monthly Cards

- Loan Payments

- Electric

- Gas

- Internet

- Phone

- Health Insurance

- Homeowners/Renters Insurance

- Car Insurance

- Prescriptions

- Gym

- Etc.

Then make an educated guess on what you spend on the variable expenses. When in doubt here, round up. If you usually use a credit card to make your purchases, you can go back to the past month or two and check how much you actually spent on these things:

- Food

- Savings Goals

- Entertainment

- Toiletries

- Clothes

- Travel

- Candles (just me?)

- Etc.

Now look at your list of expenses and divide them into Needs vs. Wants. I think when we tackle this exercise it’s easy to get a little touch about Wants. There’s nothing wrong with wanting things. A major reason we work is to spend money. It helps support the economy (#merica). And wants can bring us a lot of joy.

But think for a minute – if you lost your job and had zero income coming in for two months, what would you cut back on in that list? Those are probably your Wants.

I’m not asking you to cut back either. I just think it’s important to know the difference between our Needs and our Wants. Using that knowledge effectively is where the whole Freedom aspect really comes into play.

Ok. So now we’ve got this pile of expenses that may feel a little overwhelming.

We balance it with what’s coming in. Fingers crossed here.

Look at your monthly income from work. The goal is for this number to be equal to or higher than your budget with your Needs and Wants.

If it is, you’re golden.

If it’s not, you’ve got some strategizing to do – strategizing that will take way more than one blog post to sort, but every journey starts with a first step. If you had no idea what your financial state was before, you’ve just created your first snap shot. If there’s a gap between what you’re making and what you need to cover your budget, you know how much that number is.

You have two main options here. Spend less. Earn more.

We’ll look at them in the next few posts.

Pingback: Spending Less - brokeGIRLrich

Pingback: Earning More - brokeGIRLrich