I am awful at budgeting. Seriously awful. Mostly because I’ve been pretty lucky to not have to worry too much about money most of my life, I sort of just have an idea of what’s happening in my checking account and try to keep my expenditures under that. Once in a while I fail and then I have to keep super careful track to be able to pay off my credit card the following month. I realize that this this is probably not a long term way of approaching money.

At the start of this year, I was actually a little strapped for cash trying to get back on track after two months of unemployment and had to put some effort into making a budget plan. Also, for like the first time in years, ever really, I had to be able to figure out how to afford things like groceries and gas (because a bonus of living on a ship is never paying for car related bills and being fed in the Lido – and prior to ship life, Mom and Dad chipped in heavily for those items). Heaven help me when rent gets piled on there too someday. That was when I started trying to figure out where I could squeeze money from – and that required looking at how I spend my money.

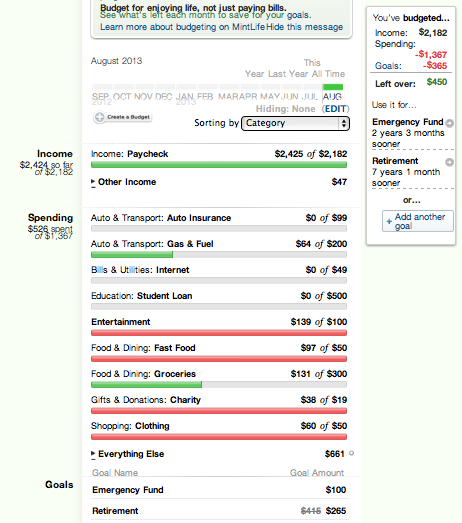

Cue mint.com, the only website that I’ve actually been using for a few years to track my finances. You enter all your financial information and it keeps track of it for you. You can then assess where you are spending your money and set up a budgeting system. If entering your financial information online freaks you out, you can accomplish the same thing with a little more research and an Excel spreadsheet.

Start by keeping all your receipts for a month. At the end of the month, break down the receipts into categories such as food, restaurants, clothing, entertainment, exercise, gas, car repairs, insurance, phone bill, etc. The totals you get should give you an idea of how much you are spending on each item.

Then assess what you’re spending. I mean, if you spent $300 on shoes, is it really necessary? Think back. Is this a normal occurrence? I mean, if you haven’t bought shoes in 5 years and then you happened to buy $300 in shoes this month, probably not a big deal. That’s actually an $8.33 investment in shoes each month. Not super irresponsible. If you have done that every other month this year though… where the heck are you putting those shoes? Seriously?

For me, that spot was actually groceries. I looked at the total and was like, WTF? What am I even eating? And I’m not like an all organic, Whole Foods kind of girl (well, I am slowly turning into that, but that has been more recently). So I checked out the receipts even further and realized that:

- I buy tons of impulsive junk food.

- Based on the time stamps on those suckers, I tend to shop on my way home from work when I’m hungry and in a bad mood and everything looks good.

- A bunch of that food was still in my cabinets months later (seriously, I have 8 month old dried edamame in there right now. That bag could’ve been a Starbucks coffee. And kale chips. I have no idea what possessed me to buy them, but surprise, they’re gross).

- I never used coupons.

Coincidentally, or not, fast food and restaurants were a close second on the list. Still working on fixing that money drain.

In an effort to bring down my grocery bill (which I’ve actually done pretty well, although I’m currently working in California and everything costs an arm and a leg here), I started making grocery lists. Then I would just Google the item and coupons and find any coupons that applied (this takes me less than 5 minutes a trip). Then I made sure I eat before I go to the food store, even if it makes swinging through a fast food line on the way there, I honestly spend enough less to make it worth it. Especially if I’m buying a lot of groceries. And I got a little more health conscious, so I only try to buy one thing that is awful for me each trip. And no more impulsive kale chip buys. Oddly enough, to save a good bit of cash, all it took was a little effort.

Some things are just not going to get any cheaper – gas, phone bills, internet, rent, car payments. So, I would split your categories into two columns. Things that you can’t control how much you spend on them and then things you can (FYI – if you really have time to kill, you could probably research the heck out of things and find a better phone plan, a cheaper car, a discount gas station nearby, etc). Now look at where the rest of your money is going – probably to stuff. And how much stuff do you need? I mean, tons have been written on retail therapy, but it’s really not the best approach to your problems, especially if debt is your problem. Don’t get me wrong, I totally get the new buy high, it happens to me too, but I prefer the my-credit-card-statement-says-$0-at-the-end-of-each-month high.

This whole creating a budget thing really helps bring the true price of the little things to light. I love candles. They cost like $5-10, which isn’t much, but I hoard them like some weirdo. And at the end of a month, I used to buy like 10 of them. I don’t even light them that often. 10 candles a month is a little much, especially when I’ve now spent $75 on candles, which is just under 20% of a monthly loan payment. But when I’m buying them spread out through the month, I don’t even notice. This has been explored more thoroughly by people focusing on buying Starbucks every morning (which, if you are going to do, check out this guy’s advice).

OK, back on track. So now you have all the numbers in your spending categories. You’ve evaluated what’s got to stay, what needs to changes, and maybe even what can go (I’ve read several impressive articles about whether or not a cell phone is really a necessity – as a millennial, I say, oh heck yes, but I can also see how a prepaid phone would more than cover it for most people).

Now you look at those numbers compared to what you make. If you make irregular amounts, average your salary for the last six months (if you want to make a budget on the safe side, just base your salary off the lowest number for those six months).

Ideally, you’d now remove 10% to put into savings. Give it a try and start your budget based off of that number (take out 20% if you’re the religious type and planning on giving 10% of your pay to the man in the sky). Subtract the non-negotiable: rent, utilities, gas, food, loans. Make sure you’ve budgeted realistic amounts. Don’t look at your utilities, take off $20 a month, and figure you’ll just be hot in the summer and bundle up in the winter. You know you will cave and use the A/C. If nothing else, you should over estimate.

Next look at your debt. Figure out how much you need to pay off each month. If you’re paying down debt, this number could look impossible. None the less, figure out the bare minimum you can pay on most of your forms of debt, figure out which item has the highest interest rate, and put all your extra cash toward paying that one down. When it’s finally paid off, go to the next highest interest rate loan.

Even if you’re paying down debt, this doesn’t mean you can’t ever buy a new shirt or go out for dinner, you just need to account for it in your budget. And if you’re so far in the hole, you can’t even do that, maybe set up a change jar and when it’s full you can use it for whatever you want. If you’re in debt from just buying anything you want when you want it, this is likely to really suck and will require a total mental rehaul. Get on it. No one can fix your debt problems but you. And you probably can.

So to finish with an example, my, very sloppy, mint.com budget looks like this:

Pingback: Doin’ it by the Decade: The Roaring 20′s | brokeGIRLrich