Now that we have a snapshot of our current financial picture and a grasp on our financial goals, it’s time to get down to the nitty gritty of financial organization – the monthly budget.

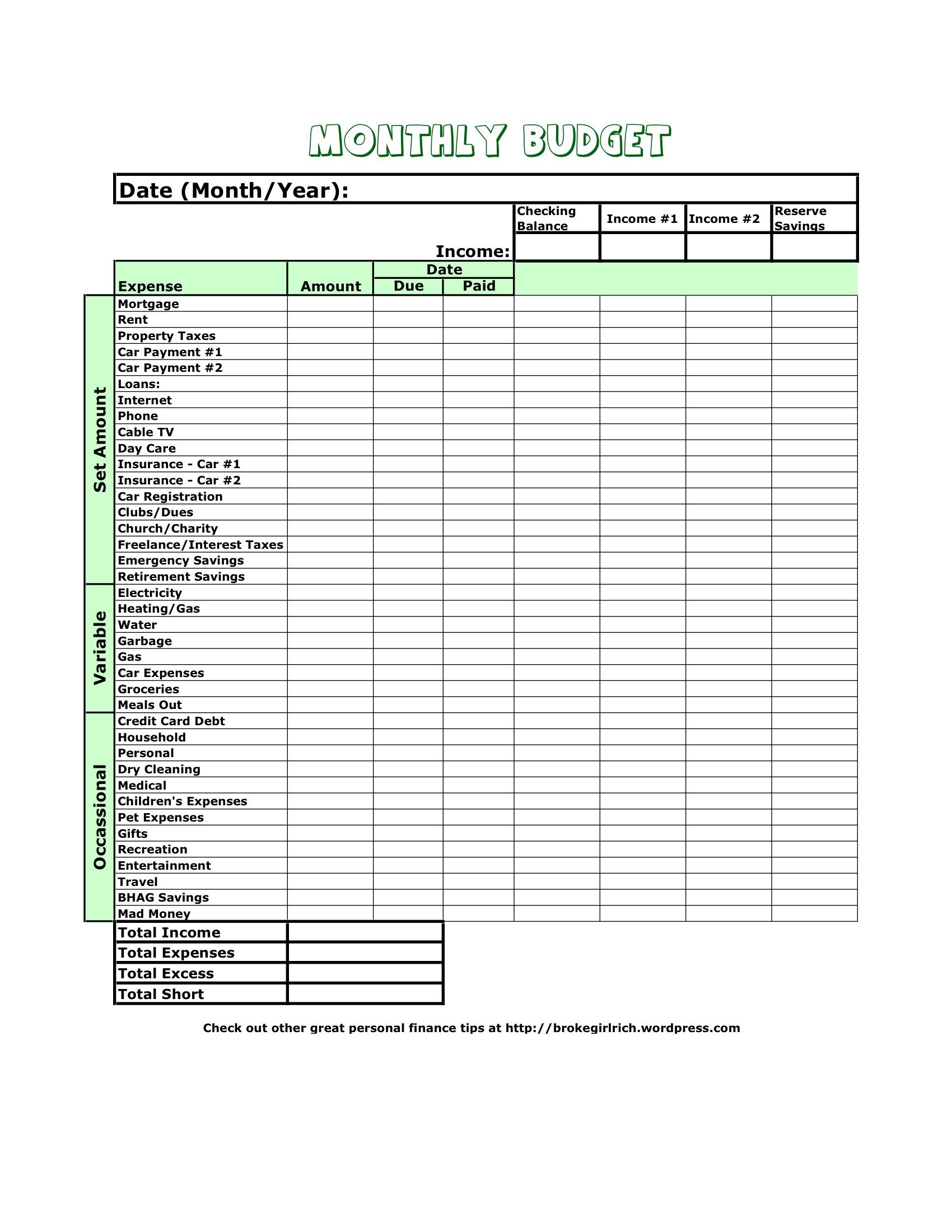

To start your monthly budget, enter in your current checking account balance at the top of the month, your income, your spouse’s income and your reserve savings account balance. What’s a reserve savings account? It should be the account that you use for payments that you don’t have to make every month. For instance, I prefer to pay my entire car insurance premium (click for the answer to “What does comprehensive car insurance cover?”) for the year from my reserve savings. It saves me a little money and I don’t have to worry about it for the rest of the year. The same with my car registration, eye doctor visits, and any other once a year sort of expenses. For me, my reserve savings account is the same account as my emergency savings… which I really should probably separate, none the less, that’s where those payments come from.

Next write in the amount of money you need to pay each month in the correct column and the due date for each. Then note which account the payment will come from. Each line should be pretty self explanatory and some may not apply often or at all.

Monthly Budget Sheet: Click through to download.Like many things in life, the main way to succeed with creating your budget is to just sit down and do it. Talking about it, even reading about it, will not get it done. I’ve got a link right here so you can download the form if you’d like, but a quick Google search will provide you with plenty of other options, if you so choose.

And then stick to it. And if you have a bad month and fall off the horse, try again next month.

Also, make sure to enter to win a copy of Judy Lawrence’s The Budget Kit. Contest ends on October 31st.

brokeGIRLrich readers, do you include anything in your budget that I haven’t listed here? What section of your budget do you have the most trouble with? What keeps you from making a monthly budget?

I use excel for my budgets. I can’t call it a budget as it is more like an outline as we often go over it. I only started blogging again this past August, if you need any tips or help you can contact me at my site.

Good thinking putting the reserve savings in there. That saves you from the “oh shit, yeah that thing” budgeting freak outs that always get me.

No kidding, my car insurance is a little over a grand a year. If I didn’t plan for that payment, I think I would have a heart attack every May. And even though I always try to remember my contacts, for some reason, they always slip through the cracks and I get down to like the last two weeks of them and it’s always an “oh shit, yeah that thing” moment. Stupid vision. I mean, who really needs to see things anyway?