Keeping track of your budget is definitely a pain in the butt – I get it – but with all the free tools online to help you, it doesn’t have to be. 30 minutes of effort can get you set up with any of these sites. Keep in mind, if you’re going to use an online budgeting website you want it to be reputable and you want websites that start with https, with the emphasis on the “s” since that stands for secure and insures that your banking and credit card information is being transmitted securely.

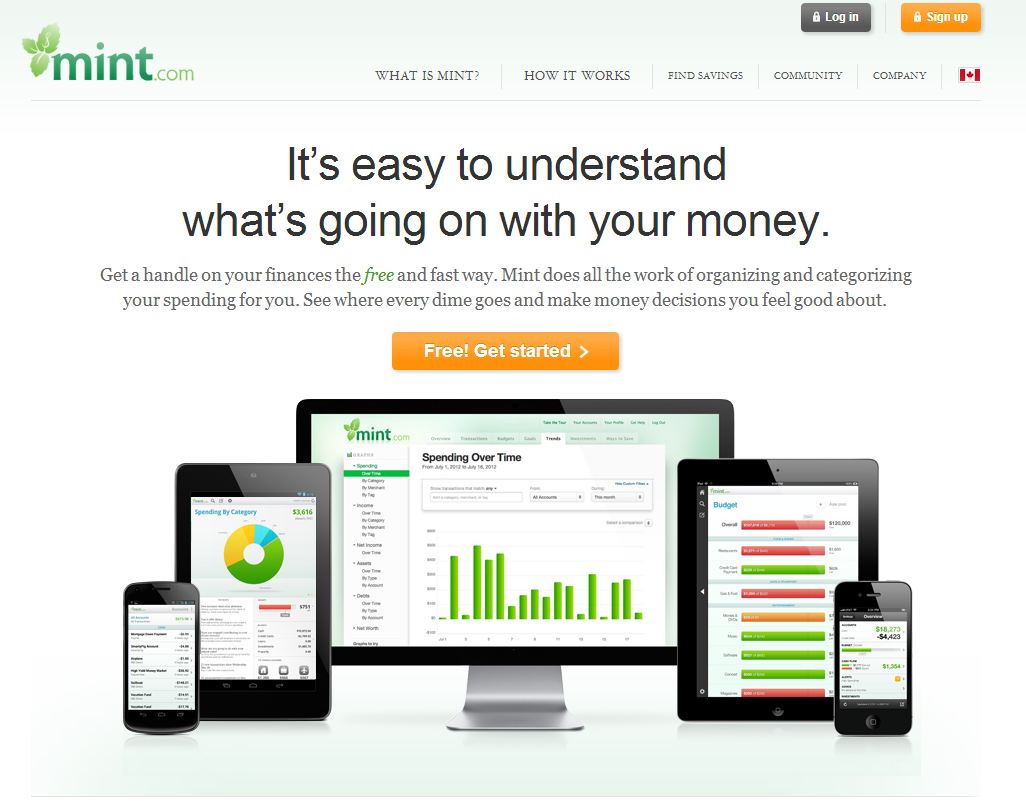

My personal favorite is Mint.com – this could also be because I’ve been using it for about 18 months. I find it very easy to use, and my only gripe is that you have to jump through a few loopholes to list personal loans. For example, my grandmother lent me $20,000 for grad school, which was no small chunk of change, and I’ve had to allot a $500 payment to her each month. Since there is no official Bank of Nanny to list this loan under, Mint won’t pull it up under loans and so I bypassed that by listing it as a negative amount under Property, but I have to manually update it each month, whereas a regular loan from a lending company would track its own balance.

On the flip side, I do like that Mint lets you list property, because, if I were ever in a jam, I like that I could look at my accounts and consider selling my car for the Blue Book value (which you also have to find on your own – it would be awesome if Mint linked up to Kelley Blue Book and just kept track of the depreciation, letting you change the condition of your car as necessary over time). So, despite the few changes I’d like to make to improve the site, it doesn’t have any flaws that drive me away from it.

Mint also takes your purchases and categorizes them. When it doesn’t recognize them, it leaves them as uncategorized and you can place them into categories. From there it files them into budgets that you can set up and it will send you email reminders when you go over. It also allows you to set up long term goals like paying down debt, saving for retirement, setting up an emergency fund or saving for college. If you’re an investor, it keeps track of your different stocks and funds has a little screen section of how they’re doing today.

On of the best spots on Mint is the Ways to Save section that looks at where your accounts are and what your habits are and it lets you know if you’d be better off at a different bank or with different credit cards, etc. I also like to check out the Mint blog – I don’t actually find it that informative, but they like infographics and I think that’s fun.

Mint also has an easy to use app for smartphones that syncs well with your online account. I’ve found it handy for double checking my monthly budget before buying an unexpected item, as well as making sure my paycheck cleared or a credit card payment went through without all the hassle of going to six different apps or online to check.

To be fair, I also have to point out that ShareBuilder recently changed the way you link your account to programs like Mint or Quicken and the process of getting their new access code to work correctly with my Mint account was a nightmare. I later figured out I was accidentally skipping one step on the ShareBuilder site to get the accounts to link, but it was thanks to no help from the Mint customer service guys who just kept sending me the exact same form letter with the steps to link my account over and over again until I was ready to tear my hair out.

Another site I set up as a research project has been with LearnVest.com. LearnVest has the same amount of set up time as Mint and is also a secure site. I may have just had trouble finding it, but it doesn’t seem to have a section for property (my car and some musical instruments are usually all I list there, but it’s about $9,000 added to my net worth, so it’s nothing to sneeze at). For some reason, it only pulls my IRA out of my Fidelity account and not my 401(k), which Mint updated all on it’s own when I started my new job and signed up for the 401(k). I’m also not a fan of LearnVest’s generic budget set up, which doesn’t account for people like me who are not paying a lot for essentials (like rent or utilities) but are paying a lot for things like gas and car maintenace. I can override their set budgets, but I feel like the LV Recommends section isn’t that awesome in general. However, their page for your overall budget breakdown is pretty good and clear.

On the plus side for LearnVest, I like the opening dashboard, which gives a quick summary of how I’m doing with my budget and my savings priorities. I find the little spending graph to be useless since it just tells me the number of transactions on a given day and money spent, not where it went. I’m also a much bigger fan of LearnVest’s blog than Mint’s.

The one thing that LearnVest has over other budgeting sites is a free “money check up” with a personal financial advisor. You set up a time for them to call you and you go over some basic financial tips based on your accounts. I wasn’t thrilled with mine or with the fact that I kept getting emails and phone calls after missing the first one. She pretty much just repeated everything on the website and when I told her my money breakdown, she told me I was doing a good job… not awesome advice really. Keep in mind, this quick check up is also a set up for them to try to sell you on one of their programs, which is entirely up to you if you want to take part in it. LearnVest is a pretty reputable company, so if you were looking for financial planning advice and your free initial phone call went well, it might be something to consider. On the flip side, there’s a lot of free advice out there on something pretty simple like setting up a budget and a set up fee of $89 and a monthly payment of $19 to keep you on track with your budget seems a bit excessive to me. I mean, I think you’d be better off investing $40 in some basic finance books (or just going to the library!), getting together with some friends for free and just agree to hold one another accountable. They also have a 5-year planner service and a portfolio builder service, but they are all a little too rich for my blood.

So those are my two main budgeting websites I would recommend. Another one often used by people interested more in a community aspect and public accountability is geezeo.com. This site is more for bare bones budgeting than people who are interested in tracking multiple investment accounts as well, as Geezeo doesn’t have very sophisticated investment trackers. What it does offer is lots of tips and customizable information regarding your budgeting needs though, so if you’re just starting out, you may want to start out here.

It’s also worth noting that some people are very uncomfortable linking their financial accounts to an outside company on the internet, which is totally cool. You’ll be laughing all the way to the bank when one Mint or LearnVest get hacked someday. BudgetPulse.com could be the site for you. You manually enter account balances and payments and it syncs the information you enter (like a digital checkbook) into useful information.

Another nifty site for people with roommates or who worry about splitting recurring bills is buxfer.com, which allows you to send bill reminders to groups of people and calculate those group bills as part of your monthly budget.

Don’t forget to enter for your chance to win a copy of The Budget Kit over at rafflecopter! Contest ends October 31st!

So, brokeGIRLs (and BOYs), what do you use to help making budgeting less of a hassle? Did I miss an awesome website? Have you ever used BudgetPulse or Buxfer? Tell me about it!

I use my own spreadsheet as I have very specific asset allocation categories that I like to maintain, but I think these online tools are EXCELLENT. Really anything that gets you tracking your spending and seeing a snapshot of your consumer behavior is infinitely more helpful than living in ignorance.

I agree – and for people just starting out and trying to get a handle on things, I think Mint is one of the best things out there!