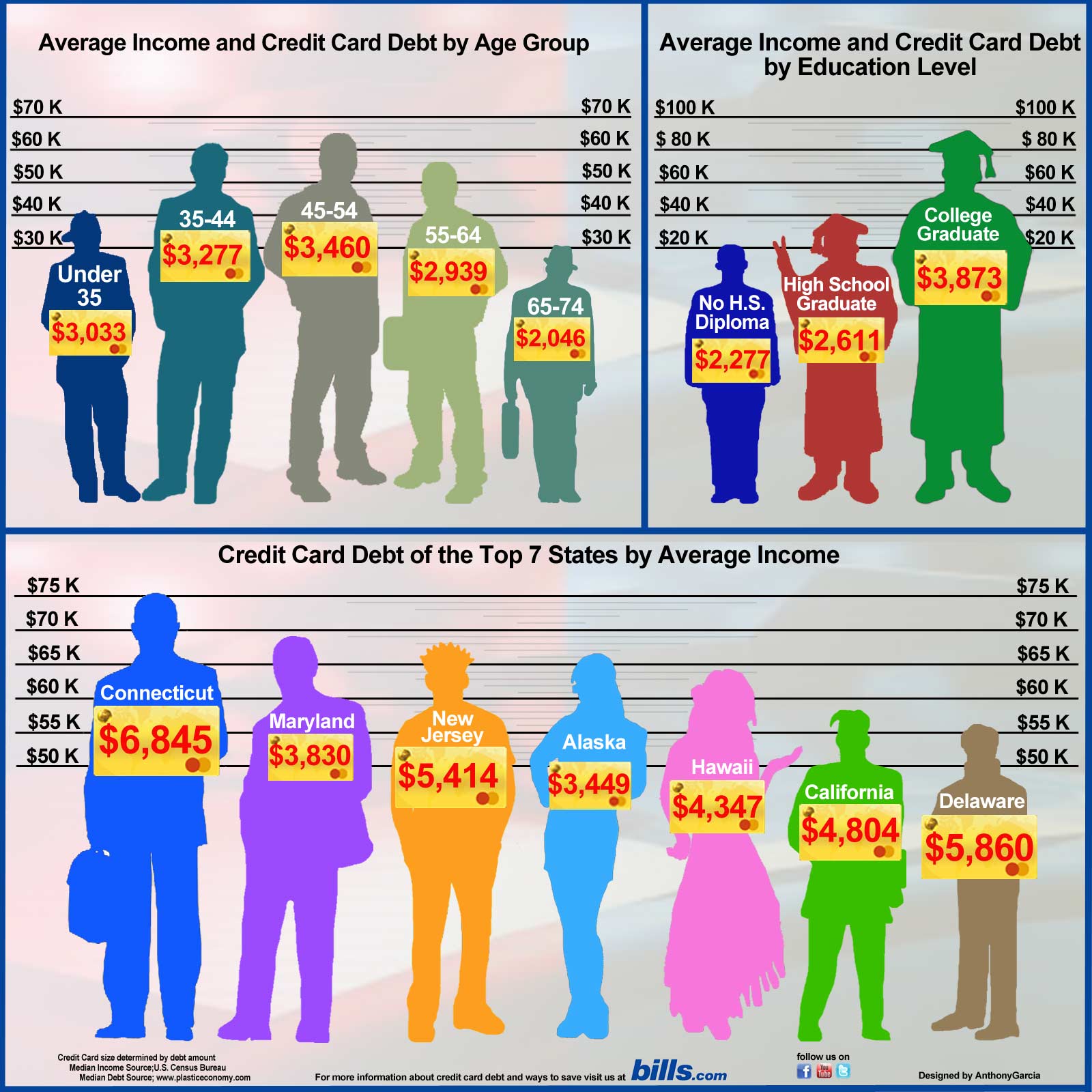

Whether you have a mountain of debt or not, a budget is a necessary tool. If you’ve managed to avoid debt all together, good for you! A budget will still help you keep track of your cash flow and allow you to maximize it’s potential. If you do have debt, like the vast majority of the Americans, you’ll probably need a plan to attack it. Developing your budget helps you create that plan.

If your debt is primarily created from buying necessities, your budget will help you minimize those purchases. If you have a realistic idea of how much you’ve been spending on groceries, gas and clothes, it may help you make better decisions – like deciding to skip some of unnecessary items at the grocery store, clip coupons, visit a thrift stores for clothes or walk to places that are pretty nearby.

You can also utilize your budget to create debt repayment plans – especially when trying to get out from underneath a mountain of debt. Work your budget to get it the lowest you possibly can. Now look at your debt and add the minimum payments for each loan and credit card to your budget. Now check out those credit cards and loans and figure out which one has the highest interest rate. Every extra penny you have that month goes towards that bill. Then you repeat next month and the next until you become one of the people who use their budget to maximize their cash flow instead of paying off debt. It may take you a decade, or even two, but debt doesn’t just take care of itself.

Remember the key with your budget it to make sure what you’re spending is less than what you’re making. If you can’t get your cash flow out to a number lower than your cash flow in, you really need to reevaluate why. Dave Ramsey is kind of the King of Debt Management and he has this handy calculator to help you provide a quick snapshot at how you should allot your money each month. I don’t agree with all of his assessments (like I think food is way too low), but you can adjust each area and it warns you when you’ve gone over budget.

My personal method to pay off debt has been one of the more “extreme” ones. I lived on a boat for about two years and now I live on a circus train. I have very few bills, so I just pour most of my paycheck into savings and paying down that debt. All in all, I left school in June 2011 and I will send in my last loan check in December 2013 for a $23,000 loan. During that time I also managed to take a trip to Peru, build up my emergency savings fund and max out my IRA. Lots of people say that they can’t change the things in their lives to allow for decisions like I made, which may be true, if I had children, the cruise ship thing would’ve been out; however, the circus is very family friendly… the point of this long, rambling sentence is that I think if you want to create a budget that lets you kick debt’s butt, you absolutely can. Most of your barriers are in your mind. Even if you’ve got half a dozen kids at home or live in the most expensive part of America, I bet you could Google how to get out of debt + your factors and someone has done it and blogged about it. And if they haven’t, why shouldn’t that blogger be you?

Make sure you enter for your chance to win a copy of The Budget Kit by Judy Lawrence over at Rafflecopter. The contest ends on October 31st.

brokeGIRLrich readers, what have you found to be the most challenging part of being in debt? Do you have a budget? What has helped you pay down your debt or avoid it altogether?