Besides this awesome series about how to create and stick with a budget, there are some other great resources at your local books store and library and even totally free advice on the internet. Some of those that I feel totally ok about recommending are:

Actual books (those things with pages and the happy paper smell):

1.) Money Girl’s Smart Moves to Grow Rich by Laura D. Adams ~ This book was the first how-to book I ever read about finance. It was terrifically clear and easy to understand and not written in a way that made me feel like I was trying to read a textbook written in German. My first attempts at figuring out my net worth and budgeting were based on the advice I found in this book. I can’t recommend it highly enough.

2.) The Total Money Makeover by Dave Ramsey ~ If you’re starting out this financial journey with a mother load of debt, this is a book to invest in (or find in your local library). The more I read about Mr. Ramsey, the more I can say, take any investment advice of his with a grain of salt (or like – a cup and a half of salt), but his debt snowball method is pretty solid. If you need to actually feel like you’re achieving something, his method’s great to get you on the road to financial recovery. If you really want to save the most money in the long run though, set up your snowball starting with your highest to lowest interest rate debts instead of just lowest to highest overall debt, and you’ll reap the most financial rewards.

3.) The Budget Kit by Judy Lawrence ~ This book is just chock full of sample forms and outlines to start you on your path to great budgeting habits. Ms. Lawrence also explains why certain budgets are necessary and how to make the most of different checking and savings accounts to be prepared for any eventuality. If you feel like you’re ready to tackle making a budget but the exact how-to’s are still beyond you, this is the book for you. Don’t have a copy? You’re in luck! I’ve still got a raffle going on for a free copy until October 31st. You can enter here at rafflecopter.

Advice Websites:

4.) The Simple Dollar ~ If you check out their tags under “Planning,” you’ll find some posts about financial planners, but most are about how to set up and stick with budgets. I find all the posts at The Simple Dollar to be engaging and easy to understand. They also have some more out of the box ideas for getting your budget in line including side hustles and unique ways of using technology.

5.) Budget Are Sexy ~ Uh, I think the name covers it really. J. Money also has a great compilation of budgeting templates (if mine didn’t do the trick for you). This site is about more than just budgeting, but it seemed like it needed a mention in our further reading budgeting… so after you’ve got your budget on track and checked out all of J. Money’s advice on that, keep reading for all his other cool, er, I mean, sexy personal finance tips as well.

6.) The Penny Hoarder ~ This is easily my favorite blog to read… sometimes your budget will come up short, or you’ll get hit by a last minute expense. “What to do?” you may wonder. The answer is check out this blog. It is the freaking weirdest ways to earn some quick cash, but they’re legit. This dude checks them all out. I fully intend to spend a month trying these things out at some point and turning the results into a blog series.

Practical Tools (or see this post for more info on these great resources):

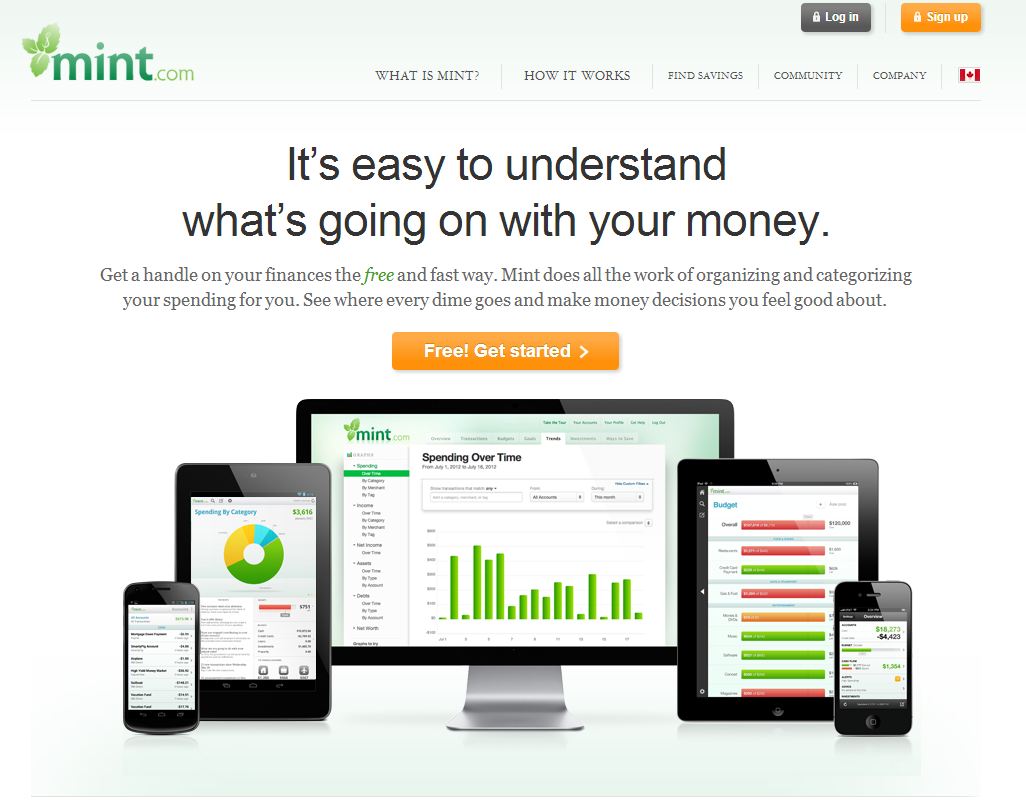

7.) Mint.com ~ Mint is where I keep my budget sorted. It only takes a little time to connect all your online accounts to their website (all of which is done securely) and then they update themselves and let you see where your money is going. One of the features I love is that it tracks your net worth, so when I transfer money to my emergency savings account or into stocks and then check out my checking account balance and feel a little sad I can’t go buy the dress I love at ModCloth, my net worth over at Mint makes me a feel a little better, since it shows the money’s not gone, it’s just working in other areas for me. Not ModCloth-i-ness areas, but other spots that are just as good.

8.) LearnVest.com ~ LearnVest is another great website, very similar to Mint. Personally, both a very solid and easy to use websites, so I think it mostly just comes down to user preferences. One of the things you do get by signing up with LearnVest is a free consultation with one of their financial specialists – although they mostly seem to just help you learn how to navigate the website, which, honestly, is a useful thing if you’re going to regularly make use of the site.

9.) Quicken ~ Quicken is the macdaddy of all desktop programs. You have to pay for the software (about $60) and then download it onto your desktop. From there is can organize all aspects of your financial life and even works well for small business owners who need to track their expenses.

And don’t forget to enter for a chance to win a copy of The Budget Kit! Contest ends on October 31st.

brokeGIRLrich readers, what’s the best budgeting book you’ve come across? Do you have a favorite post from another blog that I should check out? Let me know about it!

Thx for the kind words! 🙂 Lots of great sites here for sure.