The other day we talked about money psychology because it’s so important to get a firm grasp on your money hang ups as you start to delve into sorting out your financial state. Once you start to see why you have the issues you do, you can begin to resolve them (honestly, you can begin to resolve your financial woes without acknowledging what’s behind them, but you’re likely to just keep winding up in the same jam over and over again).

Like my last column on net worth addressed, the beginning to financial independence is figuring out where you are with your finances. How do you do that? You start with a net worth statement that let’s you know exactly where you are with your money.

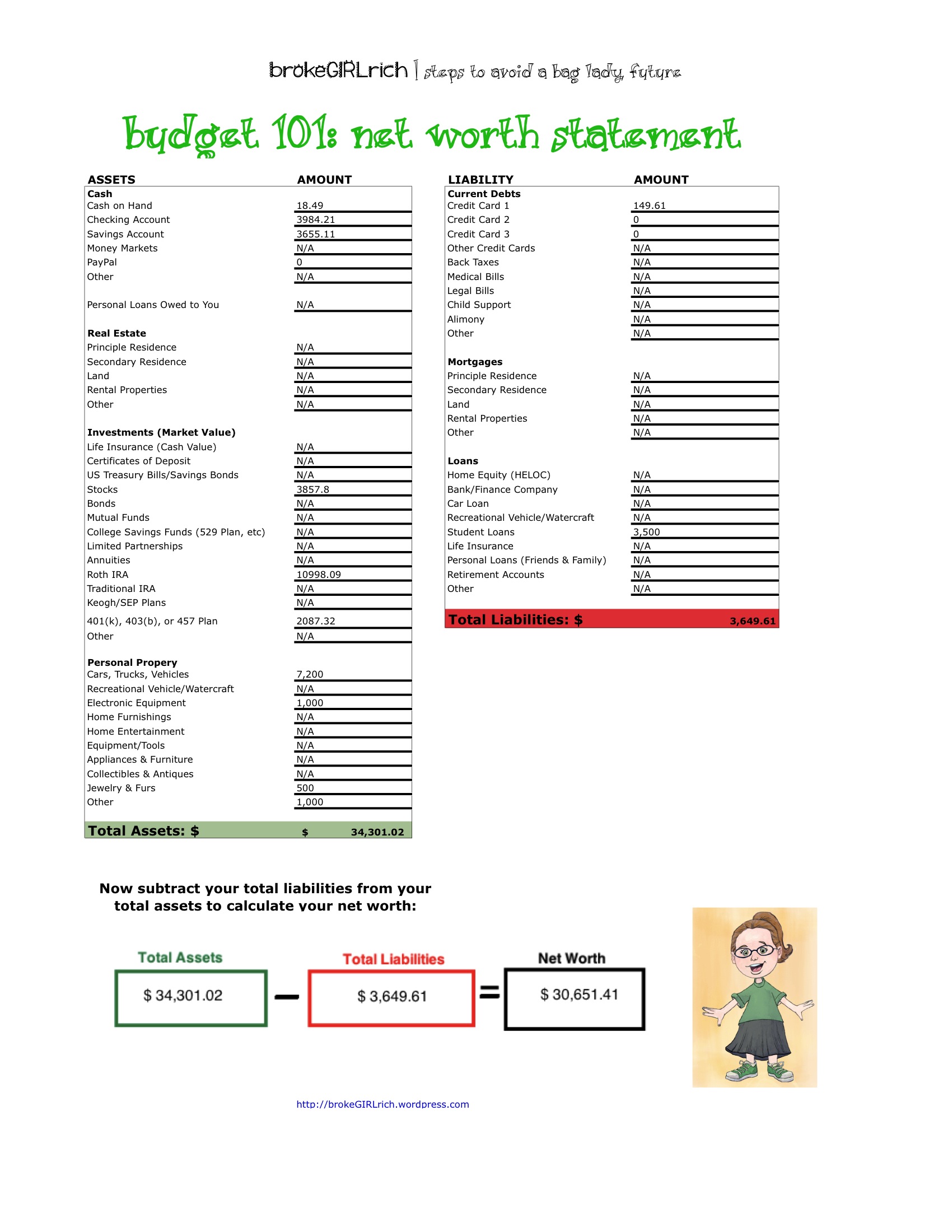

Your net worth statement is simply your assets minutes your liabilities. It’ll take you about an hour to calculate this information, but it’s well worth it (and maybe even less with today’s technology).

The categories you need information on for your assets column are cash, real estate, investments and personal property.

To figure out how much cash you have, check your checking account, savings account, money market account, PayPal account, and essentially any easily liquidated account for their balances and enter them on the worksheet. Also add whatever actual cash you have on hand (open your wallet, empty your piggy bank and check the couch cushions). To make things easier, look into a free budget calculator which can easily be found online.

Next you want to figure out the estimated price that your home (and any properties you own) would go for if you tried to sell it today. The same goes for any undeveloped land or any other property you own.

Your next assessment should be of your investments. You should be able to access the balances of many of these online. For your Certificates of Deposit and bonds, you should include them as what they are worth today, not what they will be worth when they mature in 10 years (or whatever length you’ve chosen).

Finally, you can add personal property. This includes any cars, precious metals and jewelry, furs, electronics, musical instruments, your Beanie Babies collection, etc. Be sure to find an accurate value of these items. A little Googling should get you there, or you can checkout what the same item is selling for over at eBay.

Now all of these numbers added together equal your assets.

Next you calculate your liabilities. This consists of credit card debts, mortgages and loans.

Start with the credit card debts and other outstanding bills. You should be able to find your current credit card balances online. Any other bills such as outstanding medical or legal bills, child support, alimony, etc. should be included in this section.

Then look up the remaining balance on your mortgage (or mortgages) and record that as well.

Finally list the outstanding balances on any loans you may have. This includes times you may have borrowed against your life insurance and retirement account. This also included the $10 you owe your cousin Earl and the $75 you own Uncle Billy Bob.

Now add all these numbers together and this equals your liabilities.

Take that liability number and subtract if from your asset number and you have your net worth. It may be positive or negative. Honestly, right now, what matters is that you took the time to figure out what it is, which is a step in the right direction.