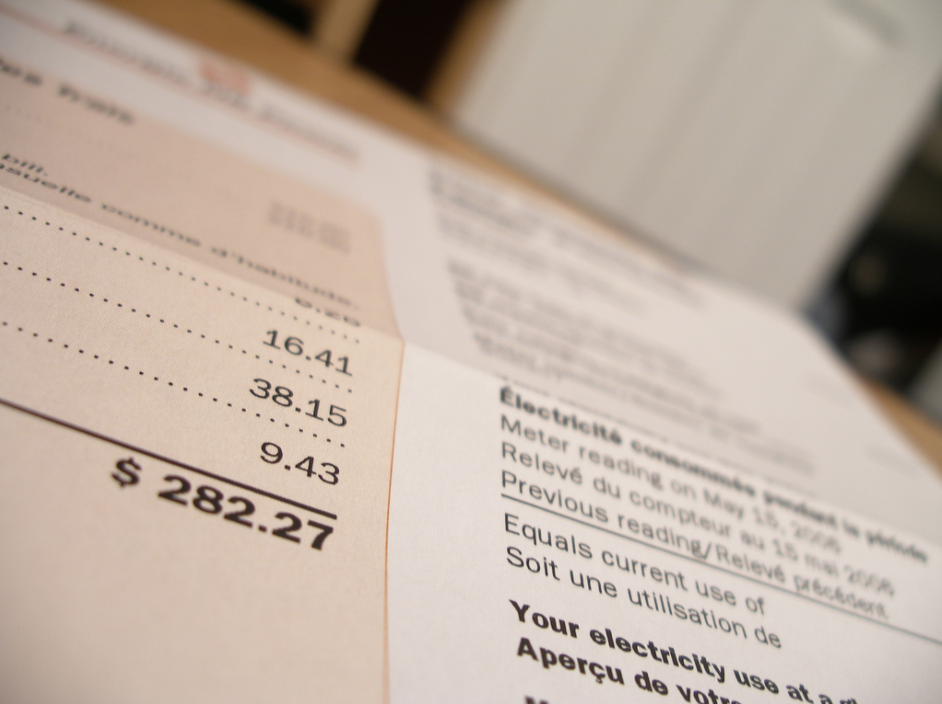

Is your mailbox forever stuffed with bills and statements? Do you devote far too much of your salary to heating your home or insuring your car? If you’re spending too much on bills, these savvy strategies could help you save a fortune.

Image source: https://www.flickr.com/photos/brendanwood/2161236298

Don’t renew your insurance policy yet

You’ve taken out an insurance policy, and the renewal date is fast approaching. What do you do? The majority of us ignore letters and emails and continue to pay out for the same policy from the same provider. The trouble is that those letters and emails may contain details of price hikes and changes to your plan that you’re not aware of. Before you automatically renew a policy, go online, check prices from other companies and give your provider a call. If you find lower fees online, your provider may match the quote. Competition in the insurance industry is incredibly fierce, and many providers reserve their best offers for new customers. As a loyal client, you deserve the same level of recognition, so call and ask for a better offer or consider taking your business elsewhere.

Compare prices

If you’ve got a new car, you’ve moved house or you’re looking into health insurance options, it’s so beneficial to compare prices. There are countless policies and insurance companies out there, and there is a huge variation in price. Work out what you need, enter your details into a comparison site and then see what you can get for your money. If you’re entitled to access health insurance schemes, for example, Medicare, it’s hugely beneficial to do some research online and learn exactly what it means to enrol. To find out more, visit GoMedigap here. If you’re not of an age to benefit from Medicare yet, it still pays to shop around and have a look at health insurance policies that are suited to you. As a general rule, the more you pay, the more comprehensive the cover, but this is not always the case. It’s also worth checking out plans that cover partners and dependents, as these may work out better value for money. When you’re comparing prices online, take care to read the small print and make sure you know what each policy covers.

Embrace energy-efficient living

The average person spends approximately $3,000 on energy per year. That’s a lot of money. If your bills are too high, there are ways of reducing spending. Firstly, you can be a little more frugal at home. If you tend to leave lights on and the TV on standby, using the ‘off’ switch more frequently will help. It’s also wise to embrace energy-efficient living. Switch old halogen bulbs for modern LED lights and invest in appliances that boast lower energy consumption. You should start to notice a difference within a few weeks.

Picture courtesy of https://www.pexels.com/photo/abstract-blur-bright-bulb-460675/

Do you dread opening bills or are you tired of spending your hard-earned cash on electricity and insurance? If you’re on a mission to spend less and bring those bills down, hopefully, these tips will come in handy.

One thing to make sure of if you change insuance policies is if you are giving up anything. In Louisiana if you have had homeowners insurance with the same company for three years or more, they can’t cancel you unless they pull out of the state completely, nor are they allowed to single you out for a rate increase. That’s big in a state known for hurricanes.

RAnn recently posted…What Are Options and Should I Invest In Them?