Profile

I am forty years old, an occasional digital event producer and freelance stage manager. I also work as a TA and an adjunct. I also work a variety of side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

So income this month was grim and expenses were astronomic and that’s where we’re at.

And next month isn’t looking any better on the income.

I’ve gone fairly full nose to the grindstone to finish this thesis and be free of the restrictions of this absolutely atrocious visa and endless horrors of the financial administration of my university.

Tuition went up by close to $2000 this year, the pound is at like an all time high against the dollar, and there is apparently only one person in the school who can administer the £2000 of prize money from the competitions I competed in last year and she is on medical leave, so I am suddenly £2000 short of tuition money I did not expect to pay and more livid than I can even manage to type here at the failed administration of the situation – which I started inquiring about in August.

Sigh. But. This should be the last large tuition payment. I still owe them £1000 more which I am waiting until the absolute last second to pay in the hopes that they will actually respond to me with something useful.

If I had to guess, in the absolute horror show way the financial department at this school works, they will put it in my account, after I have paid everything, and they will give it back to me in a random reimbursement months after I graduate sometime in the far off future.

The incompetence over thousands of pounds every. single. year is rage inducing.

Ok, ok, moving on from that massive expense. It was also quarterly tax time. This was, of course, in a savings account, though also not so big of a hit, because my income this entire year has been fairly terrible.

And overall, I would say that the pursuit of the PhD did not result in my absolute worst financial projections, it has definitely landed on the less favorable side. This is partially my fault because falling in love with a foreigner has made things also exponentially more difficult as otherwise I would just go home and finish remotely after my data collection is done and start working again like normal.

But. These are all my own choices. So here we are. Here. We. Are.

Without tuition and taxes, this month probably would’ve pushed me less over the edge. Honestly, it’s just the total failure of anyone to actually help me with the tuition/prize money issue, because I was well aware I’d be paying tuition this month.

The pound to dollar exchange rate is just an extra kick in the teeth but I guess it’s karmic balance for the Theresa May year when it was almost 1:1.

Otherwise, a lot of the extra expenses from the move have settled a bit. At the new rate of rent and utilities, I’m probably saving close to $900 a month, and that includes the fact that I now pay half a council tax bill, which I was fully exempt from as a student living alone before.

Food is still very high. I think that although Lidl is so much cheaper, its like right there, so we pop over all the time. And while that’s cheaper than London, takeaway or a night out is very much still the same and about $50 whenever it’s my turn to pay.

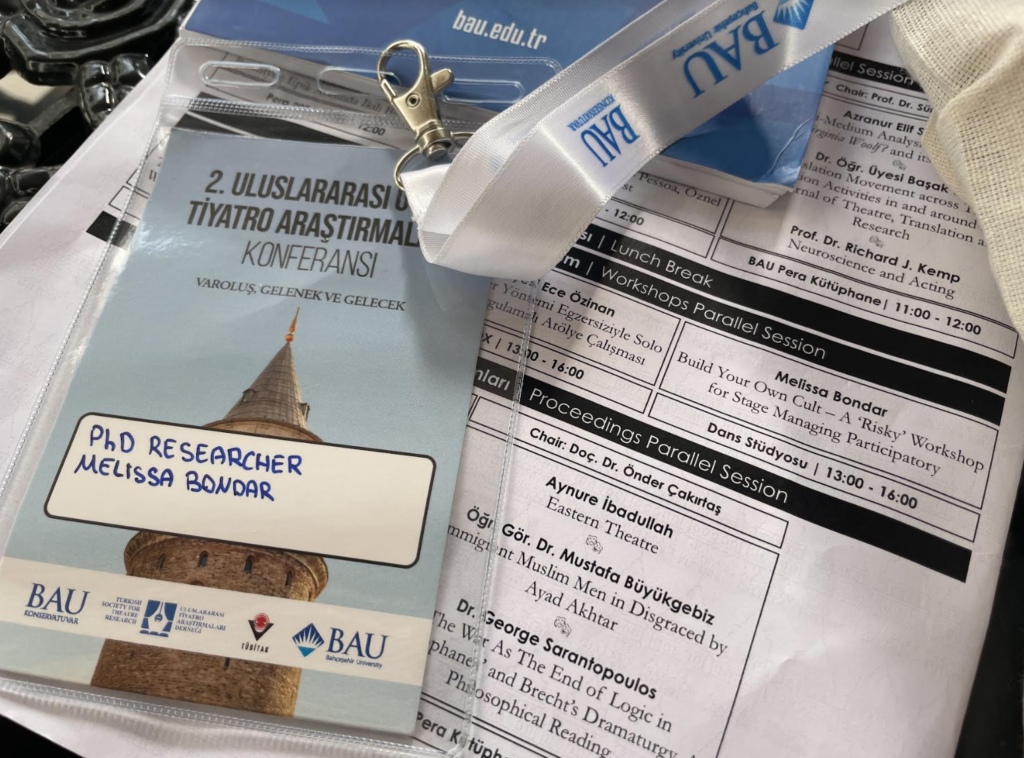

Istanbul, Turkey

I went to the optometrist for a check up and got more contacts this month. I found it very funny when they apologetically charged me £25 for the whole checkup, thinking how it’s usually over $200 at home, so that was a nice win. I did wind up switching back to the more expensive contacts. I had bought a cheaper version last time and they are so uncomfortable. Lesson learned.

Entertainment was pretty reasonable. I went to Istanbul for an academic conference during the first week of September and on the last day, my classmate and I decided to take the latest plane back to London we could find and sightsee all day. We also made our own tiny Turkish lamps, which was really cool.

I’m also really pleased with travel this month. I’ve been riding my bike most places and the few train tickets I’ve needed into London haven’t been too bad. Uber also expanded some services into the area we live in and had crazy discounts for like two weeks, which I definitely took advantage of a few times. I will note that the weather is turning and I don’t know that the biking will be sustainable in all the rain, so I have started to put some steps into motion to get a British driving license. I paid the permit fee and downloaded an app to study for the theory test.

House is a little high because you may recall I’ve wanted a specific fancy lamp for a long time. For a while it was even a goal under my annual goals that I never quite managed.

Clearly, this was a terrible month to buy a $200 lamp. My income is garbage. My expenses were very high.

I did it anyway. The lamp I wanted was a Turkish lamp. I found an even better, fancier version than the ones I’d been looking at online for years for $50 less in the grand market in Istanbul. And I just did it.

So that’s September in a nutshell. I don’t really expect work to get much better in October, though in November I’ll start TAing the second half of a class through the end of the term and I’m hopeful things will pick up more in the spring. Fingers crossed.

Expenses this month:

- School – $9106.69

- Taxes – $1206.00

- Rent – $832.12

- Food – $550.57

- House – $385.53

- Health/Contacts – $378.23

- Utilities – $181.80

- Entertainment – $118.08

- Travel – $117.29

- Council Tax – $87.21

- Haircut – $65.92

- Gifts – $65.30

- Clothes – $65.14

- Car – $53.12

- Charity – $42.60

- Blog – $37.00

- Toiletries – $10.50

- Postage – $3.28

Total Spending in September: $13,124.58 (or $2,811.89 without tuition and taxes)

Hustling

This month’s income:

- Adjuncting – $745.26

- Digital Producing – $715.00

- Blog – $447.46

- School Reimbursements – $115.17

- Dividends – $41.60

Income This Month: $2,064.49

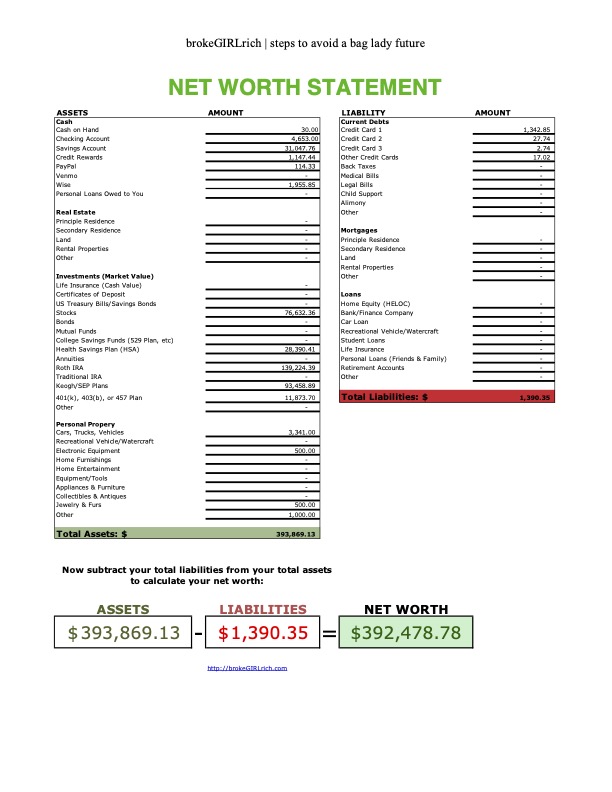

Net Worth: September 2024

Goals

- Save up $5,000 for school– via saving or scholarships. £500 to go in February to sweet freedom from all tuition payments.

- Max out 2023 Roth IRA. That happened. A while ago actually.

- Max out 2024 Roth IRA ($7000).

- Max out HSA ($4150). $100 contributed, $4050 to go.

- Stage manage a show. Done