Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

Nothing like $36k net worth plummet to make you go WTF.

Holy moly.

My dream was to be able to pay my tuition this year and still be over the $300k net worth mark.

The stock market is not cooperating with this dream.

I did give myself a little pep talk – that the stock market is the main reason that dream didn’t pan out. From last month to this month, if the market had just stayed the same, I would’ve made it.

But we just buy and hold and ride out recessions here at brokeGIRLrich so… it is what it is. Fingers crossed things improve next month but if not… it’s not like I’m retiring tomorrow.

I am a tiny bit sad I have approximately no money to buy any stock in this dip though. Such is life sometimes.

So I had two massive expenses this month. Tuition for 2022-23 and Q3 taxes. On the plus (not really) side, summer was really slow so my taxes were lower.

The Pound is currently on the struggle bus. I remember looking at the Pound:Dollar ratio at the beginning of the month and crossing my fingers it stayed so low until my tuition bill hit. I paid it immediately.

Who could’ve seen that I would’ve saved an extra like $500 if I just wanted till the end of the month? The world is freaking out over Liz’s garbage economic plan over here (probably rightfully so). For me, this is a small perk as everything is costing me a little less in USD these days.

Overall though, it came out to about $4,000 less than I had thought it might when I did my budgeting before I started school because of conversion rates, so that’s a little insane and I am pretty thankful.

I did a little card churning to pay the tuition and it didn’t go totally to plan. I opened a Chase Sapphire card, which did work just fine. I also opened an American Express Hilton rewards card and then learned my school doesn’t accept American Express. Fortunately it was a low spend ($1,000 over 3 months), so I hit the reward anyway, but… whoops. Also, I would’ve made my last card a United Mileage one if I’d known.

But you live and you learn. I’ll use the rewards points on the Chase Sapphire to buy my flight to my brother’s wedding in Cancun in June, or at least reduce the total cost. I’m hopeful to use the Hilton rewards to go to Venice sometime this spring or next fall.

I’m also pretty maxed on cards since I’ve been a little out of the churning loop and opening 5 cards within 24 months seems to be a thing with a lot of credit card providers nowadays. I opened both of these in July. I’ll close the two cards I opened to pay my initial tuition fee and visa expenses when I’m home for the holidays in December, skip opening any cards for the next two years, and hopefully take advantage of some credit card rewards for my final tuition payment in September 2024.

Taxes and tuition largely came from my savings. About £1100 of my tuition was paid from my Wise account with the money I’ve been making working part time, so that also helped maintain some of my savings account balance.

And of course when it rains, it pours, and it was time to order more contacts. I find the cost of the actual contacts are about the same as in New Jersey, though it only cost me about $35 for my contact fitting. I get free eye exams here because my prescription is so high. I also don’t have to go back for two years.

I could also cave and go with a cheaper choice of weekly or monthly but I’m so used to dailies and I do usually get about an extra month of use out of them from the various days when I don’t wear contacts through the year. I was able to make it work, but definitely a strong consideration to cut back there. Maybe next year.

It felt overall like a crazy expensive month but other than these large expenses, it was actually not so bad. Food crept down even further this month. Overall this isn’t surprising because it has been an absolutely insane month between work and school. I have not left the flat a whole lot.

Though the few times I did leave it this month were pretty nice. At the end of August/beginning of September, and old friend from the FAME tour was in town working on a show and one night she was free, a friend of mine from cruise ships actually came through London with the band he plays in, so we went to see them.

At the end of the month, I got a little of my life back and went to an outdoor cinema one night with my boyfriend, a Russian restaurant I’ve wanted to check out for months, and I saw the final show from the pile of tickets to random events I bought before moving to England – the live Welcome to Nightvale show. It’s a fairly weird podcast and the live show was… ok. And on the last day of the month I went to a place called Center Parcs with my boyfriend and all his friends and their partners for the weekend. Most of those expenses wound up in the beginning of October, so I’ll relive that adventure for you in the October update.

Other bigger expenses include a plane ticket home for a wedding in October – which will probably wind up being a pricey week but I am so excited to go home and hug the dog. My brother keeps sending me pictures of him.

Gifts are pretty high since I did like 75% of my Christmas gift shopping so I can bring it home with me next month and I picked up a birthday gift for one of my favorite little humans who is turning one the same weekend I go home for the wedding.

My flat spending crept up a bit again, but I’m still very happy with the hominess of it all.

Clothes are mostly bras because my washing machine ate some. I ordered the ones I really like (Third Love and CUUP) to my dad’s house, so I can bring them back to England with me in October. I also bought a really warm sweater to sleep in because it’s freezing in London and I refuse to turn on the heat before October – especially because gas prices are highway robbery.

I joined the gym, went for about a week, almost had a nervous breakdown trying to find enough time between school and work to swim and have sort of abandoned the endeavor – which makes me a little sad but seems necessary for this particular season of life.

We’ll see what my success rate is for attendance next month to see if I keep the gym membership. I have been attending roller skating lessons for the last few weeks, so I do get up and move at least once a week. They are often the highlight of the week. Highly recommend developing a hobby. Turns out it’s lovely.

My only higher expense I’m anticipating is all the renewal fees for brokeGIRLrich domain and hosting – probably about $400. I also have to sort out my plans for my brother’s wedding in Mexico in June pretty soon but I may put that off to November.

Here is the expense breakdown for the month:

- School – $17,015.09

- Taxes – $3728.00

- Contacts – $562.16

- Food – $536.26

- Trip to New Jersey – $320.57

- Flat – $299.20

- Gifts – $242.93

- Clothes – $217.99

- Utilities – $187.83

- Entertainment – $164.92

- Transportation – $157.82

- Gym – $40.08

- brokeGIRLrich – $37.00

- Charity – $30.99

- Toiletries – $29.39

- Health Insurance – $27.00

Total Spending in September: $23,597.23 (that is a gross number, without taxes it’s $19,869.23, and without any big expenses that were preplanned and pulled from savings, it’s $2,854.14)

Hustling

As usual, most of my income comes from digital event producing. The other income is two of my jobs in London – ushering and relationship management, and brokeGIRLrich.

- Digital Event Producing – $2502.50

- brokeGIRLrich – $1542.49

- Ushering – $597.26

- Relationship Managing – $461.21

Income This Month: $5,103.46

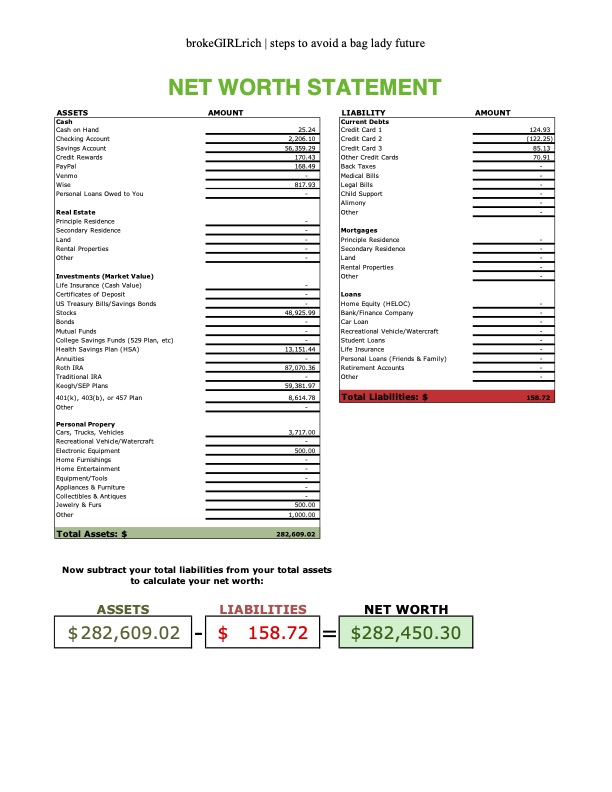

Net Worth: September 2022

Goals

I think this is a pretty good assessment of what I might be able to achieve this year. If I have some extra, I will aim to make a contribution to my SEP 401k too, but it’s looking unlikely.

- Max out my Roth IRA.

- Max out my HSA. $1,000 contributed.

- Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal).I accidentally saved an extra $800.

- Obtain £5,000 in funding scholarships. Hasn’t happened but I did make an extra £1100 that was unplanned from part time work and the super favorable exchange rate definitely helped with this year’s tuition payment.

- Save up $2,000 for traveling.Done

- Balance work and school without losing my mind. This month has not been good.

Pingback: Accountability: September 2022 – brokeGIRLrich | Indianapolis Local News