Profile

I am thirty five years old and I work as the General Stage Manager for a touring circus. I make $2,000 a week and have an approximate $40 per diem (issued in local currency). I’m currently living at home with my dad when I’m not on road, which Is a major factor in why I can save so much, and I only have a few monthly bills.

Saving & Spending

This month I spent a little bit going to FinCon, though the highest expense was last month when I bought the conference ticket. I crashed at a local friend’s apartment, which was kind of crazy since she was going to FinCon too (it was crazy because we met years ago working at Ringling Brothers – I don’t think either of us though we’d be going to financial conferences in the future).

I also went rafting with the family and some friends this month, which was a pretty big initial expense in July and August, but since everyone finally paid me back it actually wound up being a source of “income” this month.

It was our first time doing Class V rapids and it was pretty awesome, even though I definitely missed my mom. She was the one who started us all rafting in the first place about 10 years ago with a (now laughably easy) trip on the Delaware River. It was one of the few activities that all four of us liked doing together.

Anyway, we’d been talking about making the trip to West Virginia to do the Gauley River for a while now and I definitely recommend it. We did it in a completely insane way where we drove 8 hours after work on Friday, got in around 1 AM and got up to go rafting at 6 AM, then turned around and drove 8 hours home – that part I do not highly recommend. There’s another half of the Gauley and the nearby New River waiting for us next season though, and we may make a whole weekend of camping and rafting in 2020. I’m looking forward to it.

One of my BFF’s and I decided we’re going to Universal Studios in October for a long weekend to ride Hagrid’s Motorbike and drink some butterbeer because we are massive dorks. The whole trip will probably come in around $1,000 – maybe a little less because a good friend of mine from the Fame national tour works there now and he got us free tickets to get into the park for the two days we’ll be there. Some of that is reflected in this spending breakdown, the rest will be in the October one.

I have to reevaluate whether or not music lessons are a smart financial move too. On the plus side, they make me pretty happy. The place I take them has a summer session set up where you just pay per lesson and it’s very lose and if you miss a bunch of lessons, it’s fine. The fall and spring though there’s a flat fee and you pay whether you make the lessons or not, and with all the touring, I’m now paying a ton per lesson.

I also got whammed with lesson fees because you pay for the summer at the end of summer but for the fall up front, so that’s a pretty big expense.

I’m also like 99% sure the reason I used to be so much better at calling shows when I was younger was because I had recently stopped playing, so I was still “fluent” in music. I’ve noticed a very definite difference in how I call shows over the last year after a two and a half year gap of not calling and a much longer gap of not playing an instrument. And I notice it a lot on my current show, so I’m definitely going to stick out the fall with the lessons and see if there’s an improvement with my calling too.

Speaking of work, I just got back from spending the last two weeks working in Kuwait. Compared to Saudi Arabia, Kuwait was a dream. Kuwait was largely what I thought the Middle East would be like before going to Saudi Arabia. The culture is still very strong there, but I didn’t feel endangered or completely repressed like I did in Saudi.

Their performing arts center is gorgeous. It’s massive, has everything you could want in it, and is also just a really cool design. It’s a collection of several buildings. We were in the theater building, which actually has three theaters in it. There’s also a music building and a dance building.

We also go to sightsee there! A group of us went to the Mirror House, which was incredible– hands down, if you go to Kuwait, check out the Mirror House. The woman who owns the house turned the entire first floor into a mirror mosaic and she takes you on the tour herself and tells you all about Kuwait, her life there, and her art. The second floor of the house is an art gallery full of her other art and the art of her late husband. You play two different games. There is a yodeling elevator. It’s awesome and the owner is a total gem.

I also got to go on a tour of the Grand Mosque of Kuwait and I checked out the older marketplace area on our dark day. One of the ladies on tour and I went into one of the perfumeries that intrigued me so much in Saudi and did like a perfume sampling that reminded me a little of a wine tasting. It was unexpectedly delightful.

On our last day before load out, I was able to go over to the Kuwait Towers and see the view in the morning before work with two co-workers. It was a pretty cool sight. Overall, a pretty good two weeks in Kuwait.

A bigger spend than usual was stage management expenses, but some of that will be reimbursed by work next month. And it was time for a new printer. I’d reached the point where time and energy going into not buying a new printer was making life a little ridiculous.

I also bought a plane ticket from London for Christmas for a whirlwind trip that leaves Heathrow at 6 AM on Christmas Eve and leaves Washington, DC at 6 AM on Christmas day so I can spend Christmas Eve with my family in Maryland. The tight turnaround to get back for our show in London on the 26thmakes me super anxious but considering it’s the first anniversary of my mom’s death, I really want to be with my dad and my brother. Christmas Eve in Maryland used to be my favorite day of the year and now I have no idea how I’m going to feel about it, but I guess it won’t do any good to avoid it either, so we might as well deal with the crappiness of it all together.

Anyway.

The worst hit of the month was quarterly taxes. Sigh. At least it’s a sign I’ve made some money? And at least I had properly saved for them, and they came in a little lower than I expected.

Here’s the September spending breakdown:

- Food – $388.71

- Car – $61.38

- Healthcare – $140.63

- Music Lessons – $263.00

- Fun – $79.73

- Gifts – $84.00

- Gym – $89.56

- Toiletries – $38.95

- Clothes – $123.92

- Orlando Trip – $155.44

- Taxes – $1525.91

- Stage Management – $378.34

- FinCon – $200.53

- Christmas – $354.28

Total Spending in September: $3,884.41

Hustling

September’s income was mostly from brokeGIRLrich and everyone paying me back for the rafting trip we went on. I also worked a day as a stagehand. My stage management income this month is my leftover per diems after I converted it from Kuwait Dinars. I’ll get paid for the stage managing I did this month in the middle of next month.

- brokeGIRLrich – $1056.87

- Stage Managing – $433.00

- Stagehand – $81.66

- Rafting Loans – $520.00

- Dividends – $32.00

Income This Month: $2,123.53

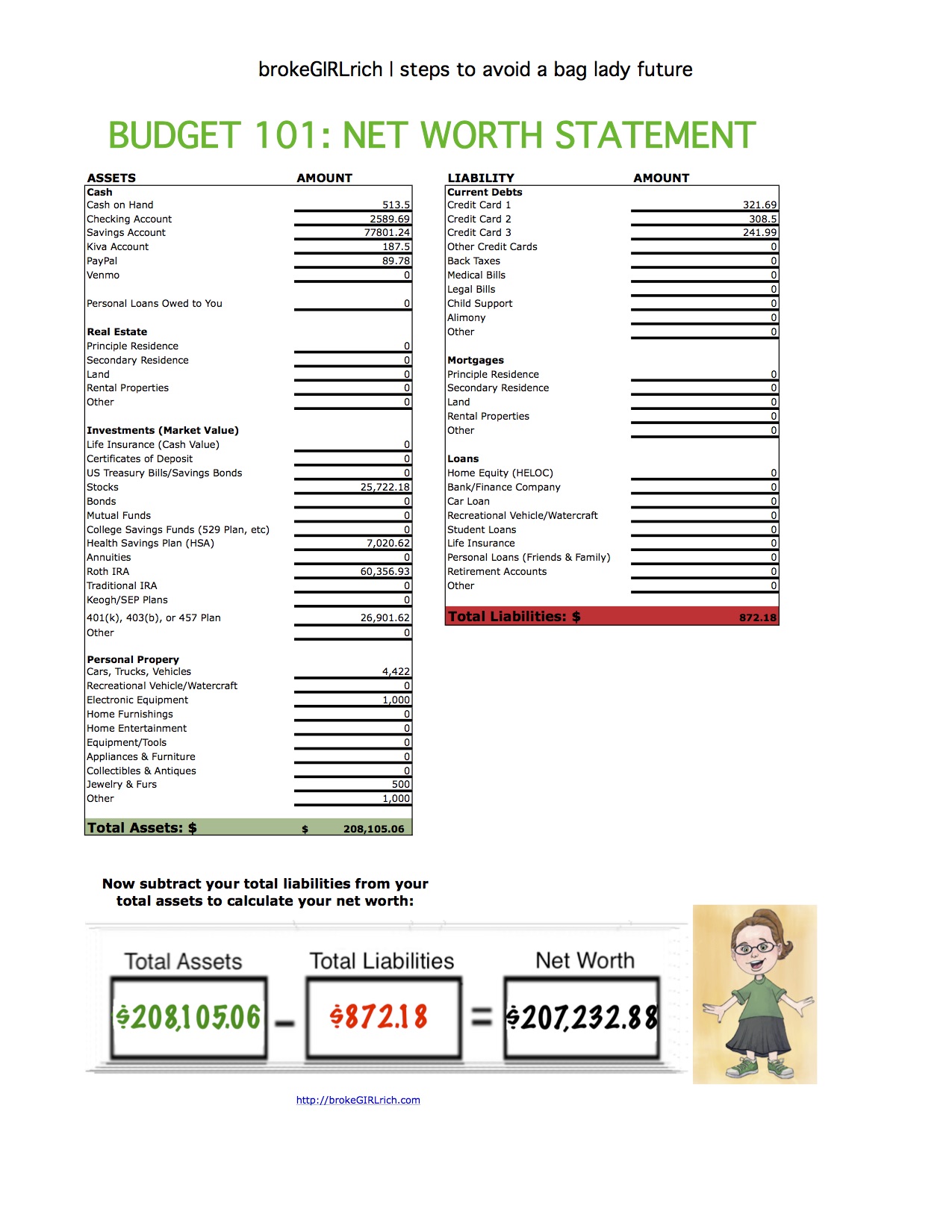

Net Worth: September 2019

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: One Thing I Wish I’d Done in College (because a lot of awesome people contributed their opinions too)

Goals

- Start eating better. Sometimes.

- Work out more. The hotel we stayed at in Kuwait had the best pool. I saw the furthest I’ve ever swam without taking a break (something about amazing circus performers watching you and judging you a little from the hot tub is a total motivator).

- Better stress management. This is going ok.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done and recertified on First Aid & CPR

- Take music lessons while I’m home for a few months. I started them at the end of the month!

- Spend more time with family and friends. Rafting trip and FinCon were successes in this category.

- Be more supportive of family and friends when I can’t be there in person. I’m really not sure I managed that at all this month.

- Go out on a date.

- Make an effort to not withhold kind words and encouragement. Always a work in progress.

- Max out my Roth IRA.

- Max out my HSA.

- Set aside $20,000 for my house down payment account.

- Set aside $5,000 for my new car account.

- Invest $3,000.

- Read more. I read I Will Teach You to Be Rich, Warren Buffett and the Interpretation of Financial Statements (as riveting as it sounds), and Horns

- Learn to make macaroons. No additional progress here.

- Visit (way more than) two roadside attractions.I think the Mirror House is another bonus in this category.