I recently came across an awesome website called Consumerism Commentary. It was started by a guy named Luke where he essentially just kept logging his net worth as an accountability tool. After several years, it gained popularity and now he has several other people doing the same thing and several professionals who provide commentary on these people’s finances.

I thought I would add this aspect to my website in my own way because:

A.) The idea of the website is to chronicle my journey from broke girl to rich girl and I’m pretty solidly on the broke side still.

B.) I think that you should only take financial advice from people if you know who you’re taking it from.

Like right now, I’d say I have a moderate background in paying off debt (not of the overwhelming, crushing kind – merely the student loan kind) and living frugally. As far as whether my investment advice sucks or is accurate, you and I are both going to have to wait a few years to find out.

Profile

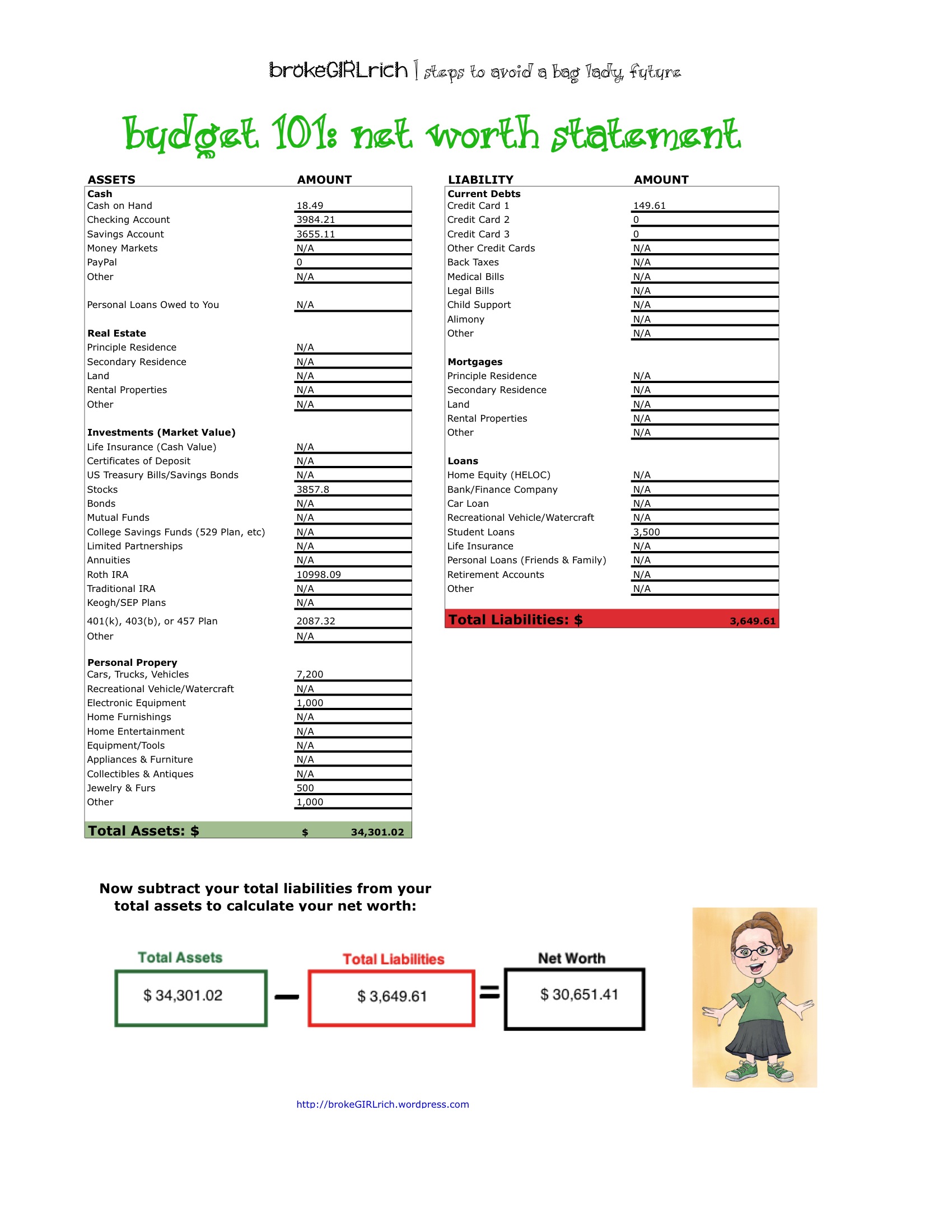

I am twenty-nine years old. I work as an associate production manager and my yearly salary is $38,000. I live on a train most of the year and stay with my parents for free during my vacations, so I have no rent or utilities to pay other than a $50 a month internet fee for my Clearspot. For September 2013 my net worth is:

My goals for this year are to max out my IRA and have $5,000 in my emergency savings account.

Pingback: Budget 101: Net Worth | brokeGIRLrich