Profile

I am thirty-nine years old, a digital event producer and occasional freelance stage manager. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

This month has been alright.

It’s also been sort of insane.

To begin with, I started the week in Washington, DC, working on the World Culture Festival as their Talent SM. It was so much work and also kind of awesome.

I forgot what it feels like to be competent at something I’m doing.

I’m not like, a wildly incompetent academic, I am just a baby academic and what do we really expect from babies? Not much. But sometimes I forget there are actually things I’m good at.

I also really like getting paid. I have every finger crossed this production company gets booked on more large events and that they hire me for some of them. Especially because since they are short festivals, they are intense while I’m there, but it’s a length of time I can probably get school to work with me on once in a while. But who knows?

I also learned that my transcripts for the adjuncting job that I interviewed for last month need to go through an International Evaluation to be considered in the US, and it takes like 6 weeks for my university to send over pre-2015 transcripts which is pretty lousy. So though they are currently being patient at the place I interviewed last month, I highly suspect that despite paying like $200 to get this job via transcript requests and now the international evaluation, I am probably going to lose it, but fingers crossed there. This is extra lousy because I now suspect I pretty much had the job based on how patient the woman who interviewed me has been being.

Such is life. Sigh.

Adding to the such is life sighs, my PhD contract has in big bold letters than tuition fees won’t change with a little asterisk next to it that they are connected to some sort of government cost of living number, which as the UK has been in a cost of living crisis this year, skyrocketed and my tuition was almost $5,000 higher this year than last year.

I had thought that with the extra stage managing pay, I would be able to put that towards my IRA and I just might be able to max that thing out for 2023 before paying taxes sometimes in 2024. I suppose it’s still not impossible but between the extra tuition bump, breaking my eyeglasses, needing a visit to the doctor, having to do maintenance on my car during the brief week I was home in NJ and seeing that November is going to be a very slow work month because I have a lot of school obligations… that did not happen. We also got a speeding ticket in Switzerland for going 4.7 miles over the speed the limit, but at least we all decided to split it, not leave it to the driver (which, funnily, was some lovely karma because we assumed it happened during a time when I wasn’t driving and all agreed to pitch in and when we finally received the official documentation with all the paperwork, it was when I was driving).

I’m actually really proud I added $1,000 to my IRA, all things considered, but it is depressing and I have some feelings about it. They will probably feature in a November blog post. But I am also grateful that things keep working out, even if I’m not currently really getting ahead financially, I am staying afloat. I feel very strongly this is God just handling things – especially last month when my blog, which has taken a major income dip, resurfaced and made an old-days normal amount of money. And then this month when that money wasn’t absolutely necessary, blog income is back to the current normal.

But I suppose that’s alright. I am doing my best to embrace an attitude of gratitude that things are ok, even if they aren’t exactly how I want them to be.

And I am clearly not destitute, if you look at the breakdown this month. Food was very high. I did some Christmas shopping. My apartment is flipping cold, so I bought a super warm pair of slippers and some fleecy long johns in the hopes that when it pivots from cold to absolutely freezing, I’m prepared. Entertainment is high because my boyfriend and I went to several shows and we finished Jaws of the Lion with our friends and that cost includes some Plano boxes to organize Gloomhaven (which, thank goodness, he is purchasing).

There has been a shining light in my research too. I may actually be able to complete at least one case study before the holidays. There is also a big milestone in my journey that needs to occur before February and I’m very hopeful that it will occur before the holidays, which is my transfer exam. If I pass, I’ll officially be a PhD candidate, which is very exciting. If I fail… I will be free of academia. So I find this to be a win/win situation. I do think it’s crazy that years of work come down to just two assessment periods.

So, that’s October. On to November.

Here is the expense breakdown for the month:

- Tuition – $9,821.13

- Rent – $1245.01

- Food – $630.17

- Entertainment – $222.40

- Eyeglasses – $157.37

- Utilities – $156.93

- Gifts – $146.38

- Travel – $124.15

- Dentist – $96.39

- Job Applications – $95.79

- Car – $83.17

- Charity – $65.54

- Clothes – $61.46

- Apartment – $48.41

- Switzerland – $44.01

- Blog – $37.00

- Stage Management – $33.28

- Health – $22.58

- Miscellaneous – $7.26

Total Spending in October: $13,098.43 (or $3,277.30 without the tuition, which were paid mostly out of savings)

Hustling

This month’s income:

- Stage Managing – $7,000.00

- Digital Producing – $1,966.25

- BFF Switzerland Repayment – $65.70

- Blog – $60.74

Income This Month: $9,092.69

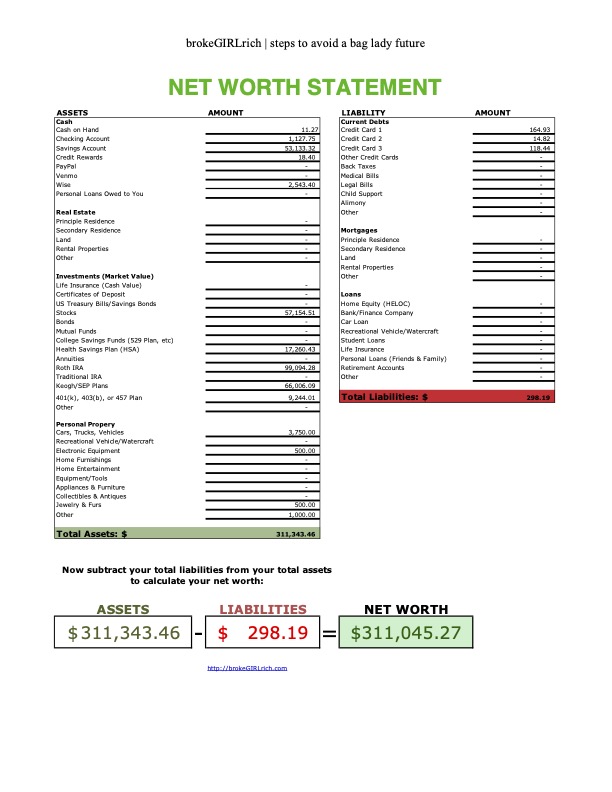

Net Worth: October 2023

Goals

- Save up $10,000 for school.

- Save up £5100 for school. This has been a resounding failure, so all of this year’s tuition payment is coming out of savings. I will try again for next year.

- Max out Roth IRA ($6500). $2000 contributed so far.

- Max out HSA ($3850).

- Buy the pretty lamp. I really don’t think this is happening this year.

- Save $2000 for vacation with BFF over the summer.This just completely and totally failed. It all came out of savings and, I’m guessing by the time we get back from Switzerland next month will be close to $1,000 more than I planned to spend too. Not my best money moments but some really great life moments? Sigh. I hate grad school for every financial reason imaginable,

- Stage manage a show. Hey! I did this twice!