Profile

I am thirty six years old and I’m a freelance digital event producer and customer service agent. I also worked for a week on two outdoor productions as a stage hand this month. I’m still living at my dad’s house. I guess I’ve found some sort of new normal for the duration.

Working my first live show in seven months. 🙂

Spending & Saving

So I finally got my unemployment money from this summer, which was a long and arduous project. You can read a more detailed account of that here, if you’re interested in reading a rant against the ridiculousness that is the unemployment system.

And, hilariously? Like… I don’t even know anymore, I just went into my bank account to do all my net worth tracking to write this post and there was a fairly substantial deposit from unemployment, which I thought was the 5 weeks of $300 boost, but actually now that I’ve stopped certifying and contacting them and gave up all hope of getting the claim to the correct amount, they adjusted it and sent over the difference with no notice – which is cool, but a little insane.

And I am just puzzled again how people living paycheck to paycheck can live with that stress. I honestly think a large amount of my financial success is just that that stress is so much that I have happily done without at times to build up the cushion to not feel that – because I cannot function within it. And I know some people have no choice, but the people who do… like… how are not just a walking stress ulcer?

Anyway. This was particularly helpful as I had a few large expenses this month.

The first was a major PF fail. You may recall that I broke my glasses at the beginning of the year. I had to go to the eye doctor to get a new prescription because it had been so long (and then I bought these Coastal glasses I hated). I didn’t ask for an updated contacts prescription.

So I had to make another eye doctor appointment and after I fought with everyone that it hadn’t been a year yet, do I didn’t need all their stupid tests again, I lost and had to pay for a full eye doctor’s appointment all over again to get them. So I am not happy with Lenscrafters at all right now and that garbage move. I was like, it was 9 months ago. And they were like, that’s almost a year, you have to do the tests again. And I was like, it is not a year, it is not even almost and this is a scam.

But I had about a week of contact lenses left and had to suck it up and pay to get the prescriptions.

I then stupidly found out there are questionable “free” exams online that probably would’ve worked to get my new prescription – which I think are a lot less questionable when you’re only 9 months out from your last very thorough eye exam – so extra PF fail. And yes, you can lecture me about how it’s important to go to real doctors, but I will remind you this is America and I am not yet rich, so… good health care moves aren’t always a realistic option for me.

So a little over $800 later, I have contacts for the next year and an updated prescription for the next two-odd years. At least I think I managed to find the cheapest way to buy the contacts online and I’ll get an additional $25 rebate from it in my next eBates check.

So glad I pay all that money for utterly useless health insurance.

Sigh. Sigh. Whatever.

I also caved to the COVID siren song of getting bangs. I will not be doing this again. I like how they look but this is far too high maintenance of a hairstyle for me. I also paid to go to a slightly higher quality salon than Walmart to get them done and also had to buy a new hair straightener for short hair to style them, which I lumped into the haircut cost.

I also caved to the COVID siren song of getting bangs. I will not be doing this again. I like how they look but this is far too high maintenance of a hairstyle for me. I also paid to go to a slightly higher quality salon than Walmart to get them done and also had to buy a new hair straightener for short hair to style them, which I lumped into the haircut cost.

I’m happy I did it because I’m the type of person who has trouble learning from other people’s experiences. And it’s just hair, it will grow back. But man are they a pain to deal with.

Another high expense category was work supplies because I have a new job! I had to get a headset for one of the jobs and an adaptor for my computer for another. I also have to have a “plain background” for one of them, so when I rearranged my room to accommodate that, I bought a few small shelves to help reorganize the mess that is my life crammed into my tiny childhood bedroom right now.

On the bigger plus side, I have jobs. I work part time as part of the customer service team at a tech startup that is trying to merge the ideas of Zoom and Zelda (yeah, you read that right). The idea is to make it all more like a fun game. The company was founded by a man who also owns a team building retreat company in San Francisco that in the before times did fun team building events for large companies.

Essentially, my little avatar of me sits in a “room” in the game and when people first join, I give them a little orientation on how the buttons work and check their audio and video and then send them into the game they are there to play. If they have any technical issues during the game, they pop back into my “room” and we try to fix them.

It honestly feels as weird at times as working in theater. I have had many, “what is my life?” moments while sitting in my little troubleshooting room.

And then I’m a freelance digital event producer with a larger corporate company that does digital sales training events. This feels almost exactly like stage managing. I do an overview of how the digital platform we’re using works (I’m certified on Zoom and MS Teams) and then there’s an agenda (aka run of show) and I deploy links to certain things, polls, manage breakout rooms, run PowerPoint countdowns during breaks, etc. And I trouble shoot any technical issues we have to the best of my ability.

So essentially my mad idea of working for free for my friend over the summer and parlaying that experience into a paying job actually worked and I feel pretty good about that.

I’m still working on the TEFL 120-hour certificate so I can hopefully pick up a few hours with iTutor each week. Also, my accounting class at Eastern Gateway Community College started this week, so thank goodness for my brother and his union. That will save me several thousand dollars as I work on my Associates in accounting. I’m also excited to finally be taking a tax accounting class.

I don’t feel like I did a lot other than work this month. The food damage is higher than previous months because all that work = less cooking. Especially on 12-hour outdoor days working as a stagehand. And because I am kind of lazy.

I did go see a socially distanced show with my boyfriend in Cape May that had an old college friend in it that was good fun. It was like a murder mystery that you move through an old house to watch, walking from sticker to sticker and standing there to hear bits of the story from the performers. I had also never really been to Cape May before, which turns out, is a super cute town, and I hope we go explore it again sometime. I also donated $20 to a friend’s digital performance and bought a ticket to a digital show. And it was my month to buy the new train game map (Pennsylvania – and it is a doozy).

My expenses this month:

- Healthcare/Contacts – $1053.39

- Food – $509.24

- Work Supplies – $228.15

- Fun – $118.04

- Haircut – $96.98

- Clothes – $84.99

- Gas – $45.00

- Toiletries – $42.39

- Candles – $36.25

Total Spending in October: $2,214.43

Hustling

My income this month was from stagehand work, brokeGIRLrich, the customer service job, and although it’s not really hustling, my unemployment payouts for the entire summer (delayed hustling? Since it’s my own money paid into unemployment?). Also a refund check from my insurance company.

- Unemployment – $5,681.00

- Customer Service Job – $1,008.80

- brokeGIRLrich – $494.90

- Stagehand – $447.76

- Insurance Refund – $4.00

Income This Month: $7,635.56

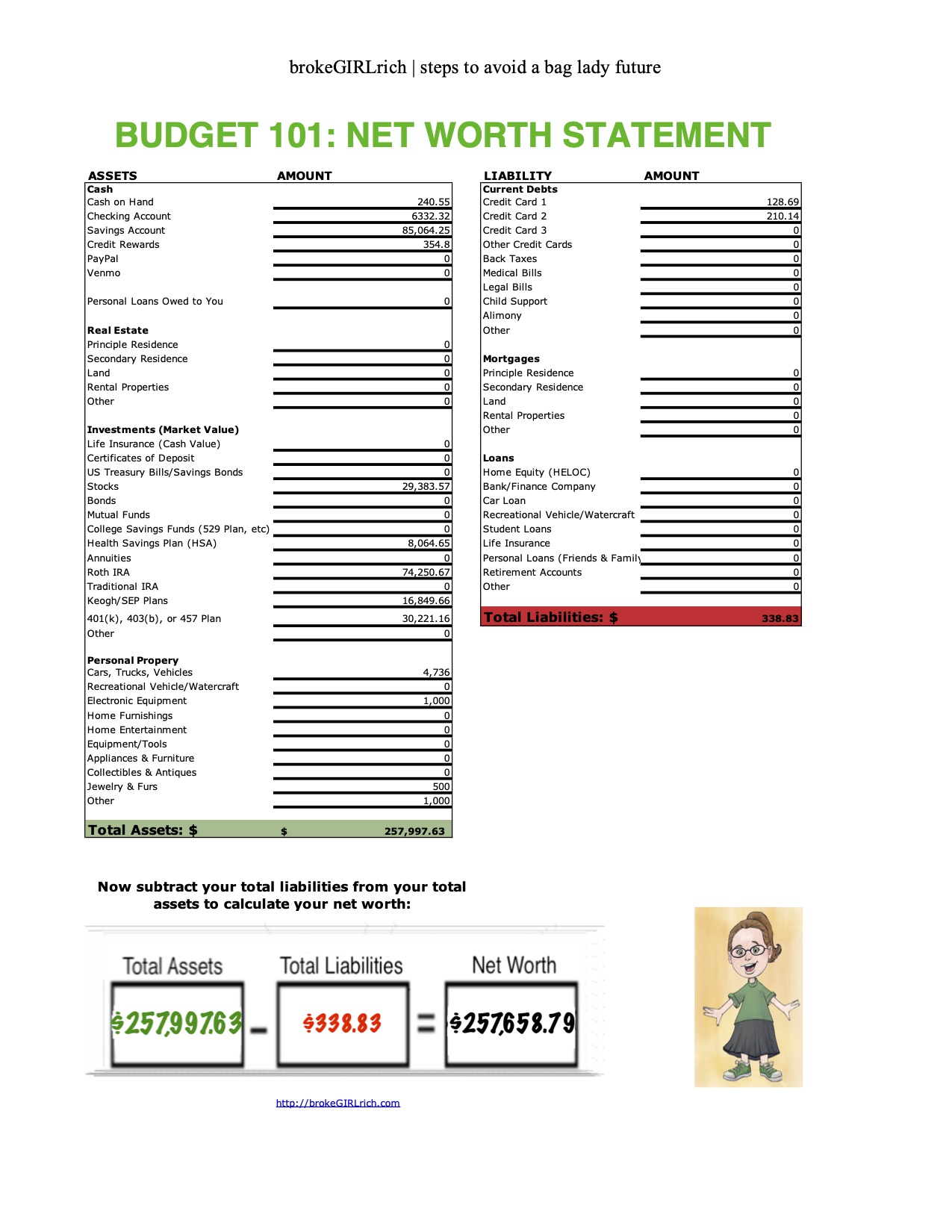

Net Worth: October 2020

I can honestly say that one of the things I find a little frustrating sometimes is that I now have enough invested that little market fluctuations can either be like magic that double my monthly income effect on my net worth or, in this case, they reduce my net worth by the same increments. Oh well. We’ll see what next month brings.

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Start With the Fun Stuff

Goals

- Do two things to build up my stage management skills.

- Max out my Roth IRA.

- Max out my HSA. I can’t max it out due to switching health care providers. My university healthcare wasn’t eligible and my current private insurance isn’t eligible either.

- Set aside $1,000 for my new car account.

- Invest $2,000.

- Read more – not so much success this month, though I did finish the Harry Potter series.

- Learn to make macaroons.