Profile

I am thirty five years old and I work as the General Stage Manager for a touring circus. I make $2,000 a week and have an approximate $40 per diem (issued in local currency). I’m currently living at home with my dad when I’m not on road, which Is a major factor in why I can save so much, and I only have a few monthly bills.

Saving & Spending

This month I went to Universal Studios with my best friend for a weekend. The last few weeks have been so crazy at work though that I honestly forgot it had even happened until I was sorting through my expenses for this post.

It’s been a slightly expensive month on the stage managing front since I finally caved in and bought an iPad, since there are so many great apps now for stage managing on it. We use Stage Write a lot for blocking at work and it’s really helpful to be able to access it so easily now. I also lumped the purchase of a new suitcase, since my broke on the last leg of tour, into stage management expenses.

Hogwarts, Donuts, and Sunshine made for a pretty good long weekend.

Food-wise my number is really low because I usual the local cash per diem for most purchases while I’m abroad and then when I get home, I just change over the leftover cash and count it as income. It makes exact tracking not so accurate right now, but since my finances are fairly solid and I’m staying under my per diem anyway, I’ve decided this is fine.

Savings-wise, I finally got my Solo 401(k) set up. I’m hopefully I can max it out this year, but even if I don’t quite manage it, anything is better than nothing.

I’ve been thinking more and more about buying a house. It still makes me very nervous, but I think the time is approaching.

Other than that it’s just been work, work, work. I wildly failed with Ubering this month. It became it’s own category of my spending breakdown. Sheesh.

I had a “small world” moment when I met up with a friend I worked with on cruise ships 10 years ago in Birmingham, England because my show was stopped there and he came through playing with a band. It was nice to catch up with him.

You all should check out his band too:

Here’s the October spending breakdown:

- Food – $286.41

- Car – $24.29

- Healthcare – $140.63

- Music Lessons – $143.00

- Gifts – $29.47

- Gym – $37.31

- Toiletries – $29.06

- Clothes – $160.62

- Orlando Trip – $774.03

- Uber – $91.73

- Stage Management – $865.10

- brokeGIRLrich– $54.51

- Medicine – $12.82

Total Spending in September: $2,648.98

Hustling

October’s income was mostly from stage managing and brokeGIRLrich. I also got paid for another random voice over gig from last month and my brother and I received another check from our mom’s pension fund. I also cashed out my Kiva fund.

- brokeGIRLrich – $1,331.06

- Stage Managing – $3,592.26

- Kiva – $187.50

- Voice Over – $40.00

- Mom Money – $536.69

Income This Month: $5,687.51

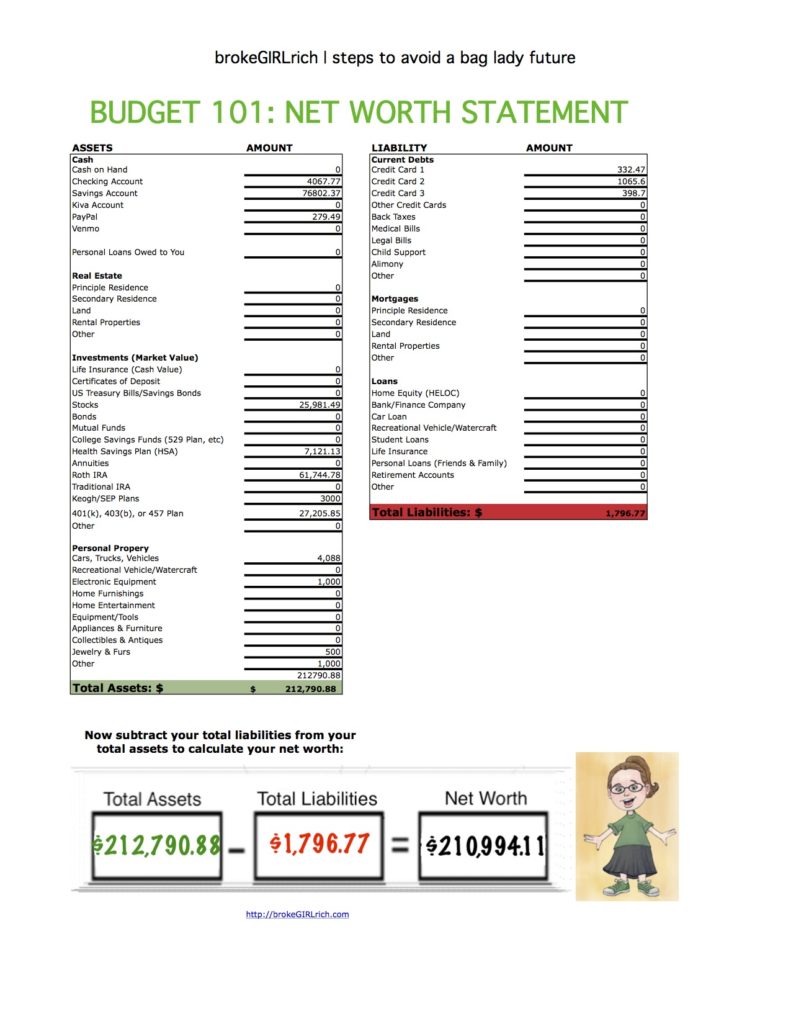

Net Worth: October 2019

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: That Sketchy Time I Sent My Social Security Number to a Chick Named Cookie

Goals

- Start eating better. Sometimes.

- Work out more. Medium success. I did really well while I was home and horrible out on tour.

- Better stress management. This is going ok.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done and recertified on First Aid & CPR

- Take music lessons while I’m home for a few months. I started them at the end of the month!

- Spend more time with family and friends. Trip to Universal Studios with the BFF with month and watching way more football than I actually wanted to with my dad and brother.

- Be more supportive of family and friends when I can’t be there in person. I’m really not sure I managed that at all this month.

- Go out on a date.

- Make an effort to not withhold kind words and encouragement. Always a work in progress.

- Max out my Roth IRA.

- Max out my HSA.

- Set aside $20,000 for my house down payment account.

- Set aside $5,000 for my new car account.

- Invest $3,000.

- Read more. I read Rainn Wilson’s The Bassoon King

- Learn to make macaroons. No additional progress here.

- Visit (way more than) two roadside attractions