Profile

I am twenty-nine years old. I work as an associate production manager and my yearly salary is $38,000. I live on a train most of the year and stay with my parents for free during my vacations, so I have no rent or utilities to pay other than a $50 a month internet fee for my Clearspot.

However, this month I got my financial butt kicked. I was a bridesmaid in an out of state wedding and the show I’m working on went across the midwest. That might not sound like a big thing, but I keep my car out on tour with me and am responsible for all the costs incurred by it. Some months we stay in the same areas and it’s only an hour or three between each city. On those weeks, one of the technicians on our show drives my car to the next city for less than the cost of a tank of gas and I stay on the train while it moves. He doesn’t like to do the “long jumps” though, so the entire month of October I had to pay for 1-2 hotel rooms a week and three tanks of gas in one day (on average – the distance between the cities averaged out to about 10 hours and it took the train about 2 days to get there, so I had to find somewhere to live while I waited to it to arrive). That really adds up. On the plus side, I’ve learned that I need to budget much, much higher for my car in the months going across the midwest (which turned out to be May and October this year). Another plus is that my boyfriend splits these expenses with me or it would be totally unrealistic to even keep my car out with us, although even the negative side of that is that he had higher standards of where we need to stay overnight than I do. I have nothing against car sleeping and think it would be interesting to try couchsurfing… needless to say, these feeling are not mutual.

But, on the plus side, I’m a mere $250 short of maxing out my Roth IRA this year, and with two more months to go, that shouldn’t be a problem. It really shouldn’t be a problem, because I’m on track to have my student loans PAID OFF by the end of November – two and a half years after graduating. I’m pretty psyched about that, since it will free up $500-1,000 a month to really increase my investing. A conversation with my mom about my interest in investing and finances made her think that she and my dad had bought one more stock in my name when I was little, which she found the info on and signed over to me.

It turned out to be in Prudential and is worth $2,456.65, so that was nothing to sneeze at to add to my net worth. Definitely helped alleviate the sting of the wedding and the midwest… although, I don’t know about you, but I there’s still a sting when my checking account gets the hit. I know net worth is really what I’m going for, but in my mind, all the invested money is “gone” for the next 40 years.

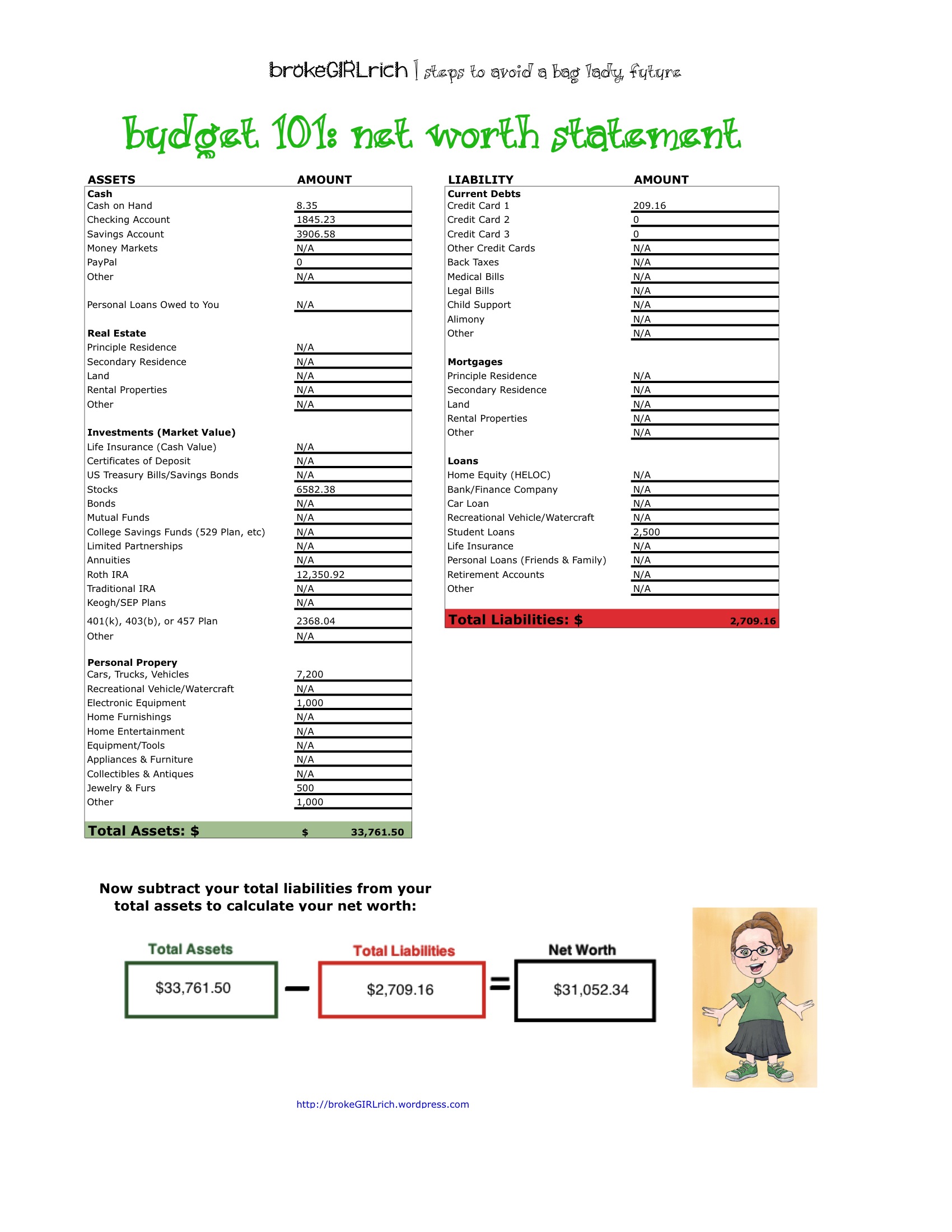

Overall, not awful, but not awesome either. I’m trying to learn how to side hustle on the road (if anyone knows of ANY accredited college hiring online adjuncts in theatre theory, literature or theology and wanted to let me know who the HR person is to send my resume to, that would be awesome. I would possible even accept not accredited and really low paying for a semester to get more experience teaching). All that being said, my net worth for the month of October is :

My goals for this year are still to max out my IRA and have $5,000 in my emergency savings account.

Check out the weekly finance writer link up at Femme Frugality: *Part of Financially Savvy Saturdays on Femme Frugality and Young Finances*

Congrats on the near ROTH max out!

Do you get a per diem on the road? I would bank my per diem as much as possible on tour by couchsurfing. I had a great time. I just made sure the people I stayed with had a bunch of good reviews.

Thanks!

I wish we got a per diem, but my show doesn’t. I have wanted to try couchsurfing for a while now, but my boyfriend totally freaks out at the mention of it. At least on our show, musicians make bank, so he usually picks up the hotel rooms. When I head home for the break though, I think I want to give it a try. I’m lucky to have a gigantic, spread out family though, so most times, we save cash by staying with friends and relatives. This was just a really unlucky month that didn’t actually bring us near anyone we knew.

Great job on maxing out your Roth IRA!

Thanks!

Congrats on being close to maxing out your Roth IRA! I wanted to do that this year but fell a bit short.

Fig @ Figuring Money Out recently posted…Beat The 9 to 5 Inspiration