Profile

I am thirty-nine years old, a digital event producer and occasional freelance stage manager. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

This month has been alright. A pretty tame British Thanksgiving since I had to work most of the afternoon and evening, but I did manage to play enough hooky to make a small feast for lunch and catch some of the Thanksgiving Parade in NYC. I also topped it off with a tiny pumpkin pie.

The pound is really regaining it’s strength, which I can see when I’m converting pound expenses to dollars. My rent was $50 more this month than last month thanks to that.

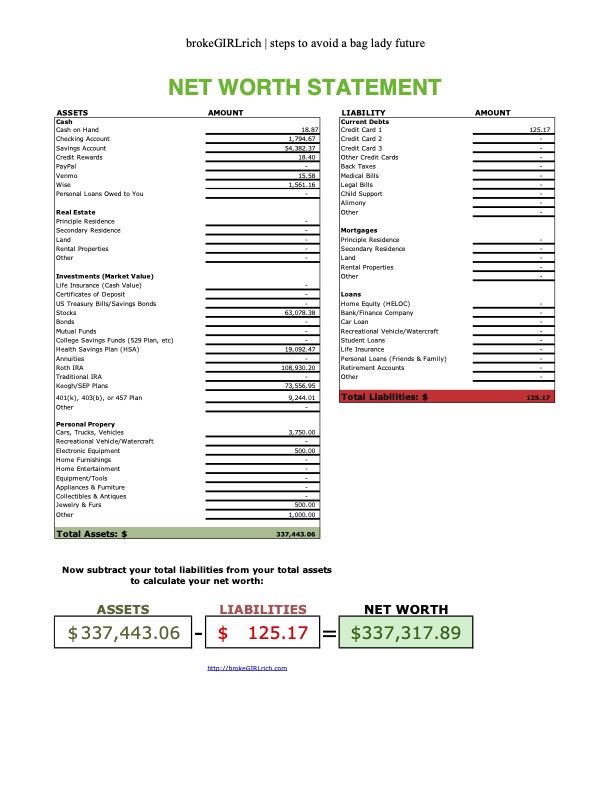

But the American stock market also seems to have rallied quite a bit the last month, because my net worth jumped up a ton as well.

Money is such a made up concept.

I’m pleased with how much I spent on food this month, though that does include 4 days in NJ, being fed by my family.

Gifts turned out ok considering that included a wedding gift and essentially the rest of my Christmas shopping and a small amount of birthday gift shopping. My last holiday gift expense I expect will be about $20-25 in British chocolate tubs to bring back for various gatherings at home right before I fly home at the end of the month.

Amazon Prime gets its own line in the budget because like… where does that fit in anyway? I only maintain it for my dad to use at this point but after years of living with him for free, I feel like I have to leave it there for him. It’s funny how some money entanglements start to get a little weird as you get older. Like my US phone and an EZpass tag in my car, that mostly sits in my dad’s driveway, is still covered by him, but I keep the car insured and my Amazon Prime current because I know he uses them (to be very fair, I did run some numbers on what a rental car would cost to achieve the same things I usually want to do when I’m home for a few weeks a year and it is about a wash).

Switzerland just keeps coming for us with speeding tickets that are like 5 mph over the limit. We got another one this month. Hopefully it’s the last. We split it three ways again, so that’s the (hopefully) final BFF reimbursement from that trip.

But this month was a lot more manageable. Overall less surprise expenses. I think I was also taking into account that December is always slow with digital workshop bookings, and November really didn’t have that many, so my income for December and January is going to be pretty low.

Fortunately I’m making a little bit again helping my supervisor’s theatre company on the weekends this month and next month and in January, I’ll start TAing again. And hopefully the digital workshopping wil pick up in 2024.

I just keep on trucking along. It’s also a little crazy to me that I’m halfway through this degree, which is a little panic inducing academia wise and a little hopeful back-to-work wise. Although I really don’t know what I want to do immediately after graduating.

That’s a problem for another day.

Here is the expense breakdown for the month:

- Rent – $1298.99

- Food – $380.37

- Gifts – $274.94

- Utilities – $197.78

- Amazon Prime – $148.21

- Travel – $128.47

- Entertainment – $99.19

- Health – $75.21

- Switzerland – $46.74

- Charity – $40.56

- Blog – $37.00

- Toiletries – $33.02

- Stage Management – $31.67

- Flat – $26.48

- Game Development – $24.81

- Clothes – $13.00

Total Spending in November: $2,856.44

Hustling

This month’s income:

- Digital Producing – $3,217.50

- brokeGIRLrich – $480.32

- Teaching Assistant for a Day – $81.66

- BFF Switzerland Repayment for Tickets Number 2 – $31.16

- Roller Skating Refund – $21.17

Income This Month: $3,831.81

Net Worth: November 2023

Goals

- Save up $10,000 for school.

- Save up £5100 for school. Thishas been a resounding failure, so all of this year’s tuition payment is coming out of savings. I will try again for next year.

- Max out Roth IRA ($6500). $2000 contributed so far.

- Max out HSA ($3850).

- Buy the pretty lamp. I really don’t think this is happening this year. Let it go, Mel. Let it go. Pretty lamps are for fully employed people. Perhaps a 2026 goal.

- Save $2000 for vacation with BFF over the summer.This just completely and totally failed. It all came out of savings and, I’m guessing by the time we get back from Switzerland next month will be close to $1,000 more than I planned to spend too. Not my best money moments but some really great life moments? Sigh. I hate grad school for every financial reason imaginable,

- Stage manage a show.Hey! I did this twice!