Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

November just flew by.

I spent the first week in New Orleans presenting at my first big academic conference. I have to say -it wasn’t the most exciting – which was kind of sad because I really love New Orleans. FinCon14 and the trip I took in 2019 with one of my BFFs were both significantly better. That being said, I did still have a nice time. I love the food there. I love the vibe in New Orleans. I will also be reimbursed by school for a lot of that amount… someday. If the reimbursement time frame from the PhD Symposium in June is any indicator, I will be reimbursed roughly mid-2024 sometime. It did include something non-reimbursable items like a trip to CVS for some wildly overpriced snacks that I could eat when I woke up at 3 AM with jet lag and an embarrassing quantity of macaroons.

The main reason clothing is so high this month was a funky vintage style store in New Orleans that I could’ve bought everything in. Everything was awesome. I also fell victim to some really impressive black Friday advertising for a necklace I wanted to a while, so that it why that is so high. The same ads got me on the candles too. I will have my own mini-Christmas when I get to my dad’s in the middle of December and all these packages are waiting for me.

I think I went a little overboard on gifts this year and I don’t think I care. I was going to blame it on all the children to buy for these days but it’s actually only like 3 kids. I am just turning into my mom a little and I refuse to consider that a bad thing.

This is how you ride a Christmas tree.

As I continue to analyze these expenses in a wildly out of order manner this month, I also admit entertainment was like double it’s usual amount. I went to Winter Wonderland with my partner and sprung for everything (in part because I owed him a little going into the evening). I also was the one who wanted to ride some seriously ridiculous rides (like the children’s reindeer ride and the ride where you are an ornament on a Christmas tree- also very family friendly). I think there were also some emotional spending aspects there as I am doing my best to force more holiday cheer and build totally new holiday traditions since I find this year extra heavy grief-wise and missing my mom-wise. So this year… let’s throw money at the problem? Maybe it will help.

Maybe not.

Either way Christmas Eve will come and go.

Anyway.

Utilities were a little lower this month though I’ve still not really been using the gas. I currently use two little portable heaters depending on which room I’m in and commit to staying in one room for long periods of time when I’m home. I also was out of town for a week, so that probably helped too.

Transportation is really starting to indicate I should possibly get a monthly Oyster card. I think if I go through all the rigamarole to get the student Oyster card, then monthly travel from Zones 1-4 would be £128.80. So there would still be an added expense to go from my flat to Heathrow (which is always the most expensive TfL fee each month). Everything about TfL and their stupid zones is confusing.

I forgot the dog’s flea & tick is on my credit card to auto renew every 6 months and I thought my Prime subscription would renew in January for some reason and had planned to cancel it, but I was wrong and it renewed this month. So I guess I’m doing that for another year despite the fact that it’s mostly useless to me. My dad does use it though.

Overall, I don’t feel upset about the state of this spending but I do know it could be a lot better. I realized this whole last week my mind was sort of thinking I was heading to New Jersey for the holidays any day now so why would I buy groceries when I could just get tons and tons of takeout? Friends. I am not headed home for three weeks. Sigh. I am trying to get my brain back into a healthier eating space. I started subscribing to Hello Fresh again and it has actually been pretty great, but I did skip the last week of November because of Thanksgiving and knowing I was going to have a bunch of leftover food. This definitely undid some of my good eating mostly at home habit.

And I am aware I need to do a little better since six months from now I’m going to have to start accounting for rent again. And I think I’m going to just pay monthly (assuming my landlord lets me) instead of the whole year upfront again.

Though speaking of doing better, next month I have the cost of the all inclusive resort for my brother’s wedding coming up. Then I still need to get the plane ticket, which may be next month. If not, I don’t want to wait much longer since I suspect prices will just go up. Then I’m hoping to use credit card reward points to cover the other 3 nights in Mexico since my boyfriend and I are going to fly in a few days early to try to beat the jetlag and see some sites. We’re just going to stay in a hotel by the airport instead of the all-inclusive for those days.

Here is the expense breakdown for the month:

• Food – $598.03

• Entertainment – $433.60

• Gifts – $380.34

• New Orleans – $363.53

• Utilities – $190.47

• Clothes – $162.69

• Transportation – $153.11

• Fees – $148.21

• Dog – $141.25

• Flat – $119.42

• Health – $98.34

• Charity – $83.48

• Blog – $56.42

• Candles – $51.00

• School – $23.49

• Toiletries – $20.18

Total Spending in November: $3,023.56

Hustling

As usual, most of my income comes from digital event producing. The other income is quite the smattering of things this month.

• Digital Event Producing – $3575.00

• brokeGIRLrich – $1000.32

• Ushering – $515.27

• Relationship Managing – $114.96

• Pub Quiz – $14.95

Income This Month: $5,220.50

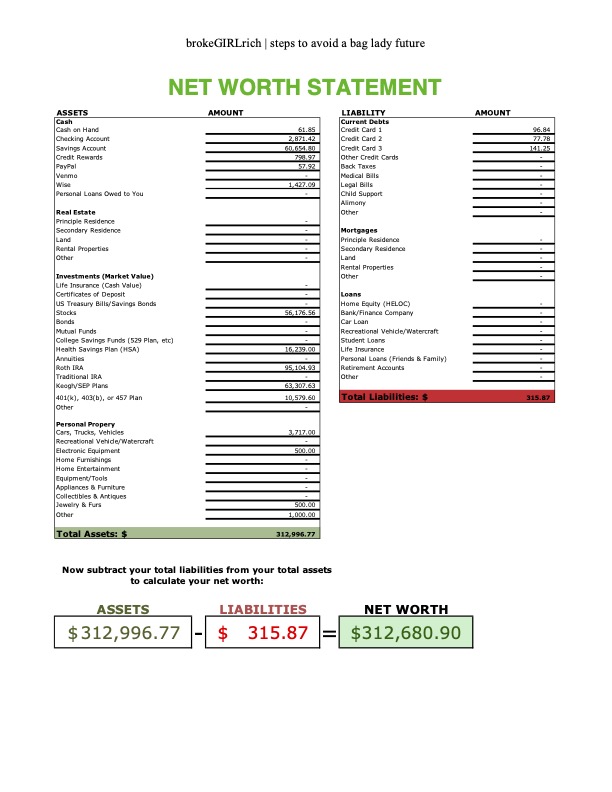

Net Worth: December 2022

Goals

I think this is a pretty good assessment of what I might be able to achieve this year. I had some pipe dreams for the SEP 401k but I think I’m just going to hit the ground running with my IRA contributions for next year. I knew when I went back to school that contributing to my 401k was really unlikely.

• Max out my Roth IRA.

• Max out my HSA.

• Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal). I accidentally saved an extra $800.

• Obtain £5,000 in funding scholarships. So this probably isn’t going to happen but I did get a £500 scholarship this month that went toward my 2023-24 tuition bill.

• Save up $2,000 for traveling.

• Balance work and school without losing my mind. This month was much better.