Profile

I am thirty seven years old and I’m a freelance stage manager and digital event producer. I made $1826 a week working for a circus and $50/hour at the digital production company I work with. I also do an assortment of other little side hustles. I have been living at my dad’s house rent free since July 2020 (thanks, ‘Rona), which is a pretty major aspect to my financial stability.

Spending & Saving

What a weird month.

…I think I’ve been saying that for about 18 months now, but it’s still true.

I STAGE MANAGED A LIVE SHOW!!

As someone who generally doesn’t get choked up about things, I will admit the first time we fully ran an act with all the cues while I called it is notably up there on career moments in my life that reminded me why I do this.

It was a kind of frustrating contract overall, but I guess I really, really did miss calling shows. It’s also strange to wonder when I might even do this again, considering my education goals.

I’ve also been reflecting a lot on stage management the last two months or so, and I realized that while I sometimes have a lot of complaints about this industry, it’s never boring, which I think is the key thing that keeps making me come back.

Rehearsing

But I also am realizing I have a lot less patience for some nonsense situations than I did a decade ago.

In other news, I got into grad school. Which doesn’t feel real at all yet. I will start in January. There is a light at the end of the living at home tunnel and I don’t really feel trapped for the first time in over a year.

So a big financial decision I made this month was related to my retirement accounts. I had saved up enough to max out my Roth IRA on January 1st, but after making a lot more than I thought I was going to in 2021, it seemed more prudent to use that and my extra circus money in my SEP 401k, mostly so I don’t get destroyed in health care fees for making too much for my health insurance rates, since my 401k contributions will lower my net income on my taxes.

I’m still trying to decide if I should contribute more, but with the whole getting into school thing and knowing I’m about to have a lot of fees over the next three months or so related to tuition, visa fees, and moving expenses, I am a little nervous about moving too much money into retirement funds.

This is totally a non-problem problem, but the 28 year old me who started this blog and couldn’t even max out her IRA some years is pretty pleased right now.

I also invested in an IPO for UserTesting, a company I’ve been side hustling with for almost 10 years. The max you could invest as $840, so I thought, why not? I’ve never done anything with an IPO before. …it has not gone well. It is down to $522.60 now, so this may not have been one of my better ideas. I guess time will tell, it just seemed to me like if they’ve held on this long, why wouldn’t they continue to do well?

I also know my net worth is a bit propped up right now because my fourth quarter taxes are pretty high but I won’t send them in until January. Barring some crazy stock market moves though, I think there’s a good chance of hitting my 2021 goals of breaking $325k net worth, even after paying tuition.

A key thing I am trying to keep an eye on though is lifestyle inflation because the combination of very low expenses and being bored at home has definitely resulted in me buying more than I usually do the last few months.

This won’t be a sustainable spending level once I’m back to paying rent and utilities if I have any hope of hitting any saving and retirement goals too.

I bought two pairs of shoes, some more clothes, and some bras during the Black Friday sales.

Also, my car broke down while I was out working on the above mentioned show. Since I wasn’t anywhere familiar and didn’t really have time to deal with this, I just took it right to Toyota, which was probably the most expensive choice I could’ve made. I needed the thermometer and the gasket replaced and they informed me that my transmission fluid is leaking and I should get that repaired soon. So that’s awesome.

To be fair, Mona (my car, Mona the Matrix) has been an excellent vehicle since October 2007 and I’ve only spent about $1,500 on repairs for her until now, which all happened when I last took her to Toyota for a 100,000 mile checkup.

It’s also Christmas soon, which contributed to a lot to this month’s spending. My brother owes me a little money for our dad’s Christmas gift.

I’m also trying to reset my mind from thinking the last three months income was normal, when in reality it was unusually high because of a combination of good luck and no work/life balance, which is not sustainable. Going forward, it will probably be about 1/3 of what it has been.

Which is totally fine. We can work with that normal. We planned this whole grad school adventure based on normal. So everything will be fine.

When does worrying about money stop? Is there a number where this happens? Because I have quite a few cushions between where I am and being homeless and yet… I still kind of worry.

Sigh.

A lot of stage management expenses (other than my StageWrite subscription) were all reimbursed by the company in my final paycheck. And quite a few food expenses will be written off in my taxes too from when I was away from home, which doesn’t mean they are free by a long shot, but they will help lower what I owe.

Also, my strange health insurance is still deducting what feels like totally random amounts. I understand there was a credit on the insurance for several months due to some NJ laws and stipends that changed, but I still don’t understand exactly how it’s being calculated now. I still suspect some tragic, several thousand dollar bill to appear on my taxes related to this.

My expenses this month:

- Food – $736.09

- Car – $634.21

- Gifts – $605.97

- Clothes – $340.85

- Stage Managing – $227.97

- Gas – $151.87

- Toiletries – $144.07

- Amazon Prime – $126.88

- Entertainment – $111.53

- Dog – $60.36

- brokeGIRLrich – $37.00

- Health Insurance – $28.90

- Gym – $28.78

- School – $21.27

Total Spending in November: $3,255.75

Hustling

This month’s income comes from digital producing, stage managing, murder mysteries, brokeGIRLrich, working as a stagehand, and a smattering of other little sources.

- Digital Event Producing – $5750.00

- Stage Managing – $4599.68

- brokeGIRLrich – $1799.90

- Stagehand – $486.47

- Murder Mysteries – $84.18

- Loan Payback – $84.00

- Insurance Refund – $66.80

- Rakuten Cashback – $12.07

- UserTesting – $10.00

- Bayer Settlement – $5.44

Income This Month: $12,898.54

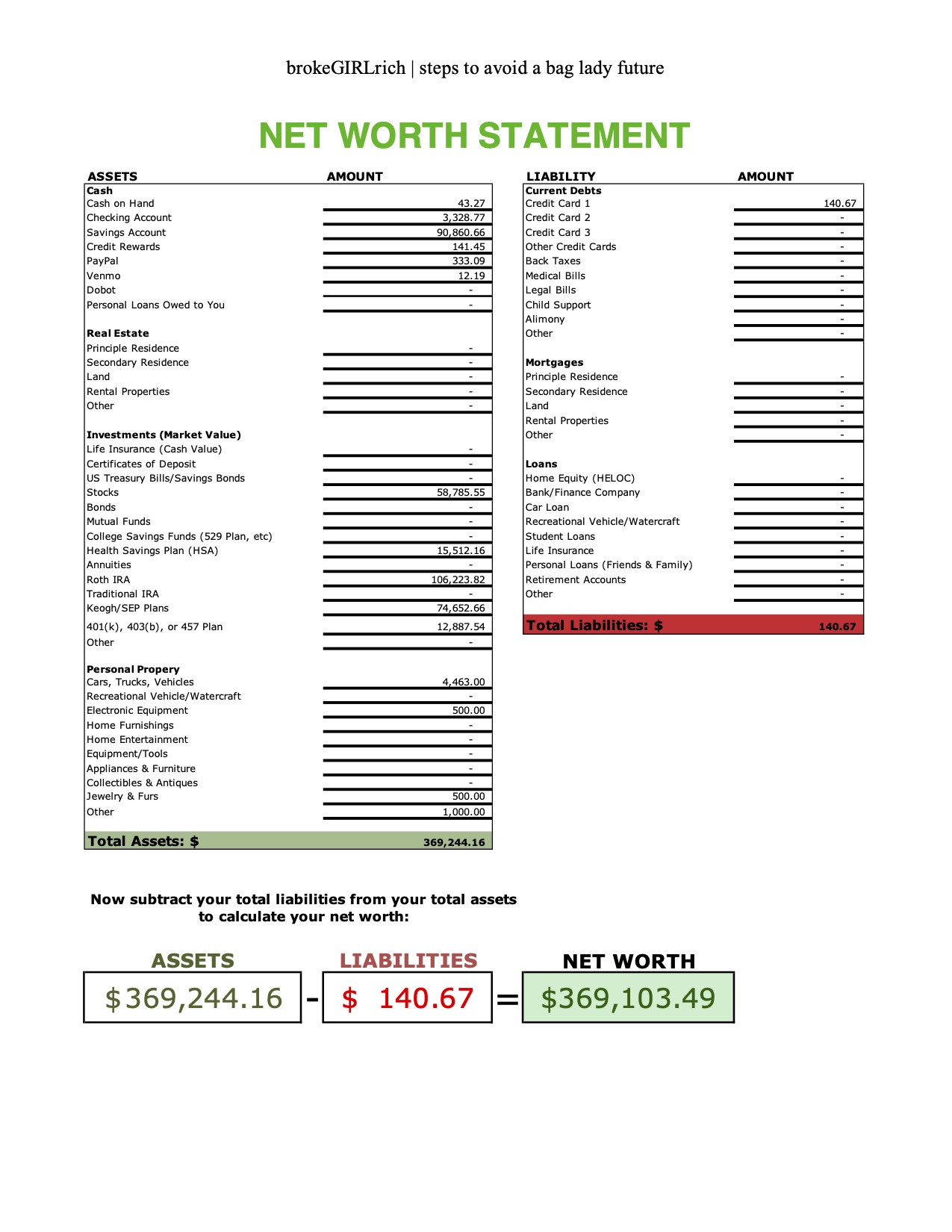

Net Worth: November 2021

Goals

- Max out my Roth IRA. New goal is to have $1000 saved to deposit on January 1st. That may or may not work out depending on school expenses in December.

- Max out my HSA. Done

- Invest $2,000.

- Save up $3,000 for post-pandemic traveling.Done

- Add $1,000 to the emergency savings account. Done

- Add $2,000 to the new car savings account.Done

- Break $300,000 net worth.Updated to break $325,000. I suspect that if I get into school, the expenses to get my visa and everything will jeopardize this – so we’re not going to consider it a success for sure until December.

- Do two things to build up my stage management skills. COVID compliance officer certificate and immersive theatre design class.

Ahh, usertesting.com! Hopefully that goes back up. I almost invested in Nerdwallet…

I recently got into US stocks for the first time, but not at the best time…! Ah well

NZ Muse recently posted…5 steps to crush your money goals this year

Not totally true, I think over time it’ll still be a good move. We’ve all been saying it’s not the best time because surely a dip is coming for years now and somehow… there are tiny dips but that big one still stays at bay.