Profile

I am thirty six years old and I’m a freelance digital event producer. I also worked for a couple of hours as a stagehand this month. I’m still living at my dad’s house. That’s where we’re at.

Spending & Saving

You know what? I’ve been blogging about money for more than 7 years and I have to admit that sometimes money makes no logical sense to me.

I have been a little stressed this month. And a little in denial about that stress too.

If you were following my NJ unemployment story post, you’re aware I finally got paid for the unemployment claim I made during the summer. Then they messed up the payments and demanded a bunch of the money back. So I mailed them a check for $1450, which they still haven’t cashed, but when they do, my bank account will be down to like… $400.

I’ve mentioned before, I don’t like it when my checking account is under $2,000.

Clearly I could move money from places, but that’s not the point. I thought many times that if I was paying a mortgage or rent and utilities somewhere – I probably wouldn’t have made enough to cover everything this month.

Which again, yes, I can easily pull from some savings, but it’s a gross feeling.

And also my firm pile of denial also meant that I bought some clothes and candles I didn’t really need (but do really like). You can see from my spending that despite being a little stressed by this, I didn’t do much to change my spending patterns.

Overall, I have felt very pauper-ish this month while I waited for my new job to fall into a weekly paycheck rhythm since I didn’t get my first freelance paycheck until 30 days after the first invoice I submitted in October and my other “reliable” part-time job fired everyone because they ran out of runway funding at the beginning of the month (yay tech start-up world).

I was super relieved the $900 of $300/week a from unemployment over the summer actually hit my bank account though I don’t really want to spend it since I suspect NJ Unemployment has probably made some sort of mistake (there’s no reason for me to think this) and will demand it back again.

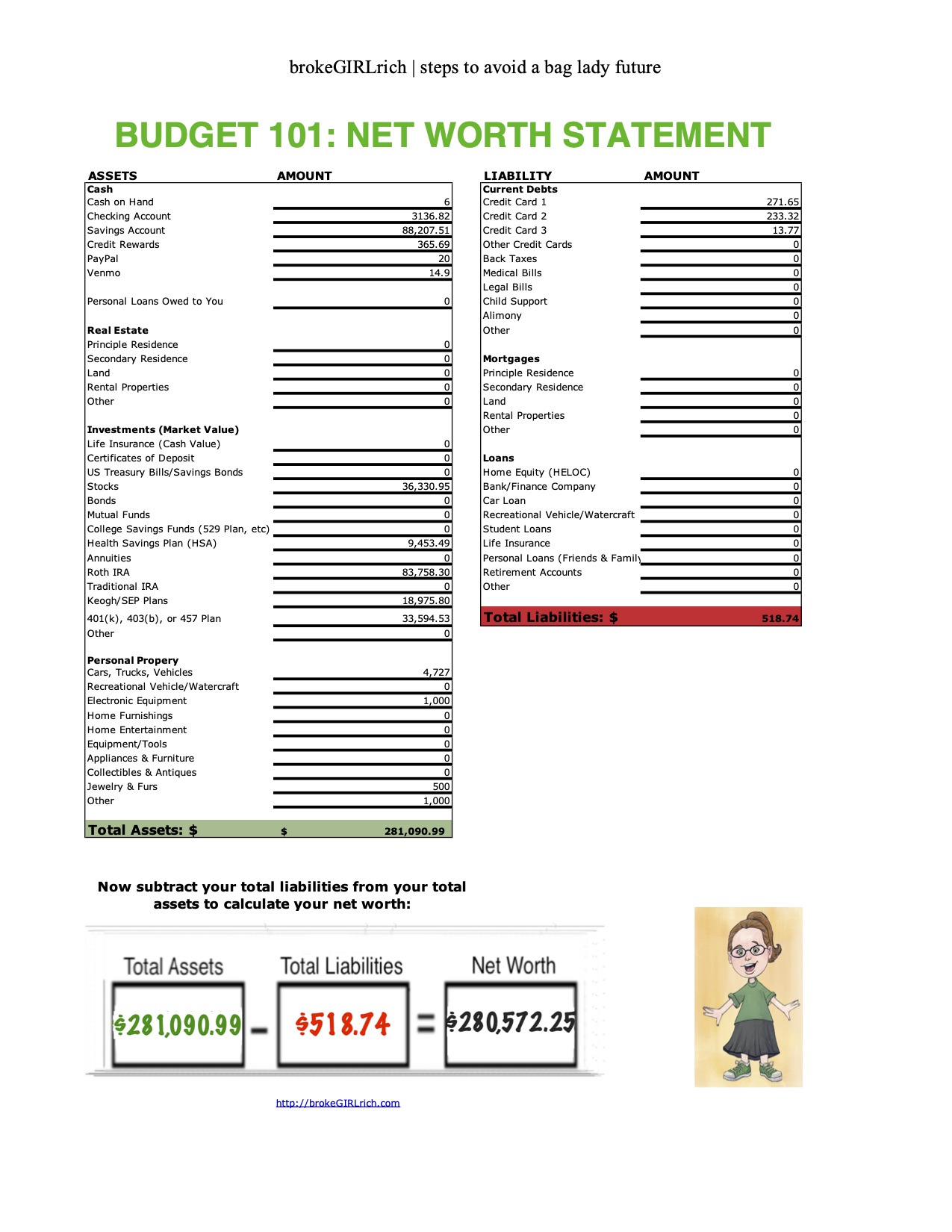

But why does this make my feel like I know nothing about money? I heard the market was doing well, but this is the largest single month increase I’ve ever had.

$22,913.46 to be exact.

There are some years when I barely made that much.

And I’m sure it’ll go down next month. Or go ridiculously higher – but at some point the bubble will pop.

But for right now, when I calculated my net worth, there was a solid… what… is… happening… feeling as I opened each account effected by the stock market to check it.

As for spending, health insurance was the worst hit because I’m switching to an ACA plan in January and had to pay that premium during open enrollment as well as my regular November premium for the current plan I’m on.

My second largest expense was food, though I did manage to keep it fairly reasonable. I’ve gotten very fond on Trader Joe’s microwave meals, which is a lot cheaper than takeout.

I think I was channeling a little bit of my mom this year for Christmas gift buying, but also two close friends had family member’s pass away so some of that expense was sending food/gifts related to that. My mom always used to go a little overboard. I’ve been slowly collecting things for the few people on my list throughout the year actually and don’t even care if I’ve gone a tiny bit overboard too because what a dumpster fire this year has been.

And yes, my third highest expense I have called bees because I kept finding bees in the house and my dad pretty much shrugged it off and was like “I guess we live with bees now.” I didn’t agree with him, so I called an exterminator.

In very exciting news, the kayaks my boyfriend and I ordered in May finally arrived and they gave us a $50 refund for the delay. So yay for that news, even though it’s way too cold to use them now in NJ.

My expenses this month:

- Health Insurance – $414.11

- Food – $391.08

- Gifts – $314.60

- Bees – $239.91

- Gas – $110.36

- Clothes – $83.84

- Work – $50.65

- Candles – $47.48

- Blog – $47.00

- School – $14.95

- Entertainment – $1.01

Total Spending in October: $1,714.99

Hustling

My income this month was from freelance digital event production, stagehand work, brokeGIRLrich, a car insurance refund, User Testing, my last customer service job paycheck, Rakuten cashback check, and although it’s not really hustling, another unemployment catchup payment.

- Unemployment – $900.00

- Digital Event Producing – $480.00

- Stagehand – $244.17

- Customer Service Job – $218.64

- brokeGIRLrich – $209.77

- NJM Insurance Refund – $75.25

- User Testing – $40.00

- Rakuten – $14.34

Income This Month: $2,182.17

Net Worth: November 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: The Economic Impact of COVID on Arts Workers

Goals

- Do two things to build up my stage management skills.

- Max out my Roth IRA.

- Max out my HSA. I can’t max it out due to switching health care providers. My university healthcare wasn’t eligible and my current private insurance isn’t eligible either.

- Set aside $1,000 for my new car account.

- Invest $2,000.

- Read more.

- Learn to make macaroons.