Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager – which I celebrated a bit this month at the Broadway Stage Management Symposium. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

A fun thing I did get to do this month was run my booth on the virtual side of the Broadway Stage Management Symposium. I’ve been so incredibly lucky to be included in this event for the last several years, put together by the incomparable Matt Stern. This year I managed to put together Q&A sessions with two tax preparers, the person who runs the mortgage department at ActorsFCU, and a financial planner. It all came together a bit last minute so I did a dreadful job advertising it and the recording option didn’t work in my booth so my hope is to do it really properly next year – hopefully with a few other folks who can speak to things like debt consolidation and SEP/solo 401ks.

Between a delayed paycheck coming through and an actually not as terrible month of digital producing last month, this month has felt more like what I usually mean when I say it’s been a bit slow income-wise.

However, I worked 3 days of digital producing this entire month so next month will sort of suck. On the plus side, one week of it will be spent at an all-inclusive resort celebrating my little brother’s wedding.

That being said, my expenses totally don’t reflect a person who is about to make like no money. LOL. L.O.L.

Sigh.

But other than perpetual money stress, it was a really good month. And at one point, when I had a very frustrating trip to the airport that became wildly expense and like nearly $200 of the entertainment expense due to the train strikes and other issues that made getting to the airport on that day the most impressive feat of my travel career, I just sort of gave up and decided I can make more money in two years but who knows if my friends and I will have time together again? I mean, that’s a bit maudlin so I totally hope so, but I do also have a few friends my age who are now gone so… it’s ok.

Here are the really lovely things I spent a lot of money on this month.

I bought some new clothes to go to Mexico next month for my brother’s wedding and paid my future sister-in-law for the hair and make up expenses for the wedding day. I also booked a tour to go see Chichen Itza and I’m really excited about it. I got a really nice pair of shoes for the dress rehearsal that are really comfy and unlike any other shoes I currently own. I also got some clothes that fit properly since I have managed to gain back most of the weight I lost during the pandemic which I feel is also a problem for future Mel, PhD but not for Mel, PhD-in-Progress since I nearly had a nervous breakdown trying to find time to go to the gym this fall.

The first weekend in May my partner and I went to his friend’s wedding in Wales. We rented a car to go which was lovely. I love renting cars to get places and not being reliant on the public transport. Unfortunately, it’s pretty pricey. We used Turo, which is like AirBnB for cars. The car we rented for this weekend was lovely and the woman who owned it was only like a 10 minute walk from my flat. 10/10 for this Turo rental. We were able to drive around Snowdonia National Park for a bit the morning of the wedding. We were going to go for a short hike but the parking was out of control and we would’ve cut it too close with the long walk from parking added onto the trip overall. On the way home the day after the wedding, we did go for a short hike and see a waterfall.

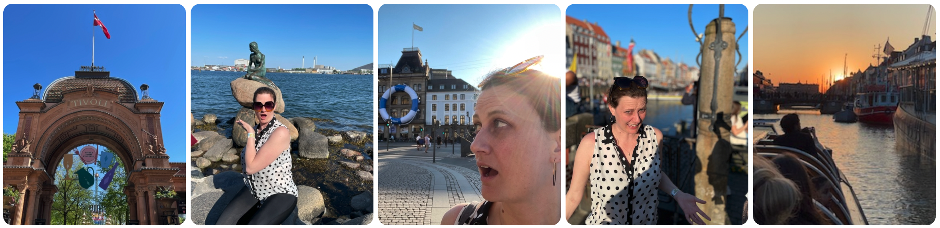

The following weekend was really the big chunk of my entertainment expense. A friend of mine was over in Denmark for a work conference and she stayed the weekend to sightsee, so I hopped over to hang out with her. The flight was booked a few months ago and less than £100, so I thought this was going to be a win but I had major problems getting to the airport in London. My flight was crazy delayed so I had to take a cab instead of public transit to the hotel, which was another $50 and then another cab back to the airport due to a marathon happening the morning we left for another $50 so before even doing anything there, I was already at like $250 in expenses.

I don’t think I regret it though. We had an amazing day together with another friend of hers. We spent the morning at Tivoli Gardens, an old amusement park that inspired Walt Disney. Then we went to the Little Mermaid Statue and then on a canal cruise as the sun was beginning to set. We finished the day at a fancy tapas place.

This past weekend, my partner and I rented a car again for the end of May bank holiday and went to the Cotswolds to see the annual cheese rolling festival. Total lunatics chase cheese down a very steep hill and the first to the bottom of the hill get to keep the cheese. And a bunch of almost as insane people climb a crazy steep hill to watch this happen. I’m so glad we went and also I will never go again. The crowds are intense. People are crazy. The hill erodes under your feet as you stand there until you start to slide down it. We rented a car again to do this and this was a little smooth but overall still better than the 8 hour public transit journey we would’ve been looking at otherwise.

So not really a money saving month but a really good one overall. School wise I finished up TAing for the semester and have been focusing on drafting my transfer papers to apply to do my transfer viva from MPhil to PhD hopefully in September.

I also went back and forth over whether or not to keep my car in the States insured because my dad often borrows it and he left me live there forever for free and at the last minute I decided to do it and like a week after I did he called to check if it was still insured because he needed to use it for a while, so I think I feel good about that decision.

Fingers crossed things pickup again for good soon with the digital producing and my bosses aren’t upset about the times I’ve had marked off for school things (and clearly a few fun things too).

Here is the expense breakdown for the month:

- Rent – $1271.31

- Car Insurance – $1043.00

- Entertainment – $837.91

- Mexico Trip – $668.22

- Food – $508.55

- Utilities – $259.84

- School – $141.70

- Transit – $126.49

- Gifts – $69.77

- Blog – $57.15

- Gym – $47.14

- Charity – $34.37

- Toiletries – $24.97

- Health – $22.58

- Miscellaneous – $16.99

- Flat – -$7.80

Total Spending in May: $5,122.19

Hustling

This month’s income:

- Digital Event Producing – $3602.50

- TAing – $749.19

- Ushering – $368.44

- brokeGIRLrich – $142.87

- Rakuten Payout – $7.83

Income This Month: $4,870.83

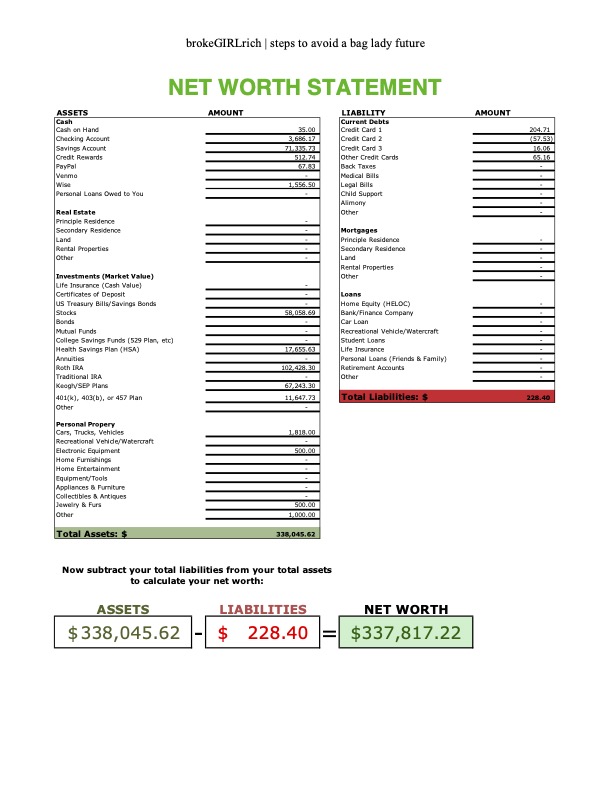

Net Worth: May 2023

Goals

These are my goals for 2023.

- Save up $10,000 for school.

- Save up £5100 for school. Up to £1861 this month.

- Max out Roth IRA ($6500). $1000 contributed so far.

- Max out HSA ($3850).

- Buy the pretty lamp.

- Save $2000 for vacation with BFF over the summer.

- Stage manage a show.