Profile

I am thirty seven years old and I’m a freelance stage manager and digital event producer. I make $55/hour at the digital production company I work with. I work a variety of small side hustles, and am also a full time student working on a PhD in Drama.

Spending & Saving

Oof, what an expensive month. I mean, May-August every year is when I get hit with a lot of annual bills but… ugh.

I found an apartment. I had the option of paying a fee every month for a guarantor or just paying out the lease. I paid out the lease for the year – so that is the massive rent expense. It will not appear again for a year and actually if I stay in the same place, it seems like my landlord will allow me to pay monthly starting next year.

I was going back and forth on the budget friendly options versus the nicer options and I picked budget friendly. I have mixed opinions about this place, so it might just be for the one year. So the goal, of course, is to resave up all that money over the course of the next year in case I just have to pay out a full lease again next May to move.

Overall though, the finding an apartment hunt wasn’t quite as bad as I thought it might be. I’m further away from the city center than I really wanted to be but I am still near the main things I go to regularly. There is a horrid hill that I have to walk up if I don’t want to pay for the bus, but the bus does stop right in front of my flat and there are groceries and some shops right around the corner.

My main source of stress in the electricity. The breakers seem to trip too easily, which I don’t love as someone who works online for a living. Also the meter has to be topped up with a key, which I go to the post office to load. I pay them £50 and they put it on the key. I put the key in the meter and reload the thing. I feel like I live in 1920 every time I do it.

I also paid my car insurance for the year, which I was sort of undecided about what I wanted to do on that front regarding keeping my car, but I guess I am for another year. Also my family has been using it once and while.

While I was in NJ camping with my family, the dog picked up ticks. So many ticks. All of the ticks. It wasa tickpocalypse. Despite being on regular tick prevention medicine. And I also feel like the vet totally hosed us for a tick bath and removal, as well as a blood test. But I was leaving for England that afternoon and my dad and brother were both leaving the state for a while too so it just had to be sorted. Supposedly my dad is going to contribute to this bill at some point, so maybe next month there will be something from him offsetting this expense.

I also had to buy a bunch of really boring stuff for my apartment like cleaning supplies, towels, plates, etc. I spent a lot of time at Poundland, TK Maxx, and Primark. I was pleased though that I figured it would all cost about $1,000 and it is sitting a little over $700 right now and I kind of wanted to buy a TV and now I feel good about that choice.

The money hemorrhaging continued with my really high food expenses this month since I pretty much I ate out constantly. My move got delayed by like a week due to some issues with the flat, so I just kept not buying groceries. I spent the last week of May in New Jersey, camping with my family, so right after I moved, I still didn’t buy many groceries since I knew I was leaving.

I also think I just sort of lost track of the idea of money for a bit this month. Nailing it as a personal finance blogger.

Entertainment is also kind of high. I paid to do roller skating lessons all summer, so that upfront cost was a little over $100 and I bought tickets to several theatre experiences. Also a few nights out. I regret nothing.

I feel a bit behind in my savings goals but I am ready to pay my tuition in August/September, which will be my next large expense. I am also excited to settle into more of a routine now that I’ve found a place.

I will say that even though I have some mixed feelings overall about the flat, on the first morning there when I just made some coffee, curled up on the couch in my pjs and read a book for school, I felt the most ok about life that I had in like… two years.

As far as making money, the digital producing picked up a bit more this month. I also got a one day a week job doing bookings and VIP invites for my supervisor’s theatre company. I also have an interview to work on the front of house team for a show near my flat a day or two a week next weekend.

School wise I still spend most of my time reading and trying to develop the framework for my research. I also have been planning a Symposium with a classmate for the last three months that is in two weeks, so I’m excited to get that big event over with. It feels like a lot of my school time the past few weeks has been spent organizing that.

Grad school is a super weird thing because I feel like I am monumentally behind all the time, but also life is way easier than it ever was working full time in theatre, and my supervisors seem largely content with my progress. So who knows really? The whole thing is just super strange.

Here is the expense breakdown for the month:

- Rent – $16,277.79

- Car – $1,031.20

- Dog – $936.00

- Apartment – $702.52

- Food – $640.93

- Entertainment – $464.26

- Charity – $361.17

- Commute – $184.58

- Utilities – $139.66

- Travel – $133.15

- Toiletries – $117.58

- Gifts – $108.19

- brokeGIRLrich – $37.00

- Health – $27.00

Total Spending in May: $21,161.03 (or $5,883.24 without all the extra rent)

Hustling

This month’s income comes from several different sources. The usual digital producing and brokeGIRLrich. Additionally, I got paid for the job I did before leaving for England back in March. I also picked up a job working one day a week for my supervisor’s theatre company doing bookings and organizing VIPs.

- Digital Event Producing – $5,362.50

- brokeGIRLrich – $1,025.55

- Stage Managing – $1000.00

- Theatre Part Time Job – $241.67

Income This Month: $7,629.72

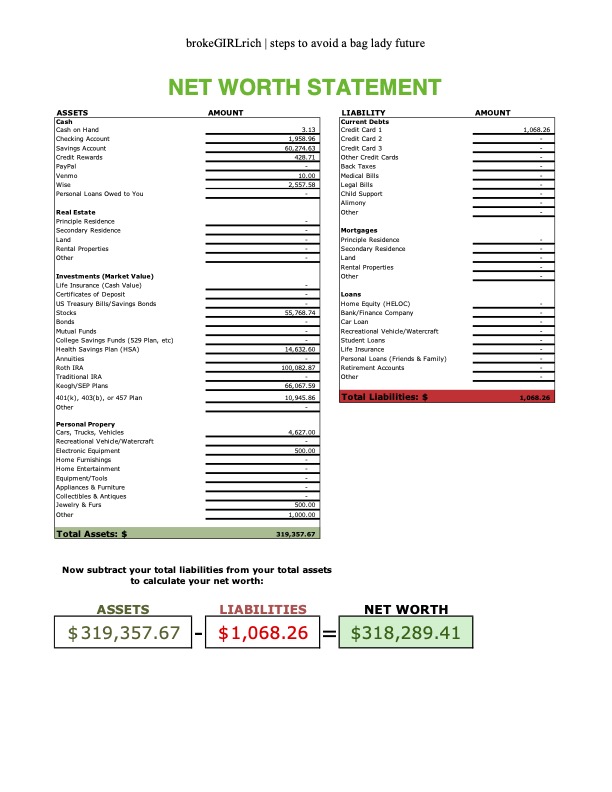

Net Worth: May 2022

Goals

I think this is a pretty good assessment of what I might be able to achieve this year. If I luck out and the blog has a really good year or something, I will aim to make a contribution to my SEP 401k too.

- Max out my Roth IRA.

- Max out my HSA. $1,000 contributed.

- Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal). $3,800 saved so far.

- Obtain £5,000 in funding scholarships.

- Save up $2,000 for traveling.

- Balance work and school without losing my mind. This feels a little less good this month.

Have you thought about putting your car under storage insurance? That could make your insurance cheaper if no one is using it.

I asked about this before I left and I was told it has to be in a garage to do that. It’s parked outdoors in a driveway. I do suspect there is some way to make this not as expensive, but I haven’t managed to figure out it out yet – besides the obvious of just selling the car. Thank you for the suggestion though!

Mel @ brokeGIRLrich recently posted…Helping Children In Unfortunate Situations: Ways to Pay It Forward

You are ahead of many people your age by taking a monthly look at your income, expenses, goals, and net worth. Having a clear view and understanding of where your money is coming and going, puts you in position to achieve your goals. Of course unexpected things pop up (and always seems to be when we feel we have a good hold on things). Seeing you have a nice cushion in your savings for emergencies is impressive. It’s that you have money in both savings and stocks. You are in a good position with the savings cushion so you can ride out the market without potentially needing to pull that money for personal expenses. Good luck with the scholarships!

Melissa recently posted…A Lesser-Known Way for Oregonians to Save on Taxes—and Change Lives

Thanks! I have been very fortunate, and I’ve also learned a lot from being a part of the personal finance blogging community for the last 9 years, for sure.