Profile

I am thirty six years old and I’m a freelance digital event producer. I make $50/hour at the main company I work with. I also work part time for a theatre company doing a digital murder mystery/escape room for £15-£20 a show a few evenings a week.

Spending & Saving

What a fast month. I worked a lot, which was nice, but some work life balance would be nice.

I interviewed for my second stage management job over the last year; however I found out at the very end of a very detailed interview that they are doing some racially charged pieces and would have to be literally out of their mind to hire a white stage management team. So I am sure I’m not getting that gig (and totally cool with it – just thought it was odd to end the interview with that info, not start it that way).

On the plus side, it never hurts to practice interviewing? Or make a good impression for the future.

I’ve been doing a lot of reading to try to catch up in the field I want to apply for a doctorate in. I have to submit a doctoral proposal with my applications. My goal is to have it done by the end of July and spend August actually submitting applications.

Spent a lot of time with this goober this month.

It’s felt sort of weird to watch the world reopening. I went to two breweries with a friend. Next month I’m going horseback riding with a few friends. My family went camping on a friend’s land for our annual Memorial Day camping trip. In some ways, it’s like a pause button was hit and we’re just… doing the normal things. In other ways… I still feel fairly overwhelmed about life and balance and what exactly is going on.

I think I’m going to feel like that as long as I’m living at home with my dad though. I always used to say it felt like I was hitting on pause on life whenever I came home between contracts and tours. For a few weeks or a month it can be really nice but for a year it’s like…. I don’t even have the words anymore. I know my mental state is not in a great place and the only thing that is likely to fix it is to leave but I have to have some sort of plan to leave, so… here we are.

My biggest expense was a charitable donation, followed by my car insurance payment for the year. That’s actually why I have a fairly high credit card balance because I used a new card to pay (the Venmo card) and will get a $100 bonus for spending $1000 within the first three months.

Food was pretty high this month. I think the meal delivery kits are definitely adding up. I started the month on Blue Apron, which is actually pretty budget friendly with the introductory offer, but then went on to Sunbasket, which is like almost twice as much, even with the intro offer.

A small win was that I was finally able to close the last on my mom’s accounts (two and a half years later – thanks for making that as difficult as possible, Charles Schwab). It was for a whopping $240, which I wound up splitting with my brother.

My expenses this month:

- Charity – $2000.00

- Car – $1046.00

- Food – $528.88

- Gifts – $179.33

- Health Care – $159.68

- Camping – $131.86

- Fitness – $97.00

- Dog – $85.99

- Clothes – $83.40

- Entertainment – $37.99

- Gas – $34.66

- Books – $16.18

- School – $14.95

- Miscellaneous – $13.16

- brokeGIRLrich – $12.13

Total Spending in May: $4,441.21

Hustling

It was a slightly lower month of digital producing income (and it will be next month too since I worked as a stage hand for a week this month) and a higher month for stage managing the murder mysteries since we added another show. I also worked as a stage hand for some graduations for a week, drove for my friend’s movie, and made a little bit from brokeGIRLrich, Rakuten cash back and UserTesting.

- Digital Event Producing – $2812.50

- Stage Managing – $1154.01

- Stagehand Work – $833.84

- Driving – $228.66

- Mom Money – $120.42

- brokeGIRLrich – $114.42

- Cashback – $21.84

- UserTesting – $10.00

Income This Month: $5,067.03

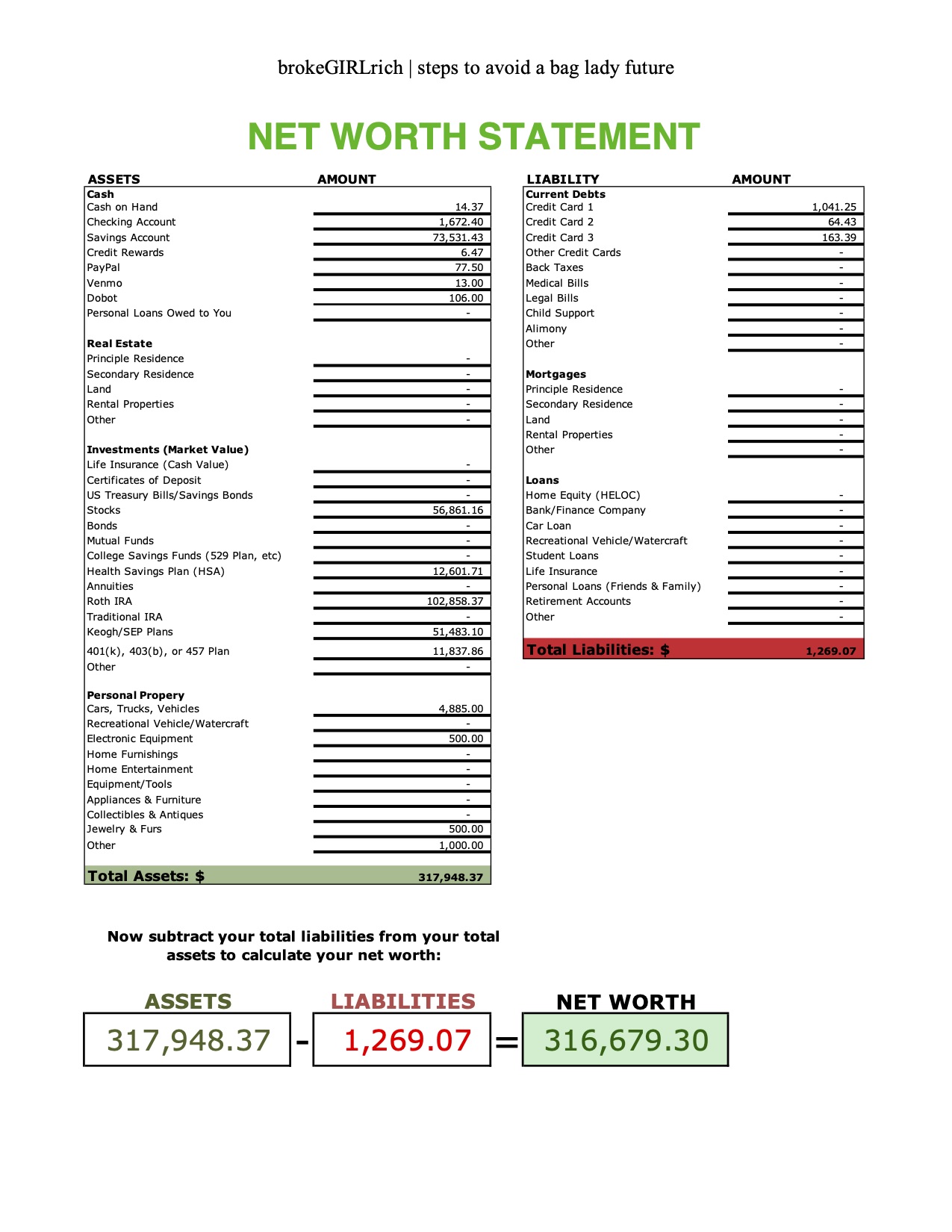

Net Worth: May 2021

Goals

- Max out my Roth IRA. $1,500 to go – stalled here for a bit. I’m hopeful to pick up some steam soon.

- Max out my HSA. This is on track. I’ve learned to just go a month at a time here, since sometimes my insurance changes over the course of the year due to different jobs.

- Invest $2,000. Halfway there.

- Save up $3,000 for post-pandemic traveling. $1250 saved so far, about $205 of it spent.

- Add $1,000 to the emergency savings account.

- Add $2,000 to the new car savings account.

- Break $300,000 net worth. Updated to break $325,000.

- Do two things to build up my stage management skills. COVID compliance officer certificate and immersive theatre design class.

I sure get the strange shift with the world reopening. I work in a customer service based industry so its been odd to go from all masks and everything closed to mostly open and almost zero masks.

Some of my accounts were moved from USAA to Charles Schwab. They made it so painful to take my business somewhere else! They wouldn’t accept digital signatures only wet ones and the wait times on the phone were crazy. Not a fan! Unbeknownst to them, it just made me more determined to switch.

You are doing awesome on your goals! Mine our semi similar except for the net worth, yours is impressive! 👏

Thanks so much! It’s been a solid 8 years now of hard work on the net worth front to get to where it is (and an inheritance from a person I’d much rather still have here).

I’m sorry you’re dealing with the Charles Schwab nightmare too but I totally feel how it can add to the determination to take your business elsewhere! Good for you!