Profile

I am thirty five years old and I am a Visiting Instructor of Theatre Arts/Production Management at a state university, where I make $26,418.51 for the semester. I’m pretty sure I have spent about 480 hours on Zoom this month. OMG.

Spending & Saving

So life’s still pretty weird, right? We’ve entered Stage 1 reopening here in NJ, which means beaches and parks are reopened.

I have taken advantage of going to a park. People were still social distancing pretty well. There was a large group of teens/early 20s having like a parking lot party in the corner of the parking lot at the big state park I went to, but they did stay far away from everyone else who wasn’t making the same choice, so… ok?

I’ve added one more person I come in contact with regularly to my tiny pool of me by myself, and then seeing my dad and the dog on weekends. So that’s my Phase 1 reopening? Seems to be going ok so far.

I’m not going near the beaches. People are fricking crazy there. The social distancing is a joke and no one is wearing a mask. The Jersey shore is a sh*tshow on the best of days, so I think it’s a ridiculous place to reopen when you need people to be making good choices.

But. Whatever. Here we are.

None of that has to do with saving or spending. You’d think quarantine would equal some savings, but I think the fact that Jeff Bezos is now a trillionaire proves otherwise. So will my spending report.

This has actually been a fairly depressing money month. The biggest loss was the misadventures in hustling turned into an extreme misadventure because, spoiler, eChecks can clear and then they bounce a few days later. And this is the entire nature of a money order scam.

So now the police and I are pals and I’m sure I’m out almost $4,000 ($3,850 to be exact). The police oh-so-helpfully told me to watch a couple of YouTube videos on money order scams because they’re fascinating. I think the cop could hear my seriously? tone of voice because he quickly added “and also very unfortunate. And very common, you shouldn’t feel too bad.”

Love it. I don’t even know how to note that in my financial tracking. As a matter of fact, these three paragraphs might be the only tracking of it I do because I shifted money out of my new car savings to cover all the stupid that is me this month, and I will continue to hope Mona the Matrix holds on for another 5-10 years.

The second most depressing money part of the month was that my website crashed for nearly a week while trying to deal with HostGator’s absolutely abominable customer service. I literally just needed them to generate a new password for me. It was so stupid.

On the plus side, if any of you have websites and they ever have an issue, Grayson Bell at iMark Interactive is where to go. I’ve had two large issues over the last seven years of blogging and he has fixed both of them incredibly quickly.

And the reason it was super depressing is that the largest aspect of my blogging income comes from sponsored posts, but those companies just sort of reach out when they feel like it – and five of them reached out to me that week. Which equals about $500 of lost income, and some damage to my blog’s reputation as being reliable, since they all also saw my website wasn’t functioning.

Two of them came back later in the month with different orders, but I think I lost three of those companies entirely.

So yay for that.

Here is some spending I don’t regret at all though – supporting the arts. This month I saw:

- Lab A – Out of Time (ß the best digital one-to-one I’ve done the whole time)

- The Torso Book Club (which was delightful and still playing – check it out)

- Performance for One: Part I and Part II (which legit seemed like a Battersea Arts Center level one to one performance, even if there were definite restrictions due to digital constrictionsSiobhan o’louglin)

- Lab B: A Love Story in Five Courses

- Siobhan O’Loughlin – The Button Man (which was a pleasant and interesting evening – and also still playing, check it out)

I also saw Theater for a New Audience’s Mad Forest, which gave me some hope that with the right script choices, interesting live performance can still be created during this time.

If you are also looking to directly support some artists who are trying to embrace and explore our brave new digital world, the main places I look are:

I’m particularly looking forward to Eschaton next month, which features some Sleep No More alums – I’m excited to see who I can recognize.

A small part of me feels like I’m back in grad school and I wish I could grab a pint in the West End Pub and chat about these weird experiences with my classmates afterward. They are very hit or miss but I feel like I learn something new about digital art at each one I attend.

All of this has also, hopefully, prepared me to stage manage a Zoom performance of The Yellow Wallpaper at the end of June, so I am really excited about that even though it’s pretty much a volunteer gig. It will be a fun learning experience. I hope.

I’m also excited to be spending the last weekend in May at my brokeGIRLrich booth at the Broadway Stage Management Symposium for the third time. So if you’re attending stop by and let’s chat about money. I also have some fun financial quizzes going for Starbucks gift cards over the weekend during breaks too.

Also in spending, I finally bought a kayak. I have been talking about it intermittently for like three years. So that was my largest expense, because I was excited to find a good deal on the kayak I wanted but then I also had to buy a paddle and a life jacket and before I knew it – it was a substantial purchase. I’ll just have to use the heck out of it this summer.

On the flip side, food was super low because my dad had to go fix something at my uncle’s house in another state for two and a half weeks. I dogsat and just ate all the food in the fridge. In my own apartment, I had stocked up at the end of April, so I literally went to the grocery store twice this month and one of those stops was pretty cheap. It felt to me like I had spent a ton on food because I got takeout two days in a row, which felt ridiculously decadent and one of those was sushi.

I didn’t realize that I still had a rewards card with an annual fee open, so surprise, that hit. Though considering the house hunting I am still kind of sort of doing, I wouldn’t close any of my credit cards right now anyway.

Home is kind of high because I bought lots of exciting things like cleaning supplies and ant traps for my dad’s house. I also spent almost $40 on a specific picture frame that’s clear on both sides for a picture my mom drew me and wrote a note on the back of. It felt like a lot but then I thought, if something happens to this picture, you are going to be crushed and it’s actually worth a lot more to you than $40. So, money well spent, just sharing some of my insane inner money dialogue with ya’ll.

My expenses this month:

- Rent – $1298

- Charity – $545.05

- Kayak – $360.24

- Food – $285.86

- Entertainment – $235.83

- Fess – $145.00

- Utilities – $134.69

- Gifts – $132.91

- Dog – $128.25

- Home – $120.95

- Stage Managing – $59.99

- brokeGIRLrich – $67.00

- Postage – $41.63

Total Spending in May: $3,555.40

Hustling

My income this month was from teaching (yay three paycheck months!), brokeGIRLrich, a car insurance refund check from NJ Manufacturers, the best insurance company on earth, and a Rakuten cash back app payout.

- Teaching – $5326.13

- brokeGIRLrich – $570.72

- NJM Refund – $45.71

- Rakuten Cash Back – $32.96

Income This Month: $5,975.52

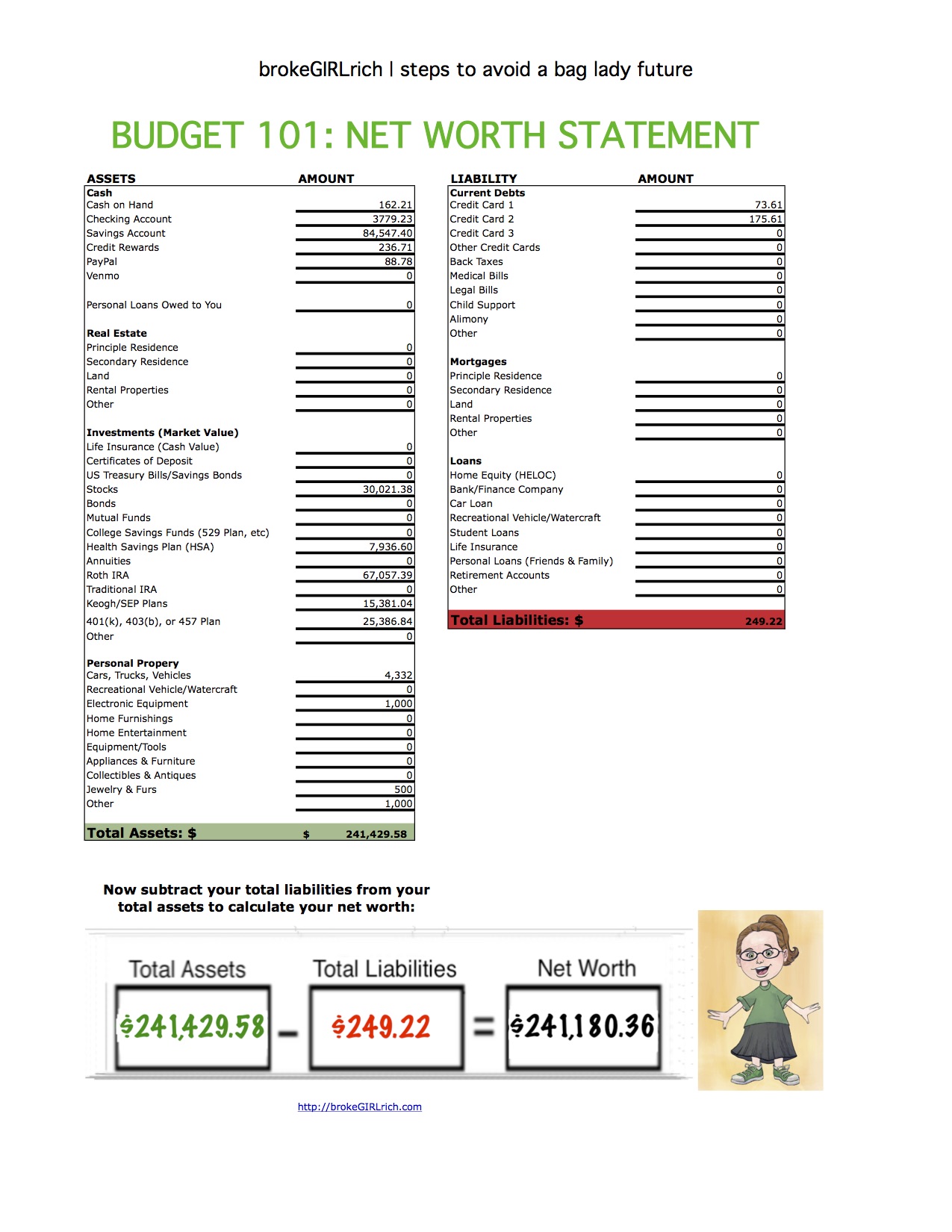

Net Worth: May 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: My Favorite Stats from the 2019 Stage Management Survey

Goals

- Do two things to build up my stage management skills. Killed it. Obliterated this goal this year.

- Spend more time with family and friends. I am doing excellent at this, in it’s own virtual way.

- Max out my Roth IRA. Done.

- Max out my HSA. I can’t max it out due to university health care, but that ends in August, so starting in September, when I go back on the Affordable Care Act coverage, I should be able to contribute again.

- Set aside $1,000 for my new car account. Done.

- Invest $2,000. Done.

- Read more – not counting textbooks I have to read. Still currently rereading The Stand, but I also finished The Soulful Art of Persuasion and am currently working on Since Strangling Isn’t An Option.

- Learn to make macaroons. June will be the month. Quarantine is the time. I believe in me. Though this goal is also starting to feel like the learn how to play the trombone one that was on here for years before I admitted defeat.

Yeah even though thing open I preferred to maintain social distancing too, hope things get well soon and we get back to the actual thing :/ though thanks for sharing the stats 🙂

Jill Everson recently posted…What’s The Best Sealant for UPVC Windows in 2020?