Profile

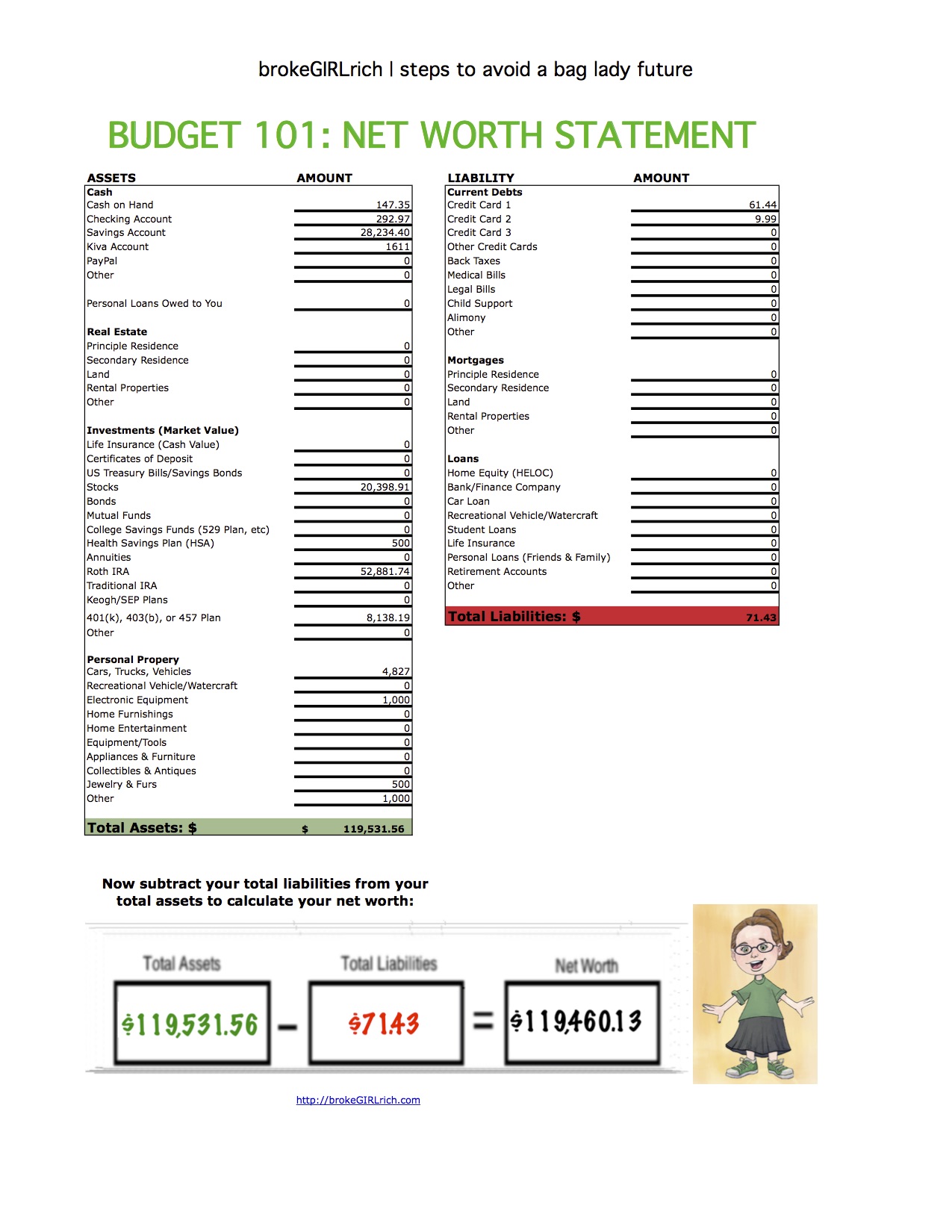

I am thirty three years old and the Performance Director at Big Apple Circus. I make $70,000 a year and live in a show provided RV. I also have health insurance through this job that’s deducted straight from my paycheck, so I don’t really count it in my bills since it’s never money I see anyway (it’s roughly $150/month).

Saving & Spending

Well, May shot by.

It felt like I’ve spent a ton on food. One of the cool things about tracking my spending though was finding it was only $50 more than last month – and I ate out a few times with friends and picked up the tab. So, in retrospect, that seems reasonable.

Transportation was a little higher due to the jump between Boston and Philadelphia. I pay a pair of our show ushers $100 to drive my car for me on jumps, since I have to tow a camper and my RV in a show owned vehicle. Honestly, I think it’s probably one of my biggest “lifestyle inflations” this year to not bat an eye at the costs of keeping my car on the road with me. When I had my car with me on Ringling, it was a constant source of stress to get it from city to city.

Work related expenses were high this month due to a lot of last minute, poor communication from our publicity company. The silver lining there though is that I was able to run out and buy several things I’ve wanted us to have on the unit for PR, so there’s that. I also splurged on a tiny end of tour gift for everyone in the company. It’s a cheap item, but I needed a little over 100 of them.

There’s a gym right by our tent with a pool that made a single month deal with us for $50. If we extend, which we might, they’re going to give us all a two week guest pass for free. I’ve definitely gained some stress eating weight, so I went for it. I forgot, however, that the bathing suit, goggles, etc. that I needed were all at home, so that pushed up my clothing budget this month too. Caving in and replacing some lost Thinx did a number on that budget line as well (but it’s been two years and I still freaking love them. Worth. Every. Penny).

It was the most wonderful time of the year again when I pay my car insurance. This is usually my biggest bill each year. One weird aspect of my job is that though I don’t have to actually do a lot related to load in and out, I still have to be “around” and able to run to the store, help out in other ways, make decisions about things that might change the show. Essentially, I just sit in my RV and read or watch TV about 90% of that time. This isn’t a complaint because I much prefer it to having to freeze or fry my butt off putting up the tent, but this time I used that time to take a defensive driving course online. It cost $20. It reduced my car insurance bill by 5% (close to $60) and it will reduce it by the same percentage for the next two years too. Time well spent.

I bought two of our plane tickets to Iceland – mine and the best friend I’m traveling from New Jersey with. Our DC buddy will meet us at the airport in Iceland. They cost me $431.11 each, but I was able to use travel rewards and knock $731.11 off that total. The BFF Venmo-ed me her $431.11 and that went to the remaining $100 balance and will go towards my part of the Iceland hotel bill. So far, so good on the reward hacking the trip.

- Food – $498.94

- Transportation – $210.64

- Gifts – $56.00

- Car Insurance – $1234.75

- Defensive Driving Couse – $20.00

- Lifelock – $9.99

- Toiletries – $50.88

- brokeGIRLrich – $2.99

- RV – $157.14

- Clothes – $188.97

- Gym – $50.00

- Candles – $23.60

- Work Related – $874.25

- Iceland – $862.22

- Travel Rewards – $-731.11

- Miscellaneous – $23.36

Total Spending in April: $3,532.62

Hustling

My income this month was from performance directing at Big Apple, dividends, and brokeGIRLrich. I also got a reimbursement at work and a friend paid me back for her plane ticket for a trip we’re taking in July – usually I don’t note something like that, I just deduct those kinds of reimbursements against my spending tally, but I used airline miles for both of our tickets, so it’s easier to account for it this way.

- Stage Managing – $2,935.32

- Work Reimbursement – $200.00

- Dividends – $28.80

- BFF Iceland Plane Ticket – $439.85

- brokeGIRLrich – $1,568.83

Income This Month: $5,172.80

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: Do It NOW

Goals

- Max out my IRA. – Done

- Max out my 401k. – On track to max out by end of year.

- Buy $5,000 in stock. – Done

- Contribute $3,000 to my New Car Fund – Done

- Contribute $5,000 to my Down Payment Fund. – $1,500 contributed. $3,500 to go.

- Go on a family vacation. – In the works, Brigantine Beach 2018.

- Go on a best friend vacation. – In the works, Iceland July 2018.

- Develop 2 new resume skills.

- Max out my Health Savings Account for the year. – $500 contributed so far.

The trip to Iceland sounds exciting, and it’s not that far off now! I’ve also taken the defensive driving course to help with insurance costs, and I definitely think it’s worthwhile.

Gary @ Super Saving Tips recently posted…HoneyMoney Review and Giveaway – The No-Stress Way to Control Your Bucks

I’m so so so jealous you’re going to Iceland (but also very happy for you!) I’ve had so many friends rave about it. Personally, I’d very much enjoy a blog post about Elf School. 😉

Also, I must say that I really like the way you list out your yearly goals in your posts and check them off as you complete them. I may borrow that idea!

The 76K Project recently posted…A Look Back At May: Beer, Budgeting, and Debt Reduction