Profile

I am thirty two years old and I started out this month as the Assistant Stage Manager/Props for Susannah with Opera Roanoke and finished it out as a Stage Manager at Sleep No More in New York City.

I’m on contract there through the end of August. I make $115/show and work 7-8 shows a week.

Saving & Spending

I didn’t even want to write this post this month because I knew I was a financial disaster.

But the entire point of this blog is accountability and proving that you don’t have to starve to work in the arts. So – let’s check out how I destroyed my bank account, put a dent in my emergency savings but am still entirely solvent because of all the months before this one where I made good money choices whenever I could.

The month started out ok. You’ll remember I had a few health issues back in April and since I actually had some down time the first two weeks of May, I thought – let’s get these lingering issues fully checked out.

You may also remember that I have an approved alternative to health insurance. I’m a member of Medi-Share, a medical sharing ministry. So the most I have to pay out of pocket, other than co-pays for doctor visits is $2,500 a year.

However, I have to pay up to $2,500 a year. That means that even though I pay a $25 co-pay to go to the doctor, until I’ve paid that $2,500, I get a bill for the rest of the visit until I hit that much. So to get my stomach and chest pains checked out, I had a doctor’s visit, a bunch of blood drawn, an ultrasound and a chest X-ray.

On the good side – there’s nothing really wrong with me? They pretty much told me to get more Vitamin D and eat more fiber.

On the negative side, the bill for just the blood getting drawn was just under $1,100. Freaking ridiculous. In my June update I’m sure I’ll vent about how expensive the other procedures were.

Because of the spring of un- and under-employment, that money is coming out of my emergency fund. And the bill for the doctor visit, ultrasound and X-ray will probably have to as well unless some extra freelance writing opportunities come my way.

I also went to Rhode Island for the weekend to see the last Red Unit performance of Ringling Brothers and Barnum and Bailey circus and say good-bye to my old home and friends before everyone dispersed forever. It was overwhelmingly depressing for a pile of reasons.

Road tripped it to Rhode Island with the only person I could imagine saying goodbye to the circus with.

So I essentially threw myself into some emotional spending. I knew I should probably save money the following week, but sitting around my house dwelling on the past was freaking me out so I road tripped up to Vermont and spent a few days with my cousin who lives in Burlington. It wasn’t super expensive, but more than I should’ve spent.

I then went to Las Vegas for that cousin’s bachelorette party. I was able to raid my bachelorette party savings for it, but it was still an expensive few days. On the plus side (?), I caught a cold, so I barely drank, which is generally a pretty big expense in Vegas.

I also moved into the apartment I’m subletting in NYC, so I started paying rent again, which is as fun as I remembered.

On the plus side, the hours I’ve been working are pretty long, so I haven’t been spending any money outside of picking up some groceries and we get fed on double show days at work, so that’s nice too.

One thing I do have going for me is that, by some miracle, I actually hit all of my savings goals for this month. Now we’ll have to see if I can pull it off again next month and get those medical bills paid too.

Now for the damage:

- Food – $169.99

- Healthcare – $1335.59

- brokeGIRLrich – $277.85

- Car Expenses – $24.00

- Gas – $41.31

- Entertainment – $52.83

- Bachelorette Party – $869.46

- Vermont Roadtrip – $210.14

- Cousin’s Wedding – $95.00

- Commuting – $40.00

- Gifts – $44.91

- Rhode Island Roadtrip – $141.91

- Rent & Utilities – $850.00

Total Spending in May: $4,152.99

Thank goodness for planning ahead. I was able to use my savings I set aside specifically for my cousin’s wedding/bachelorette expenses to put a dent in that and I was able to tap my emergency fund for the medical bills.

Hustling

My income this month was from stage managing, freelance writing and brokeGIRLrich.

- Stage Managing – $1912.29

- brokeGIRLrich – $667.10

- Freelance Writing – $315.00

Income This Month: $2,894.39

Pretty excited that it’s still a rather small drop even though it felt like I was hemorrhaging money all month! It’s always nicer to see the bottom line grow, but sometimes it’s comforting to know I can weather a few storms.

Most Popular Post of the Month: 114 Side Hustles: Ways to Make More Money

My Favorite Post to Write This Month: The Vodka Champagne Conundrum

Elsewhere On the Web: Tired Of Giving Up On Your Savings Resolutions?—How To Set Budget Goals You’ll Actually Reach at Money Under 30

Frugal Wedding Fails: Why Going Cheap Isn’t Always The Answer at Money Under 30

Just Lost Your Job? Don’t Panic—Financial Do’s And Don’ts When You’re Unemployed at Money Under 30

Where Can I Scan Documents? at First Quarter Finance

Goals

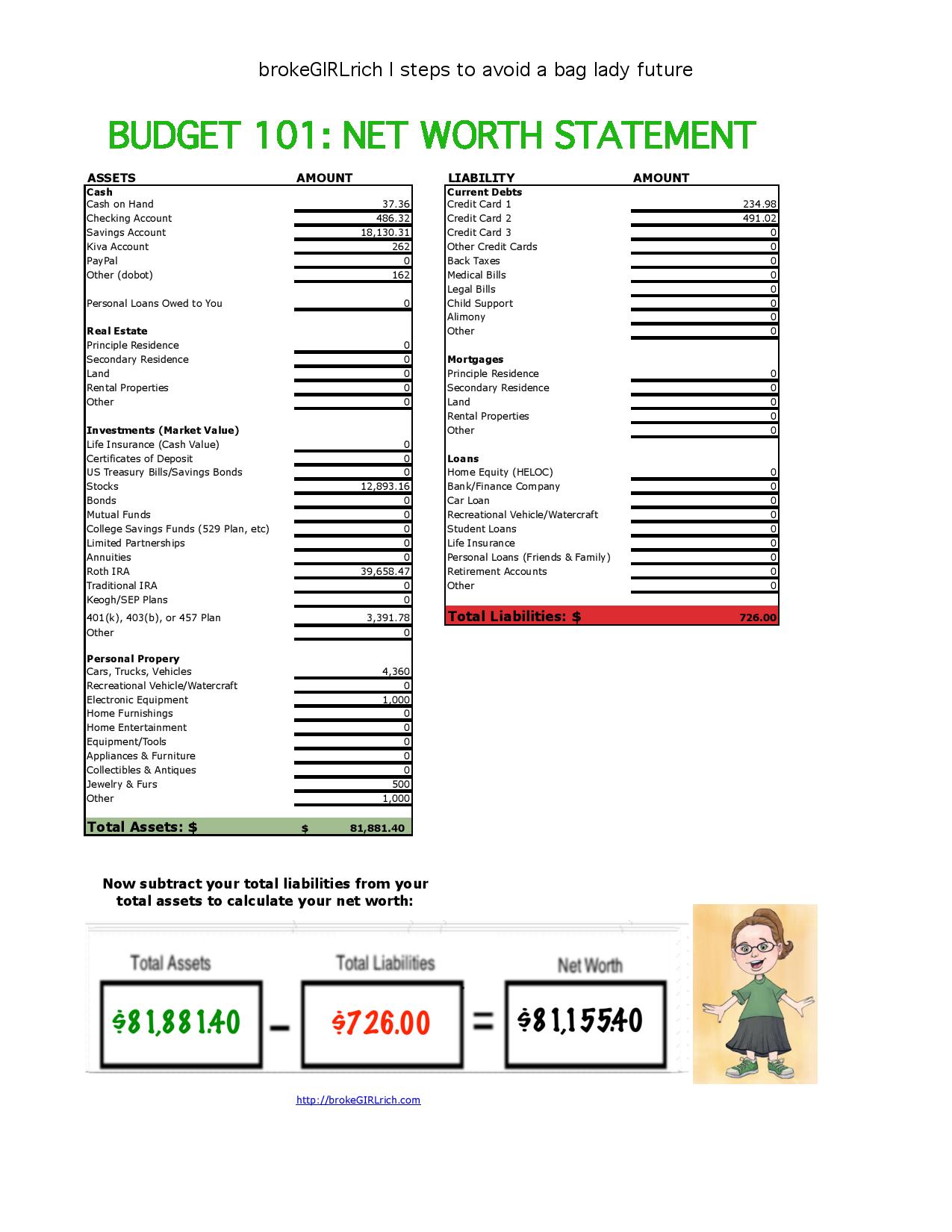

- Max out my IRA. – $2,710 to go.

- Buy $1,000 in stock.

- Contribute $2,000 to my New Car Fund – $1,165 to go. Currently on track.

- Contribute $5,000 to my Down Payment Fund – $2,915 to go. Currently on track.

- Contribute $200 to my cousin’s wedding fund. – This fund is a mess for this wedding and totally didn’t work out like it did last time. My revised goal is to get it up to $200 for her wedding gift by October.

- Develop 2 new resume skills – One to go.

- Do something really fun with my brother.

- Write a journal or magazine article.

- Hike something. Not sure how I overlooked this, but I totally hiked around Saratoga Spa Park in March. Then I hiked Natural Bridge in April and did a 6 mile hike at Watchung Reservation in May. Whooooo. Feels really good to cross something off this month.

- Master making macaroons.

Hope all the health concern are a non-issue. If you take away those cost for the month your pretty much break even. That’s great with all the travel /road trips.

Brian recently posted…Eliminating Debt to Make Your Investments Really Pay Off

Oh yeah! Way to help me find a positive spin. Thanks, Brian!

All your hard work in the months before paid off if you were able to manage those health and travel expenses without too much of an issue. And I’m glad the health scare turned out to be not-so-scary!

Gary @ Super Saving Tips recently posted…Invest in the Right Season of the Stock Market Cycles

Medical spending is the worst. I had a really hard time with it over the past year or two. At least you’re healthy and meeting those goals, though!

Femme Frugality recently posted…Summer Reading #Giveaway Extravaganza

If you can’t use your emergency fund to pay for health scares then what do you use it for? That’s what it’s there for! It’s outrageous that just the one blood test was so expensive, but at least you have the peace of mind that there isn’t anything wrong?

Woo hoo on having a long term gig! Even if it means paying rent again.

Jax recently posted…May Extra Income- $2,862.41

Pingback: How I Make Money as a Blogger - brokeGIRLrich

Pingback: 4 Great Side Hustles for Stage Managers - brokeGIRLrich