Profile

I am thirty seven years old and I’m a freelance stage manager and digital event producer. I make $55/hour at the digital production company I work with. I also work a variety of small side hustles. I am also a full time student working on a PhD in Drama. I have also been staying with my dad during the pandemic but next month I move out.

Spending & Saving

Friends, by the time you actually read this, I will be in London.

So March was my last month with my dad in New Jersey. I made a lot more money than I thought I was going to – but I also had several large expenses, including several surprise ones.

Unsurprisingly, sorting out my initial plans for London and finalizing my visa application were a little pricey, coming in at $1,842.54. This included a little more than half of the AirBnB cost for a seven week rental, a one way flight (which was only $10.99 thanks to my US Bank credit card rewards), and a round trip ticket back to New Jersey for Memorial Day Weekend. I also lumped two power adapters with voltage converters in that cost too.

The CapitalOne Venture X card also knocked $500 off that total because I was able to apply the $300 travel credit to the Memorial Day Weekend flight and a $200 vacation rental credit to the AirBnB booking.

This spending also got me to the minimum spend for the card (which is a substantial $10,000 but most of that was my tuition payment), so I also plan to use the rest of the rewards next month to wipe out the other half of the AirBnB costs.

My next highest expense was a surprise healthcare hit thanks to a surprise medical from the “what’s this stomach pain?” hunt over the summer for several hundred dollars and a trip to the dentist.

This highest was also a surprise when my brakes stopped working. The flipping breaks. Like… the only thing on my car that I felt like, I can’t just make this work for three weeks.

Gifts were notably high though half of that was really charity expenses to various GoFundMes for Ukrainian friends. It turns out if you work on a cruise ship or circuses, you wind up knowing a surprisingly large quantity of Ukrainians.

That may sound flippant. It is a flippant sentence about money, but not about what is happening in Ukraine. That is a travesty.

When the flavor is BLUE, you know the drink will be trouble.

The rest of my expenses are pretty normal. A final surprise expense was the renewing of the dog’s flea and tick medicine that I totally forgot was on my credit card.

I’m also totally ok with the entertainment expense since most of it was grabbing food with various friends to say good-bye. It has really been a crazy busy month.

As far as income, February had a lot of digital events and the blog had a very good month. I was paid for some stagehand work in February and the other job I work at sometimes randomly told me I actually had about 10 hours of sick time if I wanted to cash it out before I left.

I counted the credit card rewards as income since the annual fees are expenses?

Also still waiting on that federal tax return but the state one did appear. The stage managing is a delayed payment from the last of the digital murder mysteries. I also worked an event this month as a show caller (which is how I incurred a lot of this month’s expenses by being very lazy and driving into NYC instead of spending 2+ hours both days taking NJ Transit to like 3 different subway transfers). I was hoping the check would appear before I left, but it looks like I’ll have to wait to cash that until I’m home for the weekend in May.

Here is the expense breakdown for the month:

- Travel – $1842.54

- Healthcare – $503.14

- Car – $479.81

- Gifts – $455.96

- Food – $455.47

- Entertainment – $308.32

- Stage Management Expenses – $179.95

- Gas – $143.85

- Dog – $141.25

- brokeGIRLrich – $37.00

- Candles – $29.00

- Clothes – $5.82

Total Spending in March: $4,582.11

Hustling

This month’s income comes from several different sources.

- Digital Event Producing – $5,747.50

- brokeGIRLrich – $2,330.23

- Stagehand Work – $579.16

- Credit Card Rewards – $500.00

- NJ Tax Refund – $478.00

- Stage Managing – $318.52

- Dividends – $38.40

- UserTesting – $10.00

Income This Month: $10,001.81

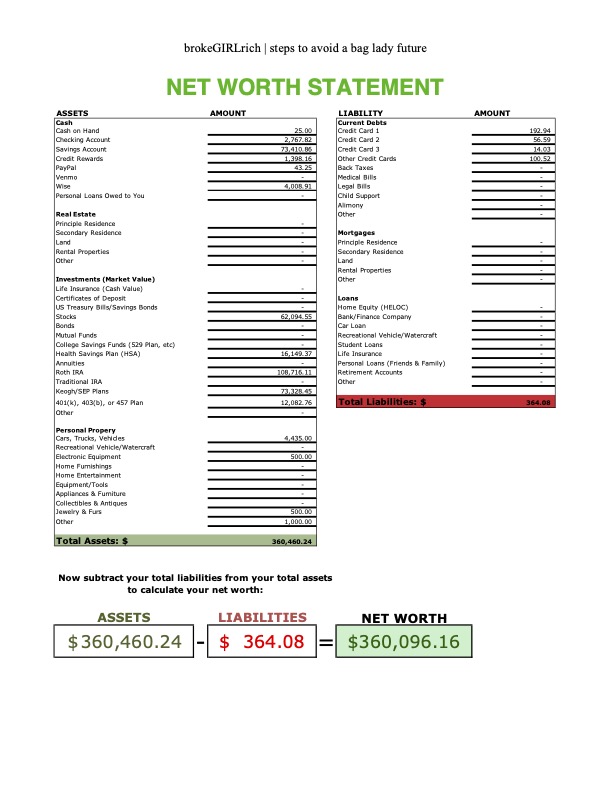

Net Worth: March 2022

Goals

I think this is a pretty good assessment of what I might be able to achieve this year. If I luck out and the blog has a really good year or something, I will aim to make a contribution to my SEP 401k too.

- Max out my Roth IRA.

- Max out my HSA. $1,000 contributed.

- Save up $15,000 to pay my tuition for 2022-23 in August without dipping into the school savings account ($9,000 if I manage the scholarship goal). $1,800 saved so far.

- Obtain £5,000 in funding scholarships.

- Save up $2,000 for traveling.

- Balance work and school without losing my mind. So far, so good.