Profile

I am thirty six years old and I’m a freelance digital event producer. I make $50/hour and generally work about 16-20 hours a week, though work was busier than previous months this month. I also work part time for a theatre company doing a digital murder mystery/escape room for £15 a show a few evenings a week.

Accountability: March 2021 | brokeGIRLrich

Spending & Saving

It was a month.

Some very high brokeGIRLrich expenses and a lot of backend work to do to fix endless some problems coming up. You’ll see more of a note about the future here on Monday.

Made a big money move and transferred a large chunk of down payment savings into my brokerage account. I still have more than 20% to put down in the cost range I was looking for sitting there but my homebuying plans are on hold. I may transfer more over, but honestly, it freaked me out to move as much as I did. Baby steps.

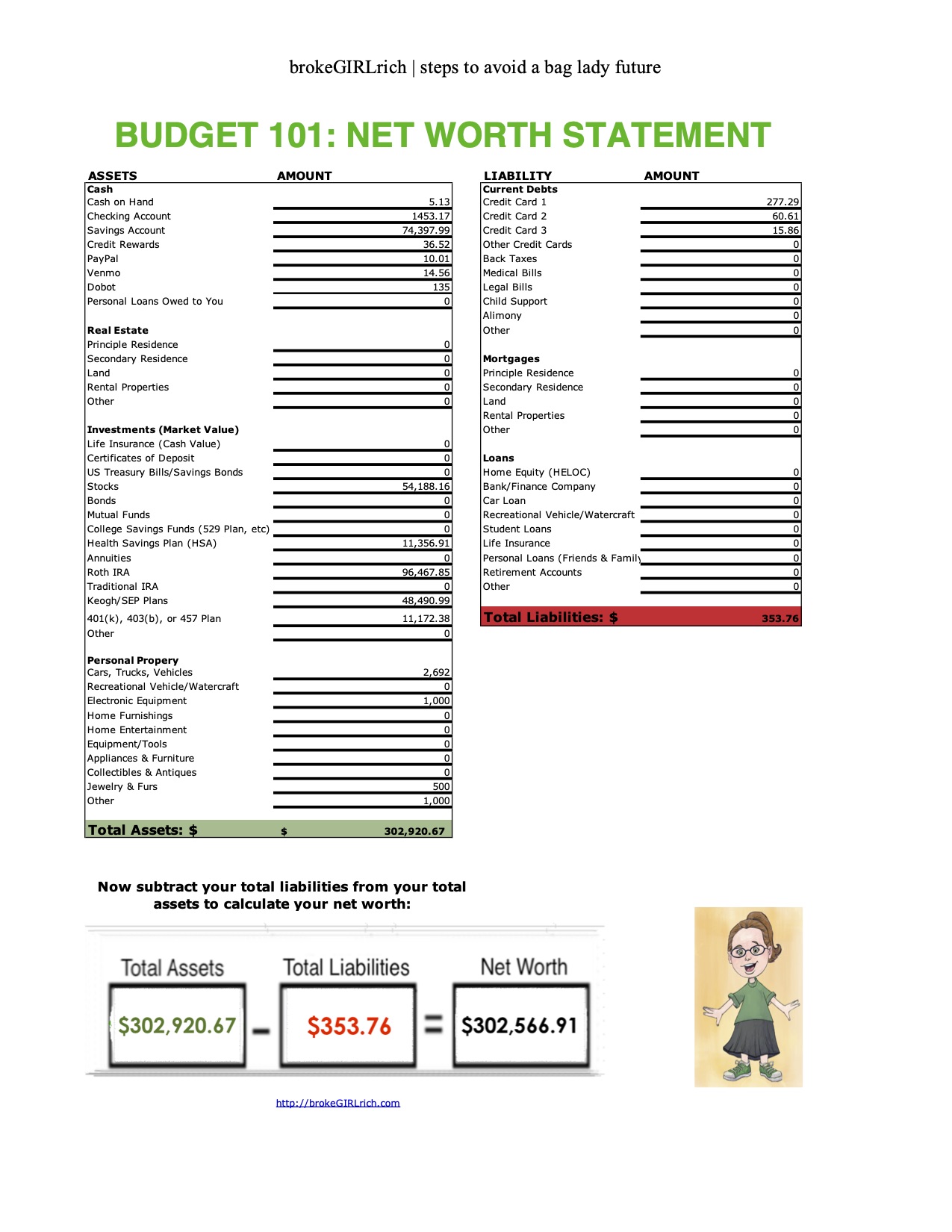

Though I’m pretty sure that move is how I managed to hit one of my 2021 money goals and break a net worth of $300,000. So yay for that despite it being an expensive month!

I remained secluded in the Outerbanks for a large portion of the month. I have since returned to New Jersey though and gotten my first jab of the vaccine, so that’s pretty exciting despite my very real and utter terror of needles. It feels like the most hopeful step towards normalcy in months though.

I worked a lot this month, so April is looking like it will be a good income month too.

Who did something really dumb and just forgot to pay her 2020 fourth quarter estimated taxes? This girl. So I had a pretty high tax bill this month and then figured out my 2020 taxes for good at the end of the month and am expecting a bit of a refund sometime next month.

I also got a bill from the state of NJ for underpayment of quarterly taxes in 2019, which feels very… what? How could I pay Q1 or Q2 quarterly taxes that year when I didn’t know I was going to be a freelancer? But I have no fight in me these days and just gave them their $144 fine.

Also, fun fact, I think everyone I know is pregnant, so between baby showers and birthdays, the gift toll is a bit high. But at least gifts are a happy expense.

My expenses this month:

- Taxes – $1295.52

- brokeGIRLrich – $747.00

- Food – $497.63

- Gifts – $164.56

- Health Insurance – $150.66

- Gas – $145.62

- Dog – $136.68

- Entertainment – $71.18

- Stage Management – $59.85

- Toiletries – $58.81

- Books – $47.36

- Earrings – $38.79

- Shipping – $35.90

Total Spending in March: $3,449.56

Hustling

I was a decent month of digital producing and late night murder mystery room SMing. I also had several bits and bobs of income from other sources.

- Digital Event Producing – $3605.00

- Stimulus Check – $1400.00

- Stage Managing – $601.01

- Stagehand Work – $269.60

- brokeGIRLrich – $133.54

- eBay – $52.09

- Dividends – $36.80

- UserTesting – $20.00

Income This Month: $6,118.04

Net Worth: March 2021

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Some Thoughts on Saver’s Remorse

Goals

- Max out my Roth IRA. $1,500 to go – hopefully by the end of next month this will be done.

- Max out my HSA. This is on track. I’ve learned to just go a month at a time here, since sometimes my insurance changes over the course of the year due to different jobs.

- Invest $2,000. Halfway there.

- Save up $3,000 for post-pandemic traveling.

- Add $1,000 to the emergency savings account.

- Add $2,000 to the new car savings account.

- Break $300,000 net worth. Updated to break $325,000.

- Do two things to build up my stage management skills. COVID compliance officer certificate and immersive theatre design class.