Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with, though work has been very slow this year. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

It’s been so bizarre to me to see my net worth continue to creep up most months (other than the month I pay tuition each year) while on this school project. Everything feels very tight, and I have clearly done a fairly terrible job adjusting to a student budget, but for now, because of good, early saving habits, things are overall fine.

For that reason alone, I’m pretty happy about tracking my net worth updates. They do remind me that even if my income feels kind of paltry right now

We got some news at my ushering job this month that the show will close on September 24th, which I have some mixed feelings about. I was in discussion to use the show as a case study for my doctorate in October or November, so I feel a bit of a panic about that as it’s been one blow after the other with case study companies and I thought I would have my pilot study done and had two theatre companies lined up to work with me and I no longer have any pilot study, one show is closing before our agreed upon date to work together, and another show is postponed for a year.

Research is fun.

I am also hopeful that the digital producing picks back up by September because as much as I don’t like the 7 day a week, work on the weekends lifestyle, I have been really grateful for that weekend income during these slow months. If producing returns to 2022 levels, then it will just be very nice to have weekends free. So fingers crossed there.

I suspect I will look for a new part time weekend job though to buffer any other slow periods with the digital producing that may occur during the rest of the time I’m in school.

I have also not been doing a good job saving. I’ve maybe been leaning a little too far into YOLO (though some forced YOLO due to a lot of weddings). I’m hopeful to fix that during the fall and I think I will probably top off any shortfall in my retirement investing from savings since there are no loans for retirement. I will definitely do that to max out my IRA.

I also realize that if I just traveled less this year while things have been tight, this was likely very doable and I increasingly don’t care. I think I can get away with this attitude for a little while but hopefully things will turn around work-wise before there’s a real reckoning. It’s just that no matter how tight things have been in the past, even if I racked up a little debt when I was younger, I have never regretted traveling.

On that note, my biggest expense this month is a trip to Switzerland next month with my two best friends. However that cost is total for all three of us but was too hard for me to figure out how to indicate just my part based on the credit card expenses since some things are divided between 2 people and others divided between 3. Under income, there’s just a line for what they paid me back since we have already settled everything. It came out to about $1000. Switzerland is really expensive.

Quarterly taxes were due but I save those in a separate savings account with each paycheck I get, so it was just ready to go.

Entertainment is incredibly high because it includes a weekend trip to Ireland for a wedding this month that was around $300 and expenses for a weekend trip to the Peak District next month when one of the BFF’s flies over to England for a week before we go to Switzerland with was also around $350. Gifts included a wedding gift for my brother and sister-in-law. The Ireland wedding was my boyfriend’s friends and we have a system where we split the expenses for the travel between us but the person whose friend it is that’s getting married gets the gift. He is definitely the winner in the system because Americans and Brits have very different wedding gift expectations.

The first half of the month was a bit of a blur because we were finally on the long-mentioned Mexico trip. All-inclusive resorts are pretty swanky. And I suspect the week there is why my food spending is so much lower than usual. We started the trip by staying at a hotel near the airport for three days that had a nice pool. The first day the boyfriend and I just hung out at the pool and watched movies and tried to get over our jet lag. The second day we went on a full day tour to a Chichikan, a cenote and cultural center, and Chichen Itza. It was really cool. Other than watching my brother get married, the cenote was my favorite part of Mexico and Chichen Itza was really cool too. The next day we hung out at the pool in the morning and then went back to the airport, which a 5 minute walk from the hotel, and caught the transfer to the all-inclusive. We were there for the next 5 days. I actually found it a tiny bit frantic trying to catch up with all my family I don’t get to see that often anymore but it was a really nice time.

I got back and repacked my bag and spent the next week at the Sheffield DocFest working for my supervisor and doing data collection for him. I was also supposed to be running my pilot study and was able to collect the audience data I needed but there were some bumps there that have resulting in a shelving of that pilot study. However, sometime next month (hopefully – next year, more likely) the school is supposed to reimburse my meal fees as part of my travel stipend.

By the time I got home from DocFest, it felt like I had been gone for ages and I was so excited to just sleep in my own bed and be home. I had been on the go for the better part of three weeks. I am really out of practice at living like that.

School has been a bit frantic this month too. Everyone tries to cram all these events into June and I think my American brain just can’t stop the WTF is going on feeling since university generally ends in May there and the summer is much calmer – in my experience both as a student and as faculty. Here it’s still full on through June and then July is pretty calm and August is a ghost town. Everyone is on annual leave. It’s lovely.

I’ve been working on my transfer document. My university has a process where between 18-24 months you complete a transfer viva from MPhil student to PhD candidate. It consists of a long form, full of what you’ve been up to since you started the program, a writing sample of either a chapter of your thesis, two published journal articles, or a 5000-word critique of your research. My supervisors suggested I do the 5000 word critique because, and they are right, the goal is to meet the requirements and give the examiners as little as possible extra to test me on. So I’ve been working on writing that. I submitted my first draft for my supervisor meeting this month and it was absolute garbage but fortunately the goal is to turn it in this September, so plenty of time to fix that mess and it is the main goal of the summer – to prepare those documents and practice for my transfer viva.

The fun thing about composing this document has been related to all the memes I saw early in my research about how you spend your subsequent PhD student years fixing the mistakes of some idiot and that idiot is you – in year one. Evidently it’s true.

So that’s been the month of June. A fairly stressful one. I have google Tier 2 Visa jobs for England numerous times due to several of these setbacks. If anyone knows of an entertainment or event management company hiring Tier 2 visa positions, give me a holler. I’d happily move back into industry these days but would like to stay in this country a while longer so… I guess I’ll keep working on that critique until my imaginary perfect position as a highly paid Lloyds of London risk analyst for immersive/theatrical experience comes to fruition.

Here is the expense breakdown for the month:

- Switzerland – $2426.78

- Taxes – $1565.00

- Rent – $1295.69

- Entertainment – $933.07

- Gifts – $371.85

- Food – $323.55

- Utilities – $264.83

- Mexico – $196.87

- Apartment – $156.15

- Blog – $137.53

- Transit – $111.53

- Charity – $35.40

- Health – $22.58

- School – $9.57

Total Spending in June: $7,850.40 (or $4,434.27 without taxes and only including my costs for Switzerland)

Hustling

This month’s income:

- BFF Switzerland Reimbursement – $1851.13

- Digital Event Producing – $1320.00

- TAing – $853.39

- Ushering – $753.43

- brokeGIRLrich – $304.90

- Zoom Class Action Settlement – $32.32

Income This Month: $5,115.17 (or $3,264.04 without the BFF Switzerland exchange)

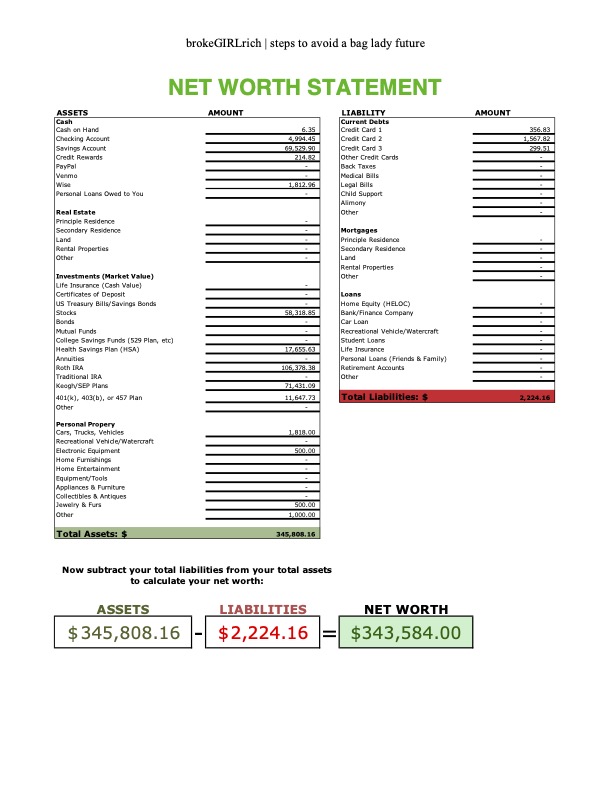

Net Worth: June 2023

Goals

These are my goals for 2023.

- Save up $10,000 for school.

- Save up £5100 for school. Down to £861 this month.

- Max out Roth IRA ($6500). $1000 contributed so far.

- Max out HSA ($3850).

- Buy the pretty lamp.

- Save $2000 for vacation with BFF over the summer.

- Stage manage a show.