Profile

I am thirty four years old and I started a new job with a touring circus on the last day of June. I’m pretty excited because it’s part time, so I get to go to crazy and amazing places for a few weeks and then come home for a few weeks. I make $2,000 a week and have a $40 per diem. As you read this, I’m in Saudi Arabia.

I also spoke for the first time on a panel and I didn’t throw up or pass out or anything, though I was quietly hyperventilating before we started. If you’re a stage manager, be sure to check out the Broadway Stage Management Symposium next year. I learn so much every time I go, meet amazing people, and maybe I’ll even get to hang out again next year and try to force some personal finance skills on the stage manager of the world.

Saving & Spending

All the checks cleared on my mom’s life insurance policy, so I have hit every savings goal I had this year and then some. I also added $5,000 to my emergency fund, bringing it up to $15,000, and invested an extra $1,000 beyond my original goal in a REIT.

My brother would like us to consider flipping a house together, which I’m ok with, but I want us to finalize her estate first and since it’s insolvent, that takes a few months. So the house flipping is on hold.

Spending was a little ridiculous this month and I know it. It made me wonder a lot about lifestyle inflation, but I actually looked back and analyzed my old spending habits only to find that once in a while, I splurge too much, but for the most part, my lifestyle hasn’t inflated over the years.

Spending was a little ridiculous this month and I know it. It made me wonder a lot about lifestyle inflation, but I actually looked back and analyzed my old spending habits only to find that once in a while, I splurge too much, but for the most part, my lifestyle hasn’t inflated over the years.

When I start to make more I spend on absolutely crazy things like signing up for life insurance, going to the doctor or dentist and buying contacts.

So despite oversplurging, I did ok.

My analysis also pointed out to me I often over splurge when I’m not working and I’m bored. Accurate description of this month.

I bought two expensive pairs of shoes. Three dresses for Saudi Arabia that were not reimbursable by work and a hijab and abaya that are. I went to a wedding and mailed a wedding gift to a different wedding I couldn’t make it to.

There were a few more expenses to finish undoing the damage to this blog from the hacker and I bought a bunch of brokeGIRLrich pencils to represent at the Broadway Stage Management Symposium.

I also donated to two things I feel pretty strongly about – the fund for That Frugal Pharmacist’s sick kid and the lawyers who are working down at the border, helping the separated families. I list these things under gifts, cause I think that’s a better mindset than charity. Charity always sounds so crappy.

I also hosted my cousin’s baby shower at my house with her sister-in-law and mother-in-law. Everyone seemed to have a pretty good time.

The miscellaneous category is a lot of random stuff that didn’t seem to make the bed bug purge from Hungary that I didn’t realize I’d lost until I went to pack for Saudi Arabia. And rebuying that No-Jet Leg for $30 cause I had to rush deliver it from who knows where WAS WORTH EVERY PENNY.

And yes, I did buy some more candles. Honestly though, the stock pile was running low.

I did work more as a stage hand that previous months, but I still had a lot of time on my hands.

Also, time of my hands meant planning new ways to spend money, including a lot of travel in August. Like… all the travel. A few days in Montreal with both of my best friends and then hopefully a European cruise with one of them a few days later. I’m waiting to see if we get approved for Family & Friends rates with the old cruise line I used to work for.

Here’s the damage:

- Food – $497.03

- Car – $58.03

- Healthcare – $140.63

- brokeGIRLrich – $296.11

- Music Lessons – $31.47

- Fun – $158.80

- Gifts – $484.82

- Candles – $52.05

- Clothes – $441.36

- Stage Management – $126.49

- Vermont Wedding Expenses – $71.76

- Toiletries – $33.33

- Shipping – $20.32

- Baby Shower – $216.70

- Travel/Global Entry – $100.00

- Montreal – $345.59

- Miscellaneous – $82.80

Total Spending in June: $3,157.29

Hustling

I definitely look like more of a hustler this month. Besides the blog and stage hand work, I also sold some stuff on eBay, got a refund from my car insurance for paying in full, received a dividend check, and got paid for the mystery shopping I did in May.

I also booked the flights for my friend and I to Montreal, so she paid me back for her ticket. I used a combination of points and cash, so she just paid the cash amount for her ticket.

- brokeGIRLrich – $489.02

- Stage Hand Work – $1171.09

- eBay – $120.56

- Dividend Check – $32.00

- Car Insurance Refund – $28.00

- Mystery Shopping – $16.62

- Montreal Flight Reimbursement – $528.88

Income This Month: $2,386.16

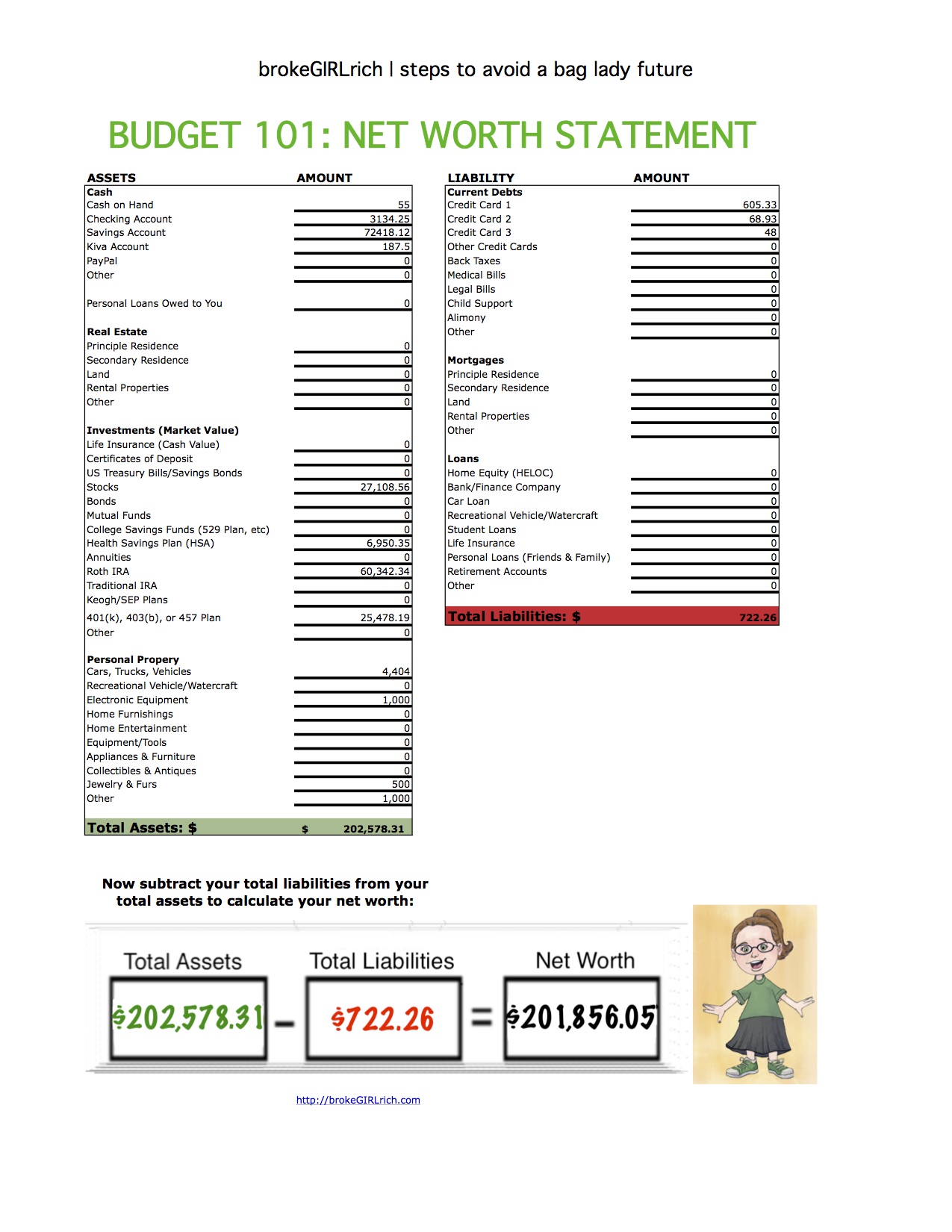

Net Worth: June 2019

Just another reminder, That Frugal Pharmacist could still use a few bucks as they figure out life with their sick kid. You can read the whole story and donate via this link. Or if you’re doing some Amazon shopping, you can do it via their link at the bottom of their website and at no cost to you, they’ll get some kickback from Amazon.

Also, she wrote a fairly awesome post about the finances of their situationthat was pretty great… in as much as the finances of cancer can ever be great…

Most Popular Post of the Month: 10 Things I Wish I Could’ve Told 21 Year Old Me About Stage Managing

My Favorite Post to Write This Month: Ignore the Haters (And Make Sure You Don’t Become One)

Goals

- Start eating better. Nope.

- Work out more. Nope. I floated a lot in a pool…

- Better stress management. This is going ok.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done.

- Take music lessons while I’m home for a few months. I started them at the end of the month!

- Spend more time with family and friends. Success!

- Be more supportive of family and friends when I can’t be there in person. Sure?

- Go out on a date.

- Make an effort to not withhold kind words and encouragement. Always a work in progress.

- Max out my Roth IRA.

- Max out my HSA.

- Set aside $20,000 for my house down payment account.

- Set aside $5,000 for my new car account.

- Invest $3,000.

- Read more. I read Every Tool’s a Hammer by Adam Savage, which was great, and 20thCentury Ghost Stories and NOS4A2 by Joe Hill

- Learn to make macaroons. No further progress.

- Visit (way more than) two roadside attractions.

I’ve been reading these for years. It’s so inspiring to see how your numbers have gone up over time, especially your income. Especially because you’re in the arts.

Aw, thanks! I honestly didn’t expect things to go as well as they have. I really think the tracking has made a huge difference for me and I’ve been incredibly fortunate work-wise.