Profile

I am forty years old, a digital event producer and occasional freelance stage manager. I work as a TA and an adjunct. I also work a variety of side hustles and am a full-time student working on a PhD in Drama. Once in a blue moon, I still get to be a stage manager.

Spending & Saving

Money isn’t real this month. That’s the only way to cope with this July. Sometimes for really lovely reasons, sometimes less so. I was sort of shocked to see my spending/income wasn’t nearly as out of whack as I thought. It was really only some surprise car repairs that pushed me over the financial edge this month.

The month began with my best friend visiting. We were finishing up a weekend trip to York. We did a little sightseeing around London over the first week of July and then we went on an Austria/Germany weekend road trip to see some castles.

So many German castles.

That wasn’t super expensive, as a lot of it was paid in advance. And we had a lot of fun. We also saw a West End show before she left the following week.

I spent the next week working on school work like crazy. By the end of September, I need three good chapter drafts submitted to my supervisor’s. To be fair, it’s the first time they’re all reading those chapters, so they will essentially be garbage no matter how hard I try – but the point is to try. I got the literature review chapter submitted and put a major dent in my methodology chapter. I continue to procrastinate with analyzing the data from my interviews for my first case study chapter, which will surely make life less pleasant in August – especially since I need to present a paper the first week of September at a conference with a preliminary discussion of two of my case study findings.

These are problems for August Mel, though I did what I could that week. Between the school work, I packed, because my partner and I moved out of London to Peterborough the following week. It’s a 55 minute train ride to central London (and another 45 minutes to my school campus, which will kind of suck, but is only once in a while).

So my home costs are astronomical this month, as well as rent, which was rent and the security deposit. The house was partially furnished, but we wound up buying a mattress, which was pretty expensive and I needed a desk and desk chair. I also have like no patience about my home not feeling like a home – if I have the cash and the need is legit, I just need to get it sorted and off my list. So we moved on Thursday and Friday (so also a rental car fee and a moving van) and we were fully unpacked by the time we went to bed on Sunday night – other than building our bedframe, which is fine as our mattress doesn’t arrive until August. Until then we are in the guest room, which did come with furnishings.

Then we headed to Heathrow to fly home for two and a half weeks with my family. I had a pretty large 40th birthday party in my dad’s backyard, which was really nice. I was surprised at how many people turned up. A lot of people met my boyfriend for the first time, since it’s his first trip to America with me.

All the traveling and catch-ups and moving have resulted in significantly higher food costs this month. Also a strong boost in entertainment spending. However, in the income is all the reimbursements from different folks for different things. Honestly, our week in Jersey hasn’t been too bad. We went out to brunch and the boardwalk with one of my friend’s who came all the way from Vegas for my birthday. There is a massive mall called the American Dream mall, which we walked around and paid way too much money for lunch and some silly entertainment like video games and riding oversized stuffed animals – though it was fun. I also got to buy some soap from Bath & Body Works because that is apparently just what I do every time I go home. I like my bathrooms to smell like America, apparently…

We also made plans to go to a fancy escape rooms with some friends, which I booked and have been partially paid back for.

Less fun expensive things this month included my very reliable, 17 year old Toyota Matrix breaking down when the oil pan and transmission line both rusted through. This was a nearly $700 surprise fix. Thank goodness for emergency savings, since that’s where the money for that came from. I feel like I need to stroke that account gently and apologize to it for neglecting it for nearly 3 years – soon I will be liberated from grad school little account and we’ll get you back up to speed.

School had some higher fees too as I had to fund a trip to a conference that will be reimbursed after we go.

Ubers were also much higher than usual, as we live a little more out in the sticks and in the exhaustion of moving, as well as doing some big shops, I wound up using them more than previously.

Another fun expense bump was health care, as both my boyfriend and I caught a cold during the first week in New Jersey, and he got to experience the cost of cold medicine in the U.S. I really missed £7 prescriptions this week.

I’m hopeful my spending is like… a third of this next month. Fingers crossed.

Income wise, the blog had the best month it’s had in ages. I got paid for a few more sessions than usual lately with digital producing in June (though I didn’t do a single session this month, so that will suck next month). I was reimbursed and paid for a few hours of work by the university. I adjuncted a bit. And I got a tax refund.

- Home/Move – $2338.37

- Rent – $1543.88

- Food – $949.40

- Entertainment – $785.01

- Car – $772.90

- Austria/Germany – $563.71

- School – $355.78

- Transit – $147.82

- Utilities – $136.48

- Gifts – $121.95

- Stage Management – $88.82

- Nails – $70.66

- Blog – $69.07

- Healthcare – $58.98

- Clothes – $57.35

- Ubers – $55.98

- Maine – $43.68

- Miscellaneous – $41.78

- Charity – $34.70

- Books – $20.28

- Toiletries – $5.18

Total Spending in July: $8,261.78

Hustling

This month’s income:

- Digital Producing – $1897.50

- School Reimbursement/Payment – $1484.99

- Blog – $1303.52

- Adjuncting – $993.68

- Tax Refund – $921.11

- BF Reimbursements – $576.30

- BFF Reimbursements – $429.67

- Escape Room Reimbursements – $120.52

Income This Month: $7,727.29

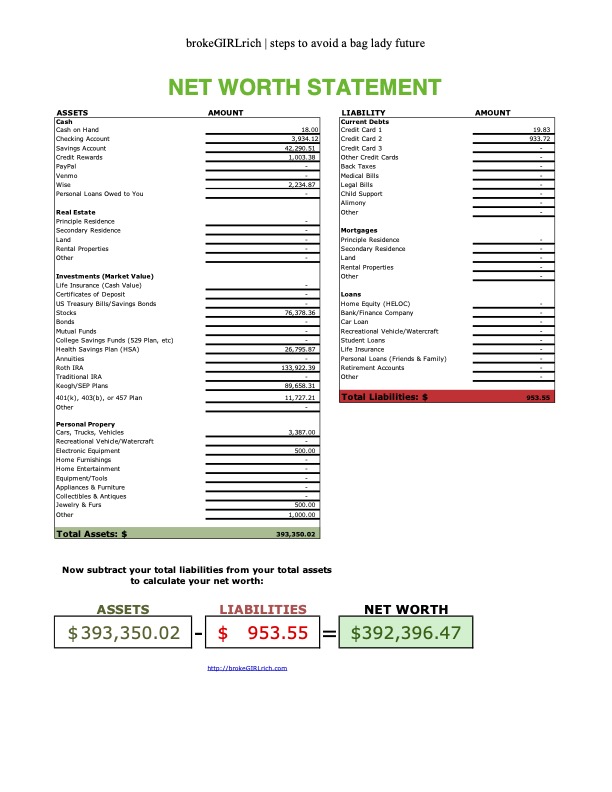

Net Worth: July 2024

Goals

- Save up $5,000 for school– via saving or scholarships.

- Max out 2023 Roth IRA.

- Max out 2024 Roth IRA ($7000).

- Max out HSA ($4150). $100 contributed, $4050 to go.

- Stage manage a show. Starting strong! I’d like to hopefully stage manage another before the end of 2024.