Profile

I am thirty six years old and I’m unemployed. …or a freelance blogger again? But as I’ve just submitted for unemployment for the first time ever, let’s just stick with unemployed, since that’s what I actually am. I am also volunteering again at my friend’s company as stage manager/production manager for a digital performance of Dracula that we’ll be doing at the end of August.

Spending & Saving

Sometimes the stock market really makes me think money isn’t real. I didn’t make a lot this month and other than my last paycheck from the school, most of it was random odds and ends.

I guess when I calculated my net worth last month though that the stock market was in a dip, because it’s up right now and I always feel a little confused when I have a large, unearned money boost.

But more evidence saving bit by bit does make a difference.

I filed for unemployment at the beginning of the month. It has been pending for a few weeks now and I can’t seem to get a hold of anyone to find out what to do about the fact that I did actually work the last week of July – a university theater I work overhire at did their graduation ceremony outdoors and used all the stagehands as ushers – but there will be no more work until…. Pigs fly? who knows? now that that’s over.

I’m sure a few more hours on hold will get it straightened out.

My big “bill” this month was taxes from freelance earnings in the first quarter. I’m hopeful that all the courses and whatnot I’ve been doing during the quarantine, which do add up, actually turn some of that into a refund next April, but for now, so long money.

I also had to set up healthcare for when mine ends through the school on September 1st, so I had to make that payment. My next health insurance payment won’t be due until October 1st.

My biggest entertainment expense was that I bought a baby pool. Floating is my happy place, even if I look totally nuts in this baby pool in the backyard that was much too expensive due to crazy supply and demand right now.

I also finally caved and admitted this pandemic is not going to get better anytime soon. I had been using one mask that kind of hurt my ears the whole time that an amazing friend made me for me, so I bought a few other styles to try. And then, of course, I was issued two totally free masks at the graduation that are actually pretty comfortable. Such is life.

My rent is so low because I had a tiny bit still due when I moved out and I am now living with my dad again.

Speaking of my dad, my birthday was a few days ago and since he didn’t know what to get me, he gave me the same amount of cash as the kayak I ordered in May (and am still waiting on it’s delivery), so that is included in my income.

My expenses this month:

- Taxes – $1328.86

- Health Insurance – $338.45

- Food – $316.54

- Entertainment – $278.13

- Stage Managing – $204.09

- Charity – $184.50

- Gifts – $176.55

- Gas – $82.01

- Utilities – $53.09

- Masks – $30.99

- Rent – $12.10

- Postage – $2.80

- Moving – $1.05

Total Spending in July: $3,009.16

Hustling

My income this month was from teaching, brokeGIRLrich, two refunds (a quarantine candle purchase that never arrived and, sadly, Harry Potter and the Cursed Child tickets), a small refund on my car insurance premiums because NJ Manufacturers are amazing, birthday money, and a residual check from The Tonight Show.

- Teaching – $1262.58

- brokeGIRLrich – $392.98

- Birthday “Kayak” – $280

- Purchase Refunds – $251.05

- Tonight Show Residual – $49.97

- NJ Manufacturers Refund – $28.00

Income This Month: $2,264.58

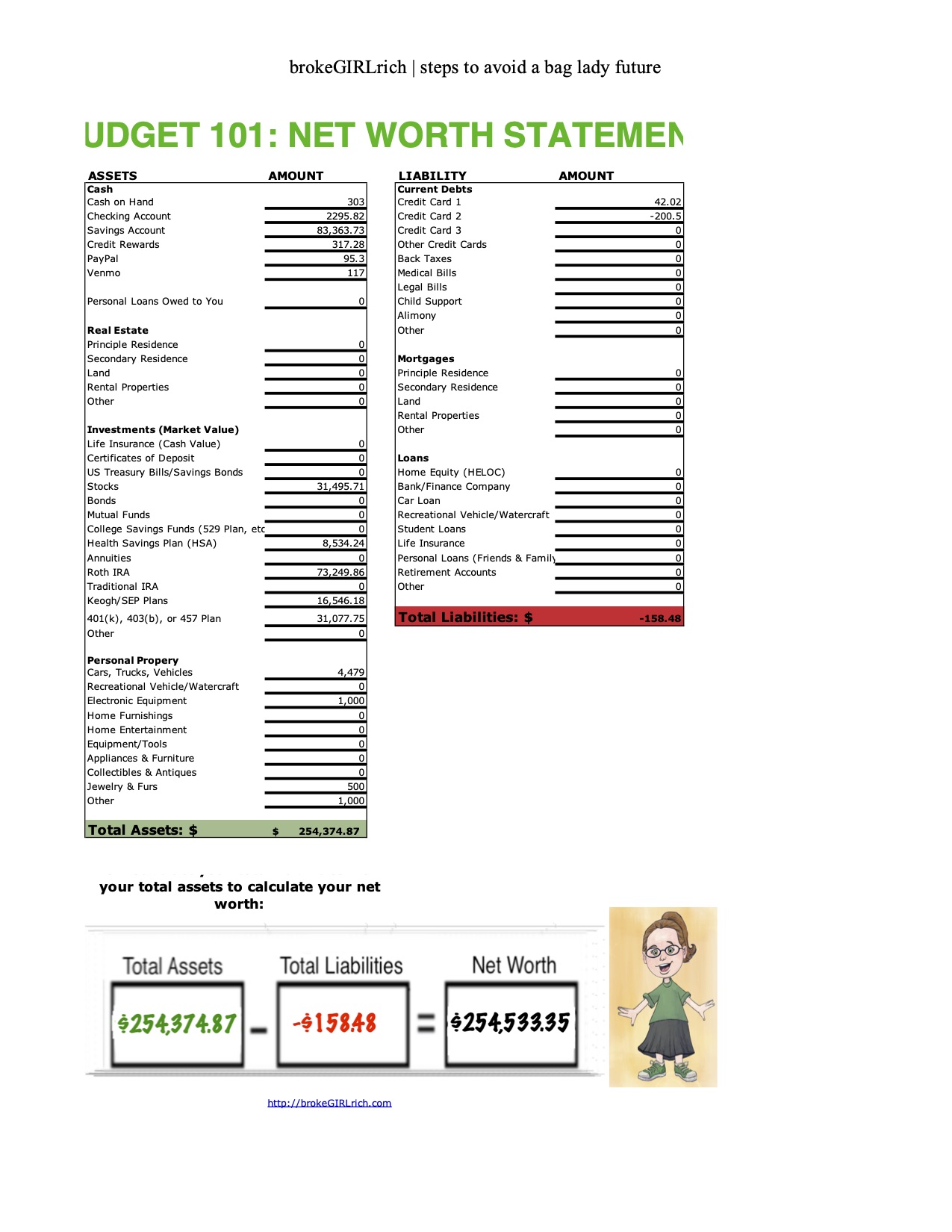

Net Worth: July 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: My Experiment as a Zoom Stage Manager

Goals

- Do two things to build up my stage management skills.

- Max out my Roth IRA.

- Max out my HSA. I can’t max it out due to university health care..

- Set aside $1,000 for my new car account.

- Invest $2,000.

- Read more – not counting textbooks I have to read. I finally finished The Stand, so this whole pandemic should definitely be over. Sigh. I’m also working on Lean In right now.

- Learn to make macaroons.