Profile

I am thirty five years old and I work as the General Stage Manager for a touring circus. I make $2,000 a week and have a $40 per diem. The job really picks up starting mid-September, but I got back last week from spending most of July in Saudi Arabia. I will be kicking around New Jersey again, picking up whatever part time work I can find, until mid-September.

Saving & Spending

I did pretty good saving this month. I did not love Saudi Arabia. I mostly hid out in my hotel room and went to work. The hotel fed me breakfast. The theater fed us dinner. It was too hot to care about lunch most of the time.

I was in Saudi Arabia 21 days, which was a local per diem equivalent to $840. When I got home, I changed over my currency at the bank and had $638.60 left over. That was after all food except about $40 of room service, gifts for some folks back home, and all entertainment (hahahaha, cause there was no entertainment).

I’m headed to Montreal with my best friends for the first five days of August and I renewed my First Aid & CPR certifications. I also booked a rafting trip for 7 of us in my family for September that only two people have paid me back for so far.

To make this more challenging though, I screenshot the shoe to keep thinking about it but lost the link to the website to buy them… so we’ll see how far I venture down that rabbit hole come August.

So Montreal and Fun, which has all the rafting expenses in it, are the two big hits.

I was surprised Food was as high as it was because it was like almost only 10 days of spending, but shopping for actual groceries was nearly 1/5 of that and a day out in NYC was also pricey but worth it.

I was also horrified when I broke down my spending over the last few years and barely had a single month without substantial clothing purchases last month, so my goal this month was to spend $0 on clothes. Nailed it.

I have a shirt and earring sitting in a cart on ModCloth that will likely win in August, but I also got a 40% off birthday coupon – so win? Also, these weird shoes that I’ve been staring down all month.

But I managed to buy none of them.

I wrote a post earlier called When It Rains, It Pours, which actually turned out to be kind of funny because while the blog did well this month, there have been endless issues with getting paid from my new gig this month and I haven’t actually gotten paid yet for any of the stage management work I did. On the plus side, I guess it will make my August income seem decent instead of almost nothing.

So much for it raining positively. 😜

Next month I plan to research how to open a Solo 401k, so if anyone has any recommendations on that front, I’m all ears.

Fun Things This Month: Seeing Waitress, Going to the top of the Empire State Building, and the NJ Balloon Festival with my Dad

Here’s the July damage:

- Food – $500.34

- Car – $30.02

- Healthcare – $226.70

- Music Lessons – $1.00

- Fun – $936.47

- Gifts – $323.87

- Gym – $154.58

- Pool – $39.42

- Stage Management – $140.00

- Subways, Taxis & Trains – $122.16

- Toiletries – $24.27

- eBay Fees – $12.75

- Montreal – $456.59

Total Spending in July: $2,968.17

Hustling

I was pretty excited to get paid for a random voice work thing I did in June. I actually had no idea what I was getting paid but I made $40 for about 30 minutes of work.

- brokeGIRLrich – $1933.56

- Per Diem – $840.00

- Stage Hand Work – $287.65

- Voice Work – $40.00

- Rafting Reimbursement – $387.72

Income This Month: $3,488.93

A strange thing happened when I was calculating my net worth. I think a small stock account disappeared off my Mint account. I logged in to the company, where I thought I had two small accounts (approx..$3k each) and only one is appearing and now I am trying to figure out if I have lost my mind or what. This feels extra vindicated by the like $3k drop in my stock line on my net worth. So, I guess I’m going to play detective over the next month and try to see if I’m delusional or if the internet ate my money.

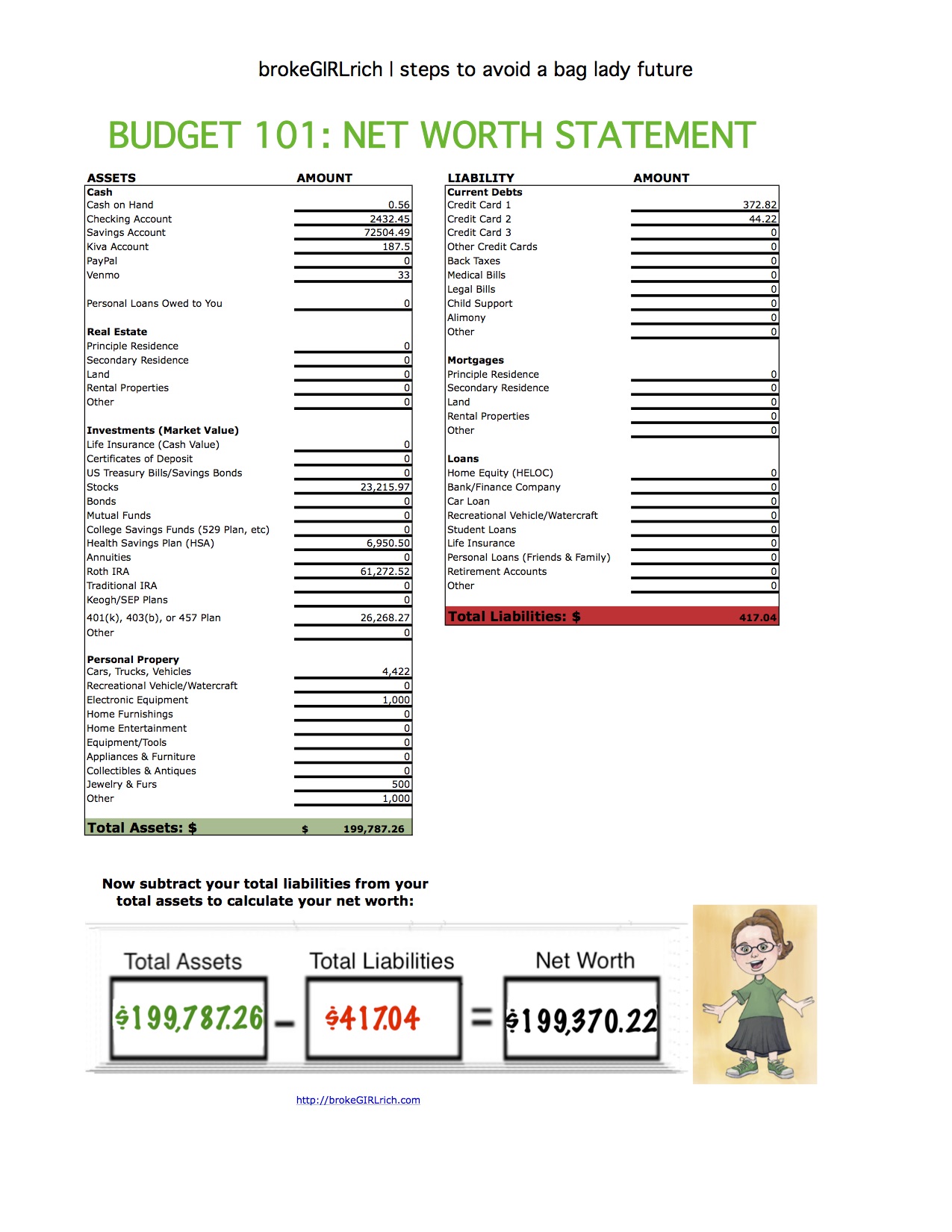

Net Worth: July 2019

Just another reminder, That Frugal Pharmacist could still use a few bucks as they figure out life with their sick kid. You can read the whole story and donate via this link. Or if you’re doing some Amazon shopping, you can do it via their link at the bottom of their website and at no cost to you, they’ll get some kickback from Amazon.

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review — Because of like the ugliest infographic ever. Thanks, Pinterest!

My Favorite Post to Write This Month: Steps I Took to Get Where I Am Financially

Goals

- Start eating better. Nope.

- Work out more. Nope. I floated a lot in a pool…

- Better stress management. This is going ok.

- Keep taking accounting classes. Nailing it.

- Do two things to build up my stage management skills. I went to an APA sponsored pyrotechnics course, so one skill project done and recertified on First Aid & CPR

- Take music lessons while I’m home for a few months. I started them at the end of the month!

- Spend more time with family and friends. Success!

- Be more supportive of family and friends when I can’t be there in person. Sure?

- Go out on a date.

- Make an effort to not withhold kind words and encouragement. Always a work in progress.

- Max out my Roth IRA.

- Max out my HSA.

- Set aside $20,000 for my house down payment account.

- Set aside $5,000 for my new car account.

- Invest $3,000.

- Read more. I read half of Big Little Lies and ¾ of Meddling Kids.

- Learn to make macaroons. No further progress.

- Visit (way more than) two roadside attractions.

I have a solo 401k with fidelity, feel free to message me with any questions.