Profile

I am forty years old, an occasional digital event producer and freelance stage manager. I work as a TA and an adjunct. I also work a variety of side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

This month has been eleven years long.

It began at home, visiting family and friends over the holiday. I rang in the New Year with my BFF’s at one of their homes in Maryland before driving back to New Jersey on New Year’s Day for a final Christmas celebration with one other branch of the family.

I am also super grateful that my dad is helping me again with some cash to off-set my expenses of paying tuition and rent and generally surviving while in school, which is reflected down in my income.

On the way home, I picked up some crabs for a feast on the 2nd, which were in last month’s expenses, but I was reimbursed this month. I spent a last few days at home culminating in doing an event as a show caller for a friend that I’ve been doing for about 5 years now. Unfortunately, they had a new person in charge of paying the invoices and last year they were kind enough to help me out by having my check ready to go so I could deposit it before fleeing the country – this year, the check is sitting at my dad’s house waiting to join a bunch of tax papers when he mails them over sometime next month. So that will be recorded in some future month’s income.

On the way home from the gig, I twisted my knee pretty good… just walking. Yet another indignity of aging combined with an old funky knee injury. But I could feel it sort of twist and rip more than previous times, so I was a little concerned and was hobbling the entire month.

In an exciting turn of events, I got a random upgrade to premium economy or whatever that level of flying is that’s not first class but not economy. Seats designed for humans instead of cattle. So I will continue to advocate for the day flight to the U.K. to anyone who has the option to do that instead of the overnight one.

About 48 hours after returning to the U.K. my partner’s mom got very, very sick and we had to rush down to London. His sister and dad were both out of the country so it was quite a scary scramble. We wound up spending the weekend down there. His sister was back by the end of the weekend and things seemed a little more stabilized and he was out of vacation days so all things considered, we headed back to Peterborough that Tuesday. Then things destabilized and we wound up back in London again on Friday and while things are overall looking up now, the month has been just pure chaos and we expect to be spending most weekends at his parent’s house in London till his mom is out of the hospital.

This mostly explains the exorbitant food number because, as many people well know, when everything is going to hell in a handbasket, you just keep ordering takeout. Especially when you are guests in someone else’s house.

Additionally, travel is a bit higher than usual as we’ve been traversing London each weekend. But it is what it is. Due to a strange amount of time to kill this month waiting to meet up with my partner somewhere, and the fact that my brain just would not with any school stuff that day, I wound up catching the Timothy Chalamet movie where he plays Bob Dylan and, as someone who enjoys Dylan’s music, I really enjoyed it.

I knew that January and February were going to be the two highest months for trains and travel as I also have to be in London twice a week to teach, so honestly, it’s worked out about where I thought it would. I’ve also volunteered a few times at You Me Bum Bum Train, an immersive show playing through February and the late night trains are much cheaper than the rush hour ones to take home.

Despite this, it’s actually been a slightly lower expenses month once the tax payment is removed (which I had already set aside in a separate savings account).

This is also the first month since I set out the goals for the upcoming year of school where I did not achieve my intended thesis writing goals to graduate on time but we have pivoted to the backup timetable, which still works and removes some of the insane pressure from me, but has also made me a little depressed that I am going to have this PhD cloud hanging over me for a few months longer than I hoped.

Expenses this month:

- Taxes – $1625.00

- Rent – $772.81

- Food – $676.17

- Trains – $307.36

- Travel (TfL & Gas at Home) – $187.06

- Stage Managing – $162.28

- Utilities – $125.33

- Council Tax – $80.99

- School – $58.69

- Charity – $39.57

- Blog – $37.00

- Entertainment – $28.40

- Gifts – $23.98

- Home – $22.94

- Ubers – $21.34

- Toiletries – $3.39

Total Spending in January: $4,172.31 (or $2,547.31 without taxes)

Hustling

This month’s income:

- Dad Tuition/School Help – $5000.00

- Adjuncting – $$1674.64

- Digital Producing – $770.00

- Teaching Assistant – $574.09

- Blog – $494.60

- Crab Refund – $360.00

Income This Month: $8,873.33

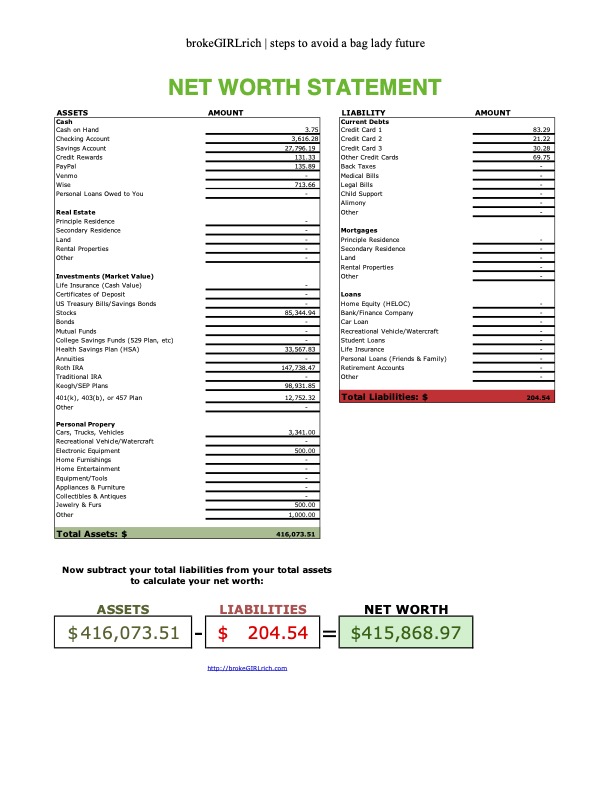

Net Worth: January 2025

Goals

So it’s that time of year when the goals get reset, which has lately been kind of depressing since I haven’t actually achieved them all on time during any of this PhD process. But we persist.

- Max Out My Roth IRA for 2024: I redirected the school money from my dad here and as I am adjuncting an extra course right now, I was able to cross this one off right at the end of January. So we are starting with a win and only slightly behind.

- Max Out My Roth IRA for 2025: $7000 to go.

- Max Out My HSA – $4300 to go.

- Go to Egypt with My Boyfriend and Family: So we have decided to go to Egypt this summer with my brother and sister-in-law and the trip is looking like it’ll be approximately $3000. I have my fingers crossed that the school I adjunct at will keep me at two classes per term and that second class will help pay for this.

- Best Friend Summer Adventures: My BFF visits every summer for like two weeks and we usually explore an area of the UK for a long weekend and fly to somewhere with a cheap plane ticket for a long weekend. Unless the digital producing really picks up, I may need to dip into the savings to do this, but I’m aiming to save between $2000 and $3000 for her visit .

- Anniversary Getaway – In May we usually try go away for the long weekend at the end of the month to celebrate our anniversary and I would be excited to save $1,000 for this – even though we can probably do it for about half that.

- Save $1,200 for my US Car Insurance by June

- Buy a Used Car in the UK – I currently have $10,000 in a new car account because my Toyota Matrix is on her last legs. I was saving to purchase a new car, but instead I’m looking to buy a used car in the UK after I finish my driving lessons for approximately £5,000 or less.

- Pay for a Graduate Visa – this is going to cost around £4000 and I have $6000 left in my tuition account, so this should be good to go. We will see at the end of the year.