Profile

I am thirty eight years old and I’m a digital event producer and very occasional freelance stage manager. I make $55/hour at the digital production company I work with. I work a variety of small side hustles and am a full time student working on a PhD in Drama.

Spending & Saving

I have some feelings about life and finances this month for sure.

I had planned for January to be a lower income month because for the last few years, there is no digital producing work for like the last two weeks of December. And then we hit the ground running.

This year we hit it with a thud. Did we even hit it? I don’t know. I do know I worked about a total of 12 hours of digital producing all of January which is the lowest I ever worked. And like any freelancer, I’ve been living under the lowkey – is it all falling apart?!?! – panic.

Then I was booked for the whole week for full days of producing starting the second week of February, which is a bit of a logistical nightmare with school but a super relief for my bank account.

Until they were all cancelled yesterday. So. Cool. And then we got another update from our boss at that job that they expect this to be a slow month too. And she is a lovely person but I think she’s waiting to see people just give up and quit rather than culling the herd of us so that the people who stay get a decent amount of work. And I have some feelings about this.

But if you’ve been reading for years, you know I’m not destitute by any means and if you check out my spending this month, you will see I was not really living like someone who is concerned that her whole plan for paying for grad school may be in the process of falling apart.

So hopefully it might just be two, slower lousy months in the grand scheme of things that don’t really matter.

We were given a heads up that things would be slow at a meeting in December. So I have been watching my cash flow – despite some large and totally optional expenses this month – with the hopes of making what’s in my checking accounts stretch through March right now.

I’m aware that my tuition payment for 2023-24 is technically already saved up but I would feel much better if 2024-25 is already in that bank account by the time I have to make the payment for school next September. I’m also aware that my year of no rent (which isn’t a real thing because I just lump sum paid it last May) is creeping to a close and that $1200-ish a month is going to suck when it’s back to a monthly expense.

Overall, it’s fine. Just very far from optimal. And not really on track with the plan I had for this year yet.

I’m not sure if this work situation is fueling my feelings about school lately or if school lately is fueling my feelings about missing working full time but I do have some serious why-am-I-doing-this vibes regarding school. If I could just stay in the UK without my student visa, I think I could happily drop out now and just go back to work and be pretty content.

Though a few months from now, if I did that, I’m sure I’d regret it. Sigh. So on we go. I am both excited and a little terrified to start my case studies. I emailed my first theatre company about being my pilot study this weekend, so hopefully they are willing to work with me.

I did move $1,000 into my IRA on January 1st – which is a far cry from maxing it out on January 1st last year, but I have faith it’ll get there this year. Some days. I will say my goals for 2023 are significantly scaled down from previous years.

Fourth quarter taxes were due this month so all my 2022 taxes have been paid now and hopefully next month or by March I will have all the documents I need to do my taxes. I’m hopeful for a little tax refund, though I don’t think it will be anything like last year’s. It will likely go into either school savings goals or retirement savings goals.

Entertainment is also really high. My best friend from an old circus I used to work for was in town for a few days at the beginning of the month and stayed with me. The day after he left, another friend mentioned they were in town so I met up with them, and then a third friend who volunteers in Ukraine had a long layover on her way home for a while and I met up with her too.

It’s hard to regret spending money to see people.

But really most of that expense was a fairly expensive spa booking for next month when my cousin visits and some opera tickets. …which sounds so bougie. And is so bougie, I suppose. Either she will pay me back for half of it or she’ll just pay for the rests of the things we do when she visits.

I also had a moment where my brain just kind of fritzed while I was bemoaning not making much money this month/next month that intersected with researching a performer whose work I’m supposed to try to see. She doesn’t do a ton of performances, so I found one happening in Norwich in March. I’ve never been there. The ticket was only £10. But then the cost to get over there was sort of maddening. So I just went sort of whole hog and asked the boyfriend if we could away there for the weekend and now we are planning to do that. So those expenses are also incorporated, though it really wasn’t that much and his half of the costs is listed under income since he already paid me back.

When I was looking up other stuff for us to do in Norwich besides see this show, I found a link to some fancy dining recommendations and one was a really nice looking place with three course meals for £23 which made my London-living brain explode with laughter. We were going to go, but Saturday night is the only night they don’t do it. I am looking forward to a weekend of not-London prices though for sure.

Food has really been holding steady at this amount even with Hello Fresh knocking out several meals a week at a reasonable cost. I did go to several fancier places while the friends were visiting.

Apartment was also higher than usual because I ran out of patience with my mattress which was wildly uncomfortable and squeaked like crazy. Mattress has been replaced but it turns out the squeaking is the bedframe which is really disheartening. So I may replace that next month. Or in March, depending on the financial situation with the low work income. Honestly, the squeaking has bothered me more than the general uncomfortableness of the mattress.

In theory, my landlord should replace these things, but based on our dance around what should be expected related to repairing the boiler – which took 5 months – I think this is fine. Also, I have wanted a silly, rather expensive lamp for years. I was thinking it was going to be one of my financial goals for 2023 because I’ve wanted it for like 5 years. You know how you know you’re really just fine during tighter financial times? When you think things like, “yeah, I’m still gonna get the lamp. I’ll probably get the next bed next month instead but lamp by March or April for sure.”

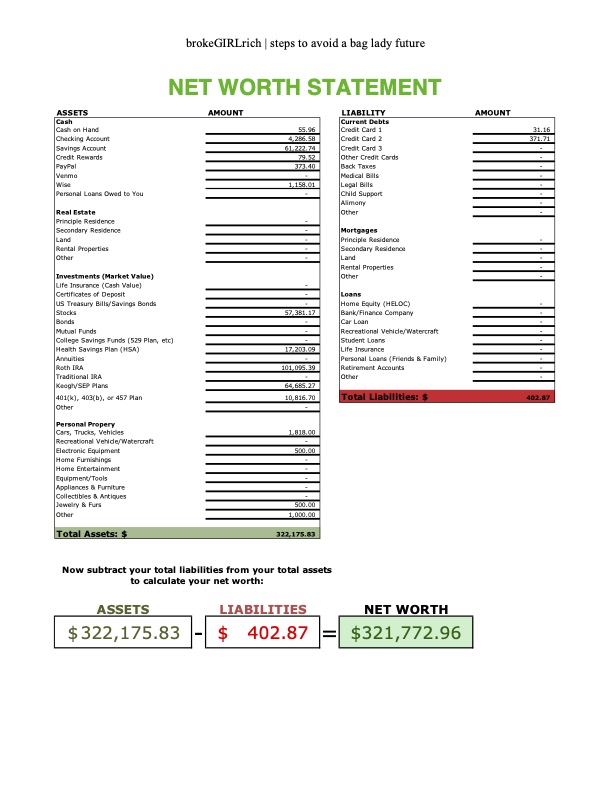

And, despite feeling like a lame money month, the stock market is clearly on the uptick because despite paying a significant portion of money for taxes, my net worth is still up quite a bit from the end of December.

I had to go to the doctor while I was home over Christmas – bam. $150. Plus my regular health insurance fee, which I guess I’m grateful I pay so that was only $150.

Overall, other than the big splurge for cousin weekend and the small splurge for Norwich weekend, which were both one time things, if spending stays kind of on par with this for February and March, I will be fine. Additionally, in March I start adding some teaching income from school through May. So that will help a bit too.

The fact that I’m fairly happy hibernating like a bear, as long as someone from outside the UK doesn’t turn up for a visit, is really a very positive, cost effective measure. On Monday nights, if I’m not working, I go to a pub quiz with my boyfriend and his friends which is really cheap… though I’m not sure I’ve ever even actually paid. If we’re both free, he just comes over and we play Gloomhaven or watch Dark, The Last of Us or Taskmaster.

I have become incredibly boring.

Here is the expense breakdown for the month:

- Taxes – $5266.00

- Entertainment – $755.66

- Food – $595.77

- Apartment – $307.25

- Utilities – $241.37

- Healthcare – $172.58

- Transit – $156.01

- Work – $148.48

- Gym – $46.77

- Blog – $37.00

- – $34.46

- School – $31.16

- Gifts – $5.46

Total Spending in January: $7,797.97 (Or $2,531.97 without taxes)

Hustling

This month’s income was largely from working the first half of December at digital producing and then a bit from both the blog and the weekend job ushering. My boyfriend and I made plans to go away for the weekend in March, so he paid me back for his half of the expenses for the things I booked. School, for some unknown reason, sent me money. It’s puzzling and I’m still trying to figure out why. Also amusing is that one of the stagehand jobs I do in New Jersey, that I haven’t done for 9 months now, sent me $1.06. And I feel like they did something like this last year too and I am still not sure why.

- Digital Event Producing – $2351.25

- Ushering – $520.23

- brokeGIRLrich – $510.52

- School – $257.48

- Boyfriend – $94.16

- Stagehand – $1.06

Income This Month: $3,734.70

Net Worth: January 2023

Goals

I’m bracing for a significantly smaller income year. I think I’d rather be pleasantly surprised and trust myself to make some good choices for my future if I find myself in a position to do so rather than feel like a total failure who can’t meet her goals. So here are the new ones for 2023.

- Save up $10,000 for school.

- Save up £5100 for school. £1901 currently – this number fluctuates a little bit monthly because utilities also come out of this account.

- Max out Roth IRA ($6500). $1000 contributed so far.

- Max out HSA($3850).

- Buy the pretty lamp.

- Save $2000 for vacation with BFF over the summer.

- Stage manage a show.

January – the month of resolutions, goals, and a brand-new planner that lasts about two weeks. I love how this accountability check-in shows that even the best-laid plans can go awry. It’s like having a gym membership in January, all motivated, but by February, we’re just trying to figure out where we left our workout shoes. But seriously, tracking goals and staying accountable is the real secret sauce. It’s like holding yourself to a promise, but with less pressure and more ‘yay, I did it!’ moments. Let’s keep it real this year, one small victory at a time! 😜🎯