Profile

I am thirty five years old and I started out the month working as the General Stage Manager for a touring circus. I made $2,000 a week and had an approximate $40 per diem (issued in local currency). I finished out the month as a Visiting Instructor of Theatre Arts/Production Management at a state university, where I make $26,418.51 for the semester.

Saving & Spending

Guys, the last few months have been a mess. Between a crazy schedule, connectivity issues while abroad, and writing an update at the last minute that my computer ate as I threw up my hands, said “eff it,” and left the post largely a mess…

Who really knows what’s going on with my money?

Least of all, me. So. We start new today. This post will be a proper spending, saving and net worth update.

Especially because a lot has changed this month and I’m feeling a little overwhelmed.

Upon looking at my expenses, I can see why this month made me cringe.

Quarterly taxes were due. I’m pretty sure I’m going to wind up with a refund when I do my final tax paperwork for the year, due to the SEP 401k contributions, but ugh. That was a more than $2,000 hit.

Then moving into my new apartment cost a security deposit (which I will get most of that $1,000 back when I move out, but I did love finding the tiny print that they keep $100 to deep clean the carpet), the third of the rent that was left for this month, and all of February’s rent. So that was a nearly $3,000 hit.

On the plus side, when you subtract the security deposit and extra third of the month’s rent and the taxes… it was still an expensive month, but not like a WHAT IS HAPPENING month… which is what it felt like.

I bought more than I needed to for the apartment, of course.

My glasses had reached the end of their life (for real, I dropped them in the hotel at the beginning of the month and asked our head of props to patch them together enough to just get me back to America in a few days – he was a rock star and those suckers limped along for three more weeks). Of course, my prescription was out of date, so I had to go to the optometrist, which was not covered by my insurance.

The rental car charge for my trip to Maryland for Christmas Eve came through.

They are majestic AND terrifying.

Teaching is ridiculous and it’s impossible to get the supplies you actually need so I spent nearly $200 on stuff for my classes.

And it’s funny, but like I almost entirely forgot that I spent an extra week in the UK after our tour ended and visited old friends in Sheffield and old ship friends in Scotland – but that happened, as evidenced by my credit card statement. And my memories of making homemade tablet and watching a swan hiss at my friend Iris for the first time in her life.

One small saving grace was that I realized this was probably a good semester to take a break from the accounting classes, so I dropped a class and was refunded for it.

As far as saving goes, I contributed to my Roth IRA and HSA this month, but that was about it.

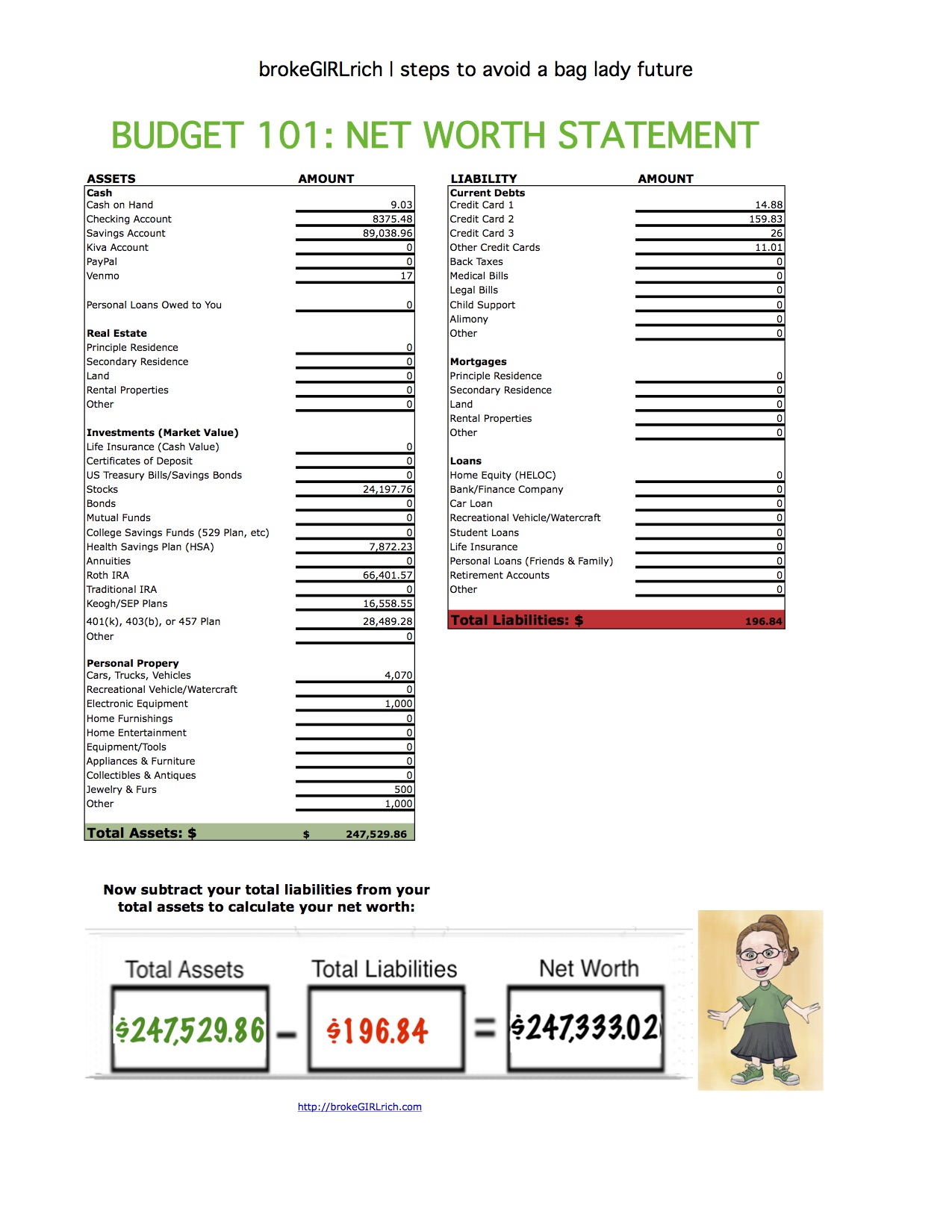

This month was another reminder of why hitting savings goals, and scrimping and saving some in my 20s, was an awesome choice, because even though I spent $100 more than I made this month, my net worth actually went up $5,000. This clearly isn’t a long term, sustainable spending choice, but pretty awesome to be able to do that once in a while.

My expenses this month:

- Food – $610.30

- Travel (Gas) – $26.42

- Health (including optometrist) – $377.75

- Fun – $27.92

- Christmas Trip – $131.05

- Teaching Supplies – $198.97

- Quarterly Taxes– $2104.73

- Rent & Security Deposit – $2956.00

- Software – $186.82

- Bank Fees – $14.00

- Gym – $37.31

- Apartment – $615.25

- Sheffield/Scotland Adventure– $204.24

- Internet – $39.99

- Renters Insurance – $141.00

- Tuition – $-717.00

Total Spending in January: $6,954.75

Hustling

My income this month was my circus pay for the last leg of tour, brokeGIRLrich, some Christmas money that I just got around to depositing, and a dividend check.

- Stage Managing – $6315.33

- brokeGIRLrich – $395.30

- Christmas – $125.00

- Dividends – $37.00

Income This Month: $6,872.63

Net Worth: January 2020

Most Popular Post of the Month: Doin’It By the Decade: The Wealthy Barber Review

My Favorite Post to Write This Month: Is It Worth the Splurge? Ipsy Review This post was a year in the making folks! (And there’s a giveaway.)

Goals

- Do two things to build up my stage management skills. I’m going to argue teaching a stage management class counts as one of these because, woah, nelly does it make me think of what I do differently.

- Spend more time with family and friends.

- Max out my Roth IRA. On track.

- Max out my HSA.

- Set aside $1,000 for my new car account.

- Invest $2,000.

- Read more – not counting textbooks I have to read.

- Learn to make macaroons. Will this be the year?

Interesting pic. I don’t know how I imagined stage management, but it wasn’t that. Very interesting to see behind the scenes!

How’s the teaching going? It can be quite challenging. I’m pretty glad not to be doing that anymore. The students were fine, the content was fine but the politics and systems will drive you insane.

Teaching is interesting. I do like two of the courses I’m teaching, as for the other stuff… we’ll see.

Mel @ brokeGIRLrich recently posted…Is It Worth the Splurge? Ipsy Review

Wow first, you got a great setup… I am exploring the asset and liability stuff… so far is going great 🙂